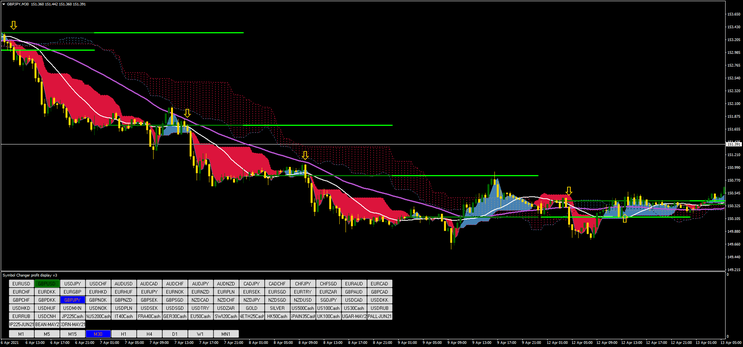

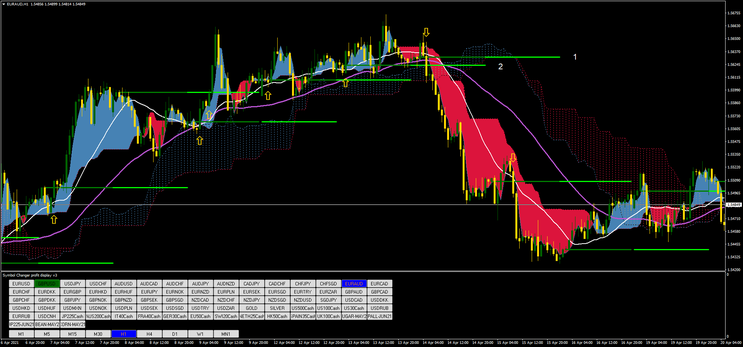

205# Ichimochu Aggressive Breakout

Ichimoku Breakout and Bank levels

Trend breakout flexible trading system

Submit by Janus Trader

IchimoKu Aggressive Breakout is an aggressive and very flexible trend following breakout strategy suitable for both stop loss trading and hedging trading as well as pyramiding. Of these last two topics I will not discuss but I expose the strategy in the classic way with stol loss and take profit.

However, those who are experts in pyramid coverage immediately understand the goodness of the system for this purpose.

The purpose of this strategy is to structure the Kumo breakout as a grid to make it more accessible and flexible. As even though the Kumo breakout is certainly an immense source of income for those who are an ascetic, it is difficult to manage psychologically, so I tried to psychologically simplify the approach to the Kumo Breakout which is a winning type of trading. The indicator I have used to achieve this is the Bank-levels, which are a robust indicator of support and resistance. This trading system is set up intra-day and multiday.

Setup Strategy

Type of strategy: day trading e multiday.

Style: Trend-Breakout

Time frame: 15 min. 30 min, 60 min.

Currency Pairs: major, minorm Indices, Commodities and Crypto.

Metatrader Indicators

Ichimoku 9,26,52.

Ichimoku 1,1,25.

Simple Moving Average 20, close.

Simple Moving Average 50, close.

Bank levels.

Delta Arrows (When you are an expert there is no need for arrows.)

Trading Rules Ichimoku Aggressive Breakout

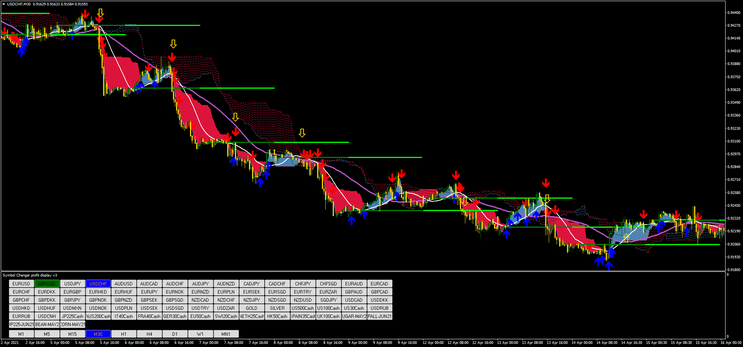

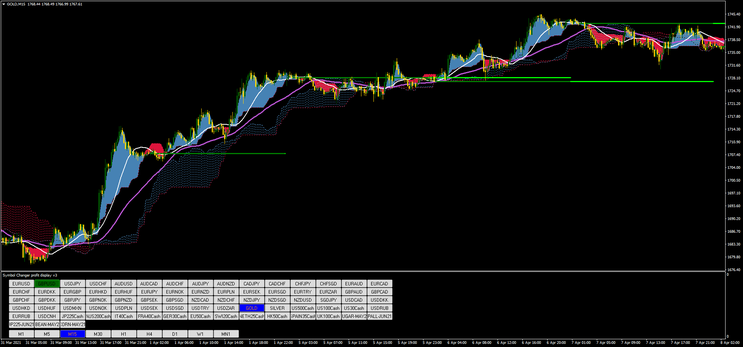

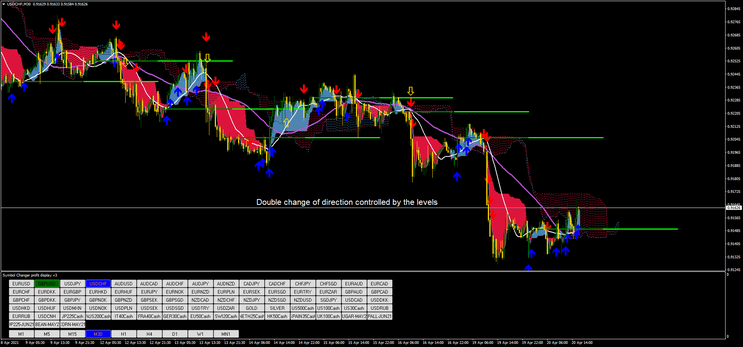

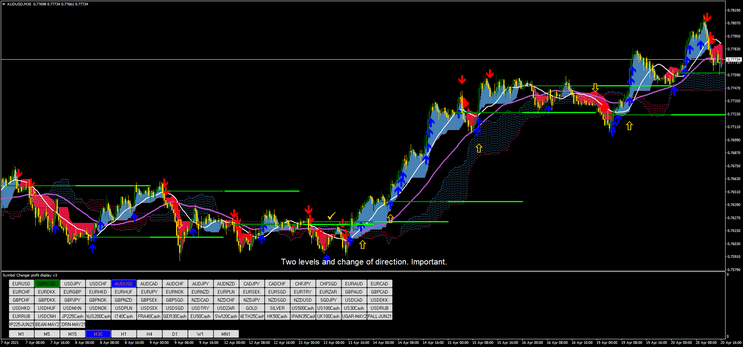

Trade in the direction of the Ichimoku and enter a position with the when the price is above / below the Kumo and the bank-levels. The change of direction always occurs after the price has fluctuated between two bank-levels in side-ways market.

Buy

The price candle must close above the two Kumo which must be in agreement and above the bank-levels (in other words it acts as an additional filter but also as a launching pad). In addition, a buy arrow of direction must have appeared.

Sell

The price candle must close below the two Kumo which must be in agreement and below the bank-levels (in other words it acts as an additional filter but also as a launching pad). In addition, a sell arrow of direction must have appeared.

Exit position

Place initial stop loss below the previous swing high/low but also good below /above the bank levels. Profit options:

Target with ratio-stop loss 1.15.

before the next bank-level.

When slow kumo changes direction (with ratio stop loss 1:2-1:2.5 or above).

Note:

The greatness of this strategy is how the change of direction is conceived, useful for both those who trade with stop losses and those who trade with hedges.

This is a winning strategy

Examples of trades