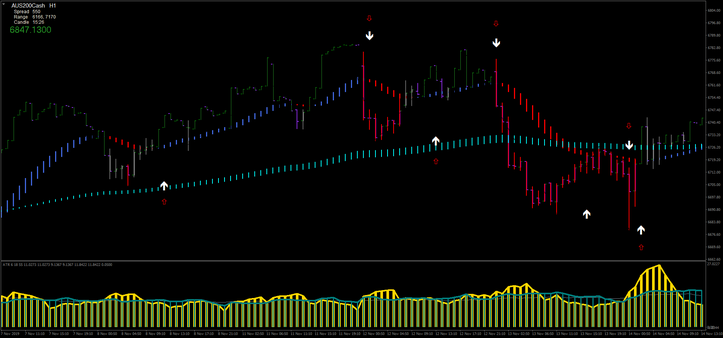

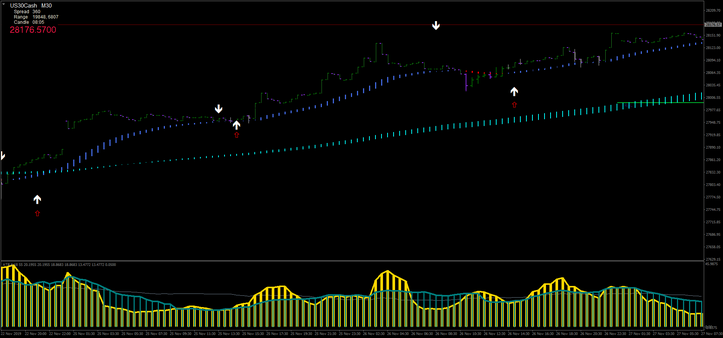

13# ATR Filtered Strategy

ATR Mastic

Barbarian arrow filtered in trend and with volatility

ATR Filtered Strategy is a volatility trend following strastegy that is based on trend indicators filtered by one best indicator of volatility composed by two ATR (ATR Mastic an costumized ATR indicator formed by two hstograms. When Histogram of ATR fast is above the histogram slow indicates that there are good conditions of volatility for entry in the market. ATR Mastic can be used in others strategy trend following or with trend indicators as filter.This trading system is suitabe with all financial instrument.

The signal arrow used is the barbarian arrow with slow configuration, different from the setting for trading with binary options.

Plataform: Metatrader 4

Time Frame 15 min or higher.Currency pairs: Forex, Cripto currencyes, stock market indices, shares.

The best financial instruments to trade with this strategy are those with high volatility.

Trading sessions on stock market indices 2:00 – 22:00 GMT- Berlin.

Metatrader 4 indidicators setting:

Trender SC

Trender H

Market Panel: display informations (spread , range and candle time).

Begashole trend indicator.

Barbarian Arrow (11 periods).

ATR Mastic A.

Trading rules ATR Filtered Strategy

Trading only in the direction of the trend with good volatility.

Buy

Candle price above trender H. (being a strategy also based on volatility, even this condition for the trend may suffice.)

Price above Begashole trend indicator (optional)

Barbarian buy arrow

ATR Mastic Sc (paint bar) green color.

ATR Mastic A gold histogram > Histogram blue

Sell

Candle price below trender H. (being a strategy also based on volatility, even this condition for the trend may suffice.)

Price below Begashole trend indicator (optional)

Barbarian sell arrow.

ATR Mastic Sc (paint bar) red color.

ATR Mastic A gold histogram > Histogram blue.

Exit position options:

Place initial stop loss above/below the previous swing High/Low.

Profit Targer with ratio stop loss 1:1.18.

Using a few pips of profit target with this strategy you get a high profitability by placing the stop loss above or below the signal bar

In the pictures ATR Filtered Strategy.

Share your opinion.