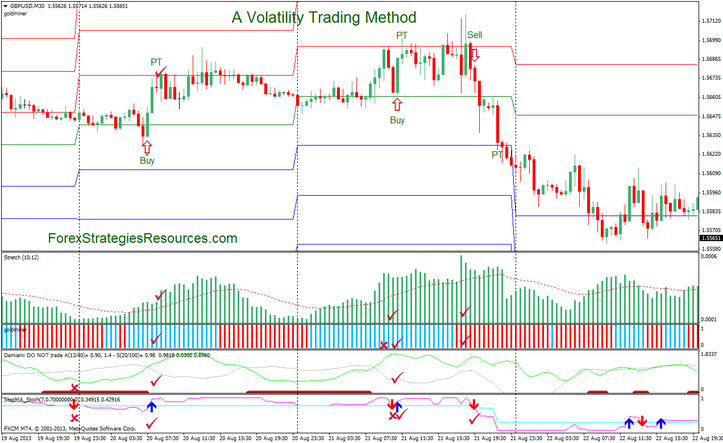

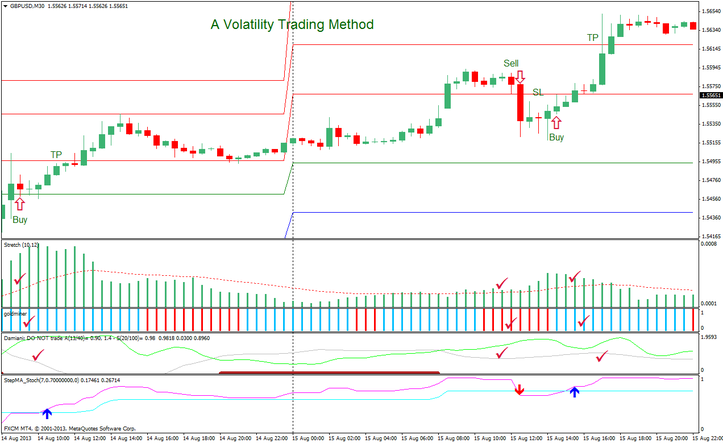

10# Volatility : Stretch indicator and Damiani Volameter v. 3.2

A Volatility Trading Method

Submit by Luky 25/08/2013

This is only an trading idea for the trading with the Volatility. I think that Damiani Volameter and Stretch indicator, work well together.

Time Frame 30 min or 60 min

Matkets :any;

Stretch indicator (10, 12, period);

Golminer 2 indicator (ssp 7);

Damiani Volameter setting default;

Nina StepMA_Stoch setting defaul;

(This indicator signal arrow can be changed with another. It 's just an example. The important thing is to demonstrate how Damiani volameter Stretch indicator and work well together,);

What is The Stretch indicator?

“The Stretch is calculated by taking the 10 period SMA of the absolute difference between the open and either the high or low, whichever difference is smaller. It represents the minimum average price movement/deviation from the open price during a period of time, and that value is used to calculate breakout thresholds for the current trading session. This can be used to plot a multitimeframe breakout channel. Source:http://codebase.mql4.com “

I Use this indicator do not for building an channel breakout but for mesure the movement deviation.

Trading Rules for : Volatility Double: Stretch and Damini Volameter v. 3.2

Buy

Nina Step Stochastic indicator Arrow Blue;

Damiani Volameter 3.2 green line > grey line;

Gold Miner 2 aqua color;

Green bars of Stretch indicator > moving average period.

Sell

Nina Step Stochastic indicator Arrow Red;

Damiani Volameter 3.2 green line > grey line;

Gold Miner 2 red color;

Green bars of Stretch indicator > moving average period.

Exit Position

At the Pivot Points levels;

Profit Target predetermined that depends by time frame and currency pairs;

Initial stop loss at the previous swing.

Write a comment