83# Parabolic SAR MARSI with SSL Channel Filter

Submit by Lorenz 2024

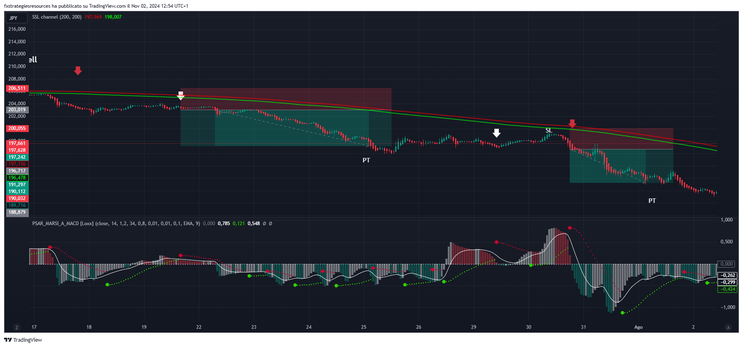

Parabolic SAR MARSI indicator, which combines the Parabolic SAR with an adaptive MACD based on the moving average of the RSI (MARSI), to identify potential buy and sell opportunities. The SSL Channel is applied as a trend filter, while exits are managed with swing-based stops and a defined profit target.

Overview of the Indicators

-

Parabolic SAR MARSI (Adaptive MACD):

-

In this indicator, the Parabolic SAR interacts with a MARSI-based MACD histogram rather than the price itself.

-

Buy and sell signals are generated when the Parabolic SAR crosses above or below this MACD histogram, signaling potential bullish or bearish momentum.

-

-

SSL Channel (High 200, Low 200):

-

The SSL Channel provides a trend confirmation filter by defining an upper and lower boundary based on a 200-period moving average of highs and lows.

-

The SSL Channel indicates the main trend direction, with trades only taken in the trend’s favor (long positions in uptrends, short positions in downtrends).

-

TradingView reference: SSL Channel by Erwin Beckers; Parabolic Sar Marsi by Loxx

Strategy Rules

To create a structured approach, we will only enter trades when both indicators align in the same direction, using swing highs and lows for stop placement and a calculated profit target.

Entry Conditions

-

Long (Buy) Entry Conditions:

-

SSL Channel Uptrend: The price must be above the 200-period SSL Channel Low, indicating a general uptrend.

-

Parabolic SAR MARSI Buy Signal: The Parabolic SAR flips below the MACD histogram. This crossing signals bullish momentum according to the MARSI-based MACD.

If both conditions are met, a long position is opened.

-

-

Aggressive entry (optional): MACD histogram >0; Parabolic Sar green dot.

-

Short (Sell) Entry Conditions:

-

SSL Channel Downtrend: The price must be below the 200-period SSL Channel High, confirming a downtrend.

-

Parabolic SAR MARSI Sell Signal: The Parabolic SAR flips above the MACD histogram, signaling bearish momentum.

When these two conditions align, a short position is initiated.

-

-

Aggressive entry (optional): MACD histogram <0; Parabolic Sar red dot.

Exit Strategy

We manage each trade with a combination of swing-based stop losses and profit targets, along with optional exit rules based on the Parabolic SAR MARSI signal.

-

Stop Loss:

-

Swing-Based Stop Loss: For long trades, place the stop loss at the most recent swing low. For short trades, place it at the most recent swing high. This technique provides structure by using natural support and resistance points for risk control.

-

Trailing Adjustment: As the trade progresses, adjust the stop loss to follow new swing highs or lows that form in the trade’s favor.

-

-

Profit Target:

-

Set Profit Target Based on Risk-Reward Ratio: Define the profit target at 1.2 to 1.5 times the stop loss distance. For instance:

-

If the stop loss is 10 points, the profit target would range between 12 and 15 points.

-

-

This flexible profit target allows for capturing gains while keeping the reward-to-risk ratio favorable.

-

-

Exit on Opposing Signal:

-

If the Parabolic SAR MARSI provides an opposing signal (e.g., the Parabolic SAR crosses the histogram in the opposite direction), consider closing the trade. This can help avoid potential reversals and protect gains.

-

Example: Applying the Strategy

Long Position Example

-

Conditions for Entry:

-

The price is above the SSL Channel Low, confirming an uptrend.

-

The Parabolic SAR crosses below the MACD histogram, giving a buy signal.

-

-

Entry: Open a long position at the current price.

-

Stop Loss: Place the stop at the recent swing low, say 10 points below the entry price.

-

Profit Target: Set the profit target at 1.2 to 1.5 times the stop loss, e.g., between 12 and 15 points above the entry.

-

Managing the Trade: If the Parabolic SAR flips above the MACD histogram, indicating a possible bearish reversal, consider closing the trade to preserve gains.

Short Position Example

-

Conditions for Entry:

-

The price is below the SSL Channel High, confirming a downtrend.

-

The Parabolic SAR crosses above the MACD histogram, giving a sell signal.

-

-

Entry: Open a short position at the current price.

-

Stop Loss: Place the stop loss at the most recent swing high.

-

Profit Target: Aim for 1.2 to 1.5 times the stop loss distance.

-

Managing the Trade: Monitor for a potential exit if the Parabolic SAR flips below the histogram, suggesting an upward shift.

Advantages of This Strategy

-

Dual Confirmation: Using the SSL Channel as a trend filter and the Parabolic SAR MARSI as a momentum signal provides strong entry criteria aligned with the trend.

-

Risk Management: Placing stop losses at recent swing highs or lows offers logical, market-structure-based exits, protecting against large reversals.

-

Flexible Profit Target: The risk-reward ratio of 1.2 to 1.5 allows for systematic profit-taking while maximizing gains in trending conditions.

Considerations

-

Sideways Markets: In low-trend environments, this strategy may face more false signals, so it is best suited for markets with a clear trend.

-

Best Timeframes: For optimal results, consider higher timeframes (e.g., 1-hour or 4-hour) to reduce market noise.

Conclusion

The Parabolic SAR MARSI with SSL Channel strategy, combined with swing-based stops and adjustable profit targets, offers a balanced approach to capturing trend-following opportunities. By using the Parabolic SAR MARSI’s adaptive signals in conjunction with the SSL Channel filter, traders can increase their chances of trading in the market’s primary direction, maintaining structured exits to manage risk and reward effectively.