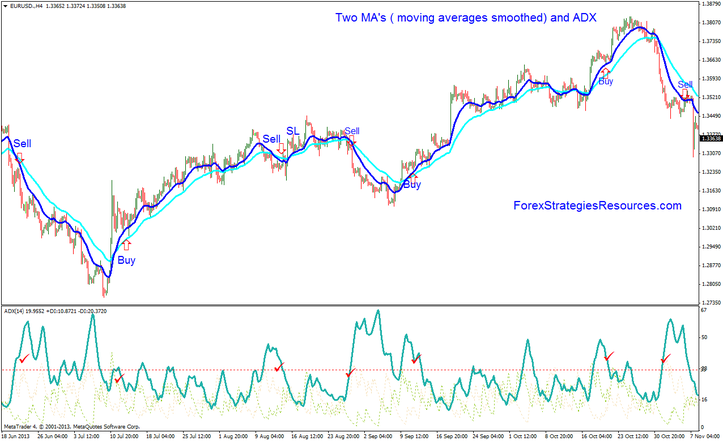

150# Two MA's ( moving averages smoothed) and ADX

Swing Trend Following Forex Strategy

Submit by Emi 09/11/2013 (independent financial technical analyst)

Two MA's and ADX is an swing trend following forex strategy

The forex strategy uses moving average cross-over go long when the MA 9

crosses above the MA 21 to go short when the MA 9 crosses below the MA 21.

Time Frame H1 and H4.

Currency pairs: the major currency pairs

Forex Indicators:

1. moving average (MA smoothed) with period 9 (MA 9).

2. MA with period 21 (MA smoothed 21).

3. Average Directional Movement Index default setting (ADX 14). A level of 33 is added.

Rules for Two MA's ( moving averages smothed) and ADX

Buy

1. Wait for the MA 9 to cross above the MA 21 and the ADX is> 33 level.

2. Take an entry when the price comes back down to touch the MA 9.

3. Set the initial stop loss 15 pips below the MA 21 and after 30 pips in gain move stop loss at the entry price(Time frame 60 min- for time frame240 move initial stop loss after 45 pips in gain)

4. Profit target with ratio 1:2 stop loss or exit position when MA cross in opposite direction.

Sell

1. Wait for the MA 9 to cross below the MA 21 and the ADX is>33level.

2. Take an entry when the price comes back down to touch the MA 9.

3. Set the initial stop loss 15 pips above the MA 21 and after 30 pips in gain move stop loss at the entry price(Time frame 60 min- for time frame240 move initial stop loss after 45 pips in gain).

4. Profit target with ratio 1:2 stop loss or exit position when MA cross in opposite direction.

This trading system is also good for trading with Options and Binary Options.

Two MA's ( moving averages smoothed) and ADX trading with Options

Buy Call or Sell Put Options

Wait MA 9 cross above 21 MA and the ADX is > of 33 level.

This event is an alert for Buy Call or Sell Put.

Draw on the chart an line at the level of the previous High swing, This level is the strike or the fixed price.

When the price comes back down to touch the MA 9 Buy Call or Sell Put with the stike at the level of the previous high swing ( In the example buy call or sell put with the strike 1,3700, the fixed price).

Buy Put or Sell Call Options

Wait MA 9 cross below 21 MA and the ADX is > of 33 level.

This event is an alert for Buy Put or Sell Call.

Draw on the chart an line at the level of the previous Low swing, This level is the strike or the fixed price.

When the price comes back down to touch the MA 9 Buy Put or Sell Call with the stike (fixed price) at the level of the previous low swing ( In the example Sell call or Buy put with the strike 1,3700, the fixed price).

The expiration time of the option is relative to the risk that a trader wants to hire.

Entropy and Alligator trading system

60 min Binary Options Strategy High-low: Bollinger Bands and Momentum

Binary Options Strategy One Touch: Intraday Trading Trend

5min Binary Options Strategy High Low: Bollinger Bands Breakout

5min Binary Options Strategy High Low: Stochastic Cross Alert

Binary Options Strategy High/Low: JMO with ATR

5 Candles Reversal Binary Options Strategy High/Low

Reversal channel Binary Options High/Low

Write a comment