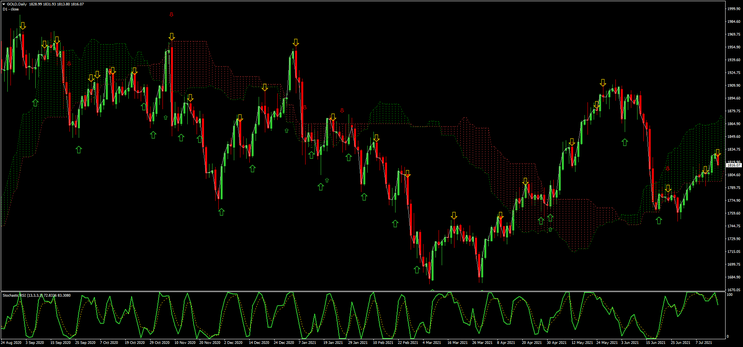

209# Multi Positions Trading with Ichimoku

StochasticRSI as timing of entry

Trend Momentum Strategy

Submit by Alexander

Multi Positions Trading with Ichimoku is a trend-momentum strategy based on Ichimoku and StochasticRSI. The strategy is very simple, it trades in the direction of the trend and the entry timing are the arrows that generate the StochasticRSI. You can have multiple positions in the same direction. This is a winning strategy.

Setup Strategy

Time Frame 3 minutes or higher, but best time frame to learn this trading system are higher,

Currency pairs: majors, minors, Indexes and Gold.

Metatrader 4 indicators

Ichimoku MTF Kumo (trend direction)

StochasticRSI (timing of entry)

Trading rules Multi Positions Trading with Ichimoku

Trades only in the direction of the trend

Trend up above the Kumo appears little buy arrow.

Trend down below the kumo appears little sell arrow.

Buy

Price above the kumo.

little buy arrow (arrow of direction)

Buy arrow of StochasticRSI.

You can also open more positions when a next buy arrow appears.

Sell

Price below the kumo.

little sell arrow (arrow of direction )

Sell arrow of StochasticRSI.

You can also open more positions when a next sell arrow appears.

Exit position

Place initial stop loss below/above the next swing high/low. Even if it is inside the kumo. Profit at opposit arrow or with ratiostop loss 1:1.25 (best choice).

Examples of trades.