207# PullBacks Trend Strategy

Trend Following Strategy

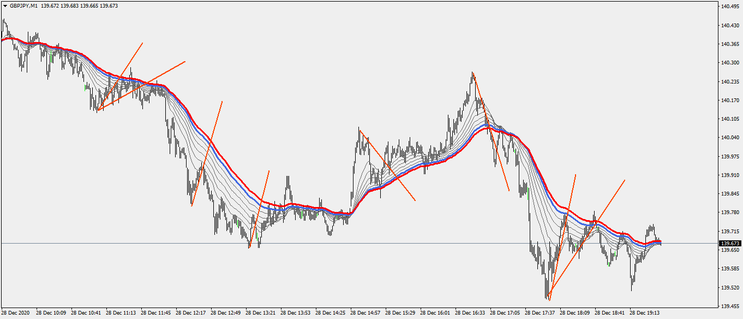

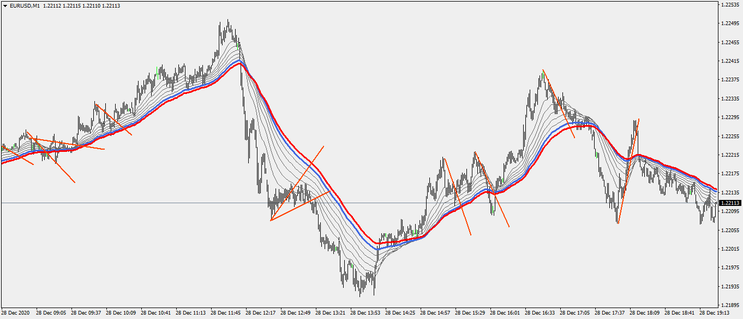

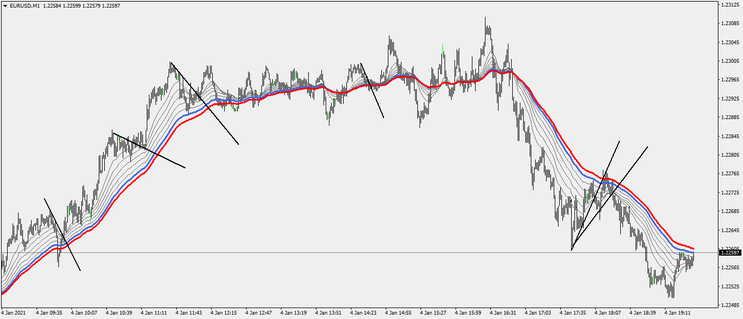

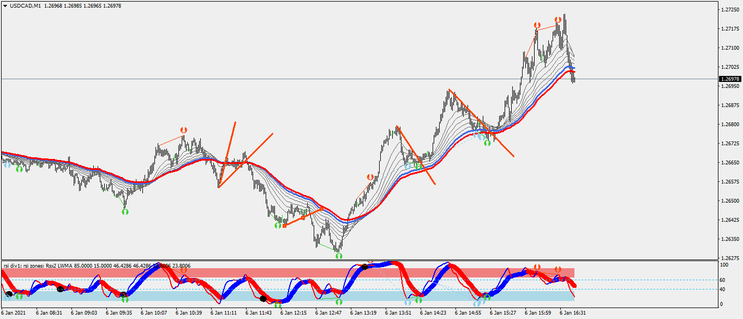

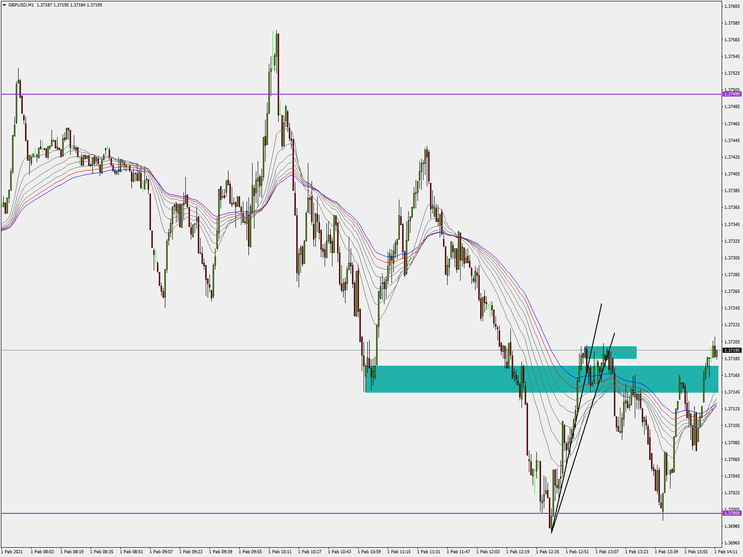

Trendline Breakout Entry and Moving Averages Breakout Entry

Submit by Dimitri

PullBacks Trend Strategy is a trend following trading system for scalping, day and swing trading based on t the return of the price towards the average and the subsequent recovery of the trend. In the trading system to better interpret the price action there are two other indicators: supply and demand index and RSI divergence. This more than a trading system is a trading methodology suitable for all financial markets and all time frames. The proposed template is very welcoming and therefore simple and practical to implement.

Setup strategy

Type of Strategy Trend Following

Style: Scalping, Day Trading, Swing trading

Time Frame 1 minute or higher

Currency pairs: any.

Metatrader 4 Indicators:

Exponential Moving Average 20 periods, close.

Exponential Moving Average 30 periods, close.

Exponential Moving Average 40 periods, close.

Exponential Moving Average 50 periods, close.

Exponential Moving Average 60 periods, close.

Exponential Moving Average 70 periods, close.

Exponential Moving Average 80 periods, close.

Supply and Demand Indicator (optional tool).

RSI Divergence

Trading rules PullBacks Trend Strategy

Trades only in the direction of the trend.

Trend up price above the moving average.

Trend down price below the moving averages.

Buy

Price retrace into the moving averages.

Manually draw a trend line from the previous high on the leaning peaks.

Buy at the break of the upward trendline by the price at the opening of the bar following the breakout.

Sell

Price retrace into the moving averages.

Manually draw a trend line from the previous low on the falling peaks.

Sell at the break of the downtrendline by the price at the opening of the bar following the breakout.

Note: The support and resistance zones can also be used as a retracement pivot.

When the moving averages are flat change the chart.

Exit position

Place initial stop loss on the previous swing high/low. Make profit with predetermined profit target or with ratio stop loss 1:1.2.

Examples of trades.