201# Ichimoku Cloud Filtered Super Profit

Force and Momentum Filter

Trend Following Winning Strategy

Submit By Dimitri

Ichimoku Cloud Filtered Super Profit is a classic trend following trading system which over time has proven to be one winning strategy. I have added two filters to this trading system, one for momentum and 1 for strength to improve profitability. This strategy is configured for day trading or for positions that can last a maximum of two to three days if the hourly time frame is used.

Setup Strategy

Currency pairs: majprs, minor and Indices.

Time frame best suited: 15 Minute time frame and higher

Sessions: Any, though London and New York sessions generally yield more trade opportunities as during these sessions.

Metatrader 4 Indicators

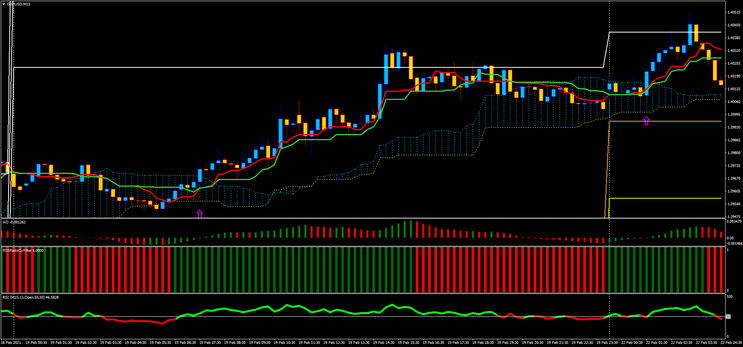

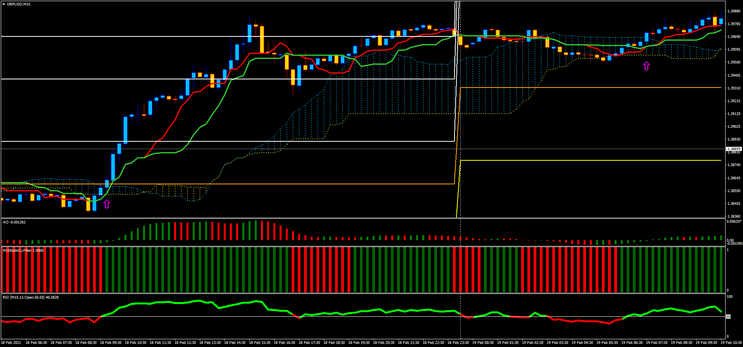

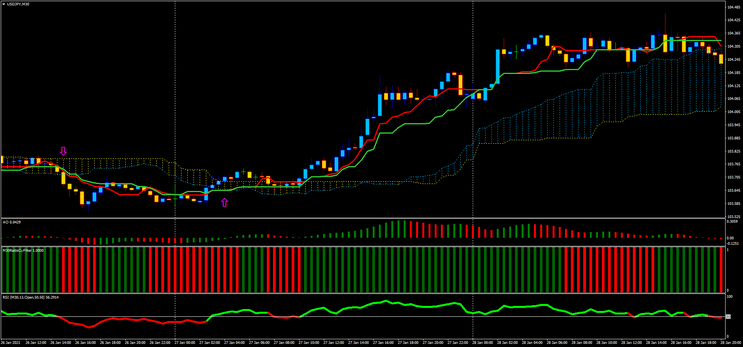

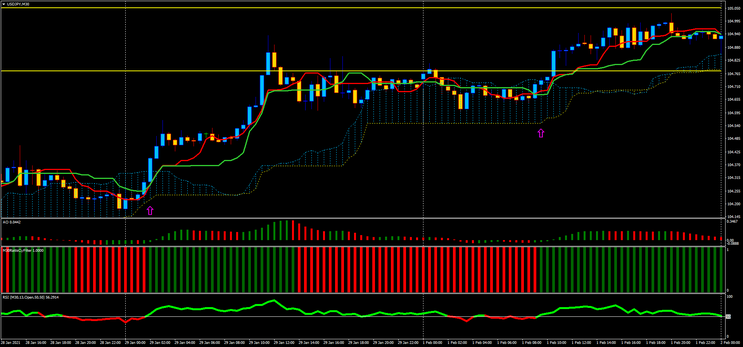

Ichimoku cloud, main indicator (default setting). The Cloud is either Blue (signaling that the current price momentum on that time frame is Bullish) or Gold (signaling that the current price momentum on that time frame is Bearish). Note that the color of the cloud is significant for our purposes only in that we want price to close either above the cloud irrespective of its color (for buy trades) or below (for sell trades). Cloud lines are standard set in the template as either colored red or green. This is done for ease of spotting a display that coincides with colors of our other indicators. When the Red line crosses below the green this shows a sell signal while, when the Green lines crosses above the red line this shows a buy signal.

Accelerator Indicator with standard settings This indicator will identify bullish and bearish trends with a Green or Red histogram.

Color RSI the line to be either red and below the 50 level for a sell signal or green and above the 50 level as a buy signal.

Momentum filter (Ratis), any Green histogram bars: Long/Buy trade signal, any Red histogram bars: Short/Sell trade signal.

Pivot point indicator

Trading rules Ichimoku Cloud Filtered Super Profit

Sell

1 On the main chart the red line must have moved above the green line at any point.

2 The candle/price must close BELOW the cloud.

3 The AO to be red.

4 Color RSI red line.

5 Momentum indicator red histogram.

6. Enter a trade at close of first candle that closes below the cloud or at open of the next candle.

7. Set stop loss at least 2 pips above the most recent swing high (or if that appeared too close (not less than 5 Pips from entry.

8. Set target equidistant from entry to stop, in other words at a minimum ratio of 1:1

Buy

1 On the main chart the blu line must have moved above the red line at any point.

2 The candle/price must close above the cloud.

3 The AO to be green.

4 Color RSI green line.

5 Momentum indicator green histogram.

6. Enter a trade at close of first candle that closes above the cloud or at open of the next candle.

7. Set stop loss at least 2 pips above the most recent swing low (or if that appeared too close (not less than 5 Pips from entry).

8. Set target equidistant from entry to stop, in other words at a minimum ratio of 1:1

Exit possibilities:

When price hits your set target (default exit strategy) ;

When the red chart line crosses back above the green line.

When the AO indicator turns green for at least 2 histogram bars.

At the next closest Pivot daily support/resistance line.

Examples of trades.

Fred (Tuesday, 10 September 2024 00:57)

"Ichimoku Cloud has become my favorite strategy! � It’s a bit complex at first, but once you get the hang of it, it’s incredibly powerful for identifying trends and momentum. Super reliable!" Here. good strategies.

Phúc (Saturday, 26 March 2022 08:21)

Good !