198# FX Master Trend Strategy

Moving Averages and Double CCI

Scalping and Day Trading with Price Action of the Trend

Submit by Janus Trader

FX Master Trend is a simple pure trend following trading system for day trading and scalping, based on moving averages and slow double smooth CCI. T The purpose of this template is to trade in the direction of the trend (trend is your friend). The template in any case is very simple because the interpretation must always be clear and you must never have any interpretative doubts especially when trading on the financial markets. The reading that the template offers of the market is medium-term with slow moving averages and double CCI slow. Moving averages and double CCI must always agree to open trading positions. This

Setup strategy

Time Frame 5 minutes or higher. For day trading best time frame 15 and 30 minutes time frames.

5 min time frame: Sessions London and New York.

Currency pairs: Majors, minors, Indices and Commodities.

Metatrader 4 indicators

main chart

Moving averge smoothed 24 periods, HLC/3 typical.

Moving averge smoothed 72 periods, HLC/3 typical.

Heikin Ashi APB.

Best Scalping Indicator,

Pivot points levels only for day trading.

In Sub Window

Double CCI setting (entry trend CCI period 130- Entry CCI period 50).

Tradin rules FX Master trend strategy

Buy

Trades only in the direction of the trend.

Moving average 24 periods above moving average 72 periods.

Double CCI blue bars.

Best Scalping indicator buy arrow.

The opposite arrows during an uptrend are used to close the position only when the Entry CCI is less than zero, in the other case they must be stored. In other words, if the moving averages are upwards and there are blue bars on the indicator and a contrary arrow appears, it should not be considered.

Sell

Trades only in the direction of the trend.

Moving average 24 periods below moving average 72 periods.

Double CCI red bars.

Best Scalping indicator red arrow.

The opposite arrows during an downtrend are used to close the position only when the Entry CCI is above than zero, in the other case they must be stored. In other words, if the moving averages are downwards and there are red bars on the indicator and a contrary arrow appears, it should not be considered.

Exit position

At the opposite arrow as described above.

Exit at the pivot points level.

Place initial stop loss above/below the previous swing high/low.

Note. Swing Trading. By applying this system at a time frame of 30 minutes or more, it is indeed mandatory to have precise price objectives as a profit target and not to follow the position, as you can do in 5 or 15 minutes. A great way out of a position in a trading swing is with past resistance support levels, which ensures a profit factor> 1.15 having a profitability of approximately 60% very high for a trend following system.

This trading system can be used as a signal service, certainly the template base is an excellent starting point that makes the difference.

Tutorial

Practically how to apply this system in general and for Swing trading?

1 Look for trending currency pairs, (this is a fundamental step to trade trending on currency markets and beyond), so this knowledge is a necessary and sufficient prerequisite. (if you don't have this knowledge you have to learn it otherwise you can't trade.

2 Comply with the established conditions.

3 avoid entering on signals that are generated too far from the

slow moving average.

4 the initial stop loss is the previous swing, but then you can advance the stop.

5 Always evaluate an exit on a major support or resistance by targeting 2 pips first.

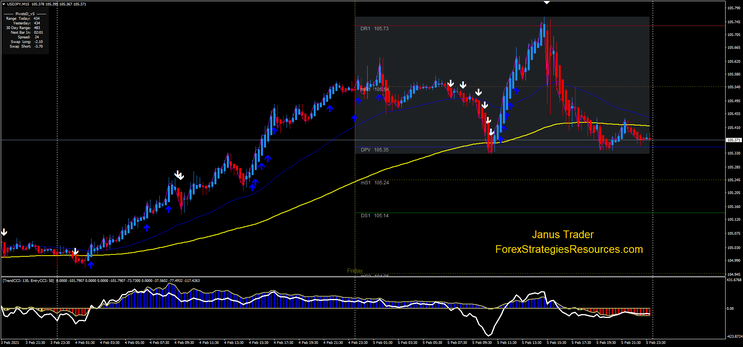

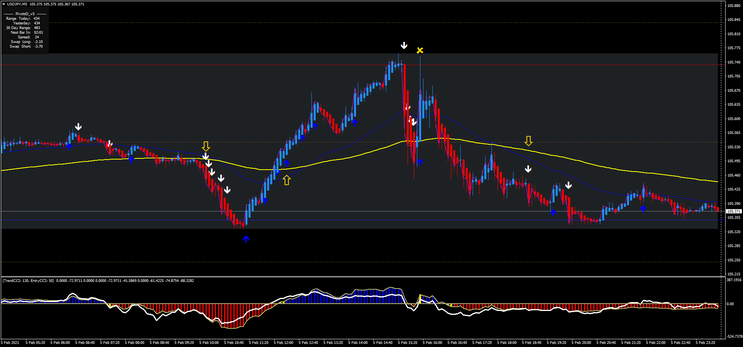

Example of trades

In images above there are the examples of trades applied in day trading.

In images above there are the examples of trades applied in swing trading,

It can be seen that despite being the same template there are differences in how the position can be managed. In day trading it is also possible to follow longer to hold the position longer, while in swing it is recommended to exit on verified support or resistance levels. But in both cases it can be seen that there is good profitability