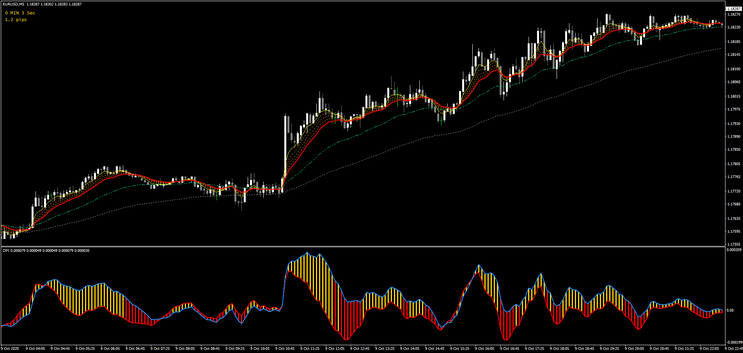

197# Viper Trend with Moving Averages

SDI filter

Trend Following strategy

Submit by Dimitri

Viper Trend is a pure trend following trading system based on moving averages and SDI indicator.

he signals generated by the different components on the chart will help us determine whether to enter the market with a Buy or a Sell trade every time we trade the system. While this system can incorporate multiple time frames there is generally no need to flip between multiple charts or time frames. Our system indicators allow us to determine:

The Reversal point

The Emerging Trend direction

The Trade direction

The Entry level

The Stop Loss level

The Take Profit level Our system uses 2 main indicators, the Moving Average indicators and the DPI indicator which appears on the bottom windowpane.

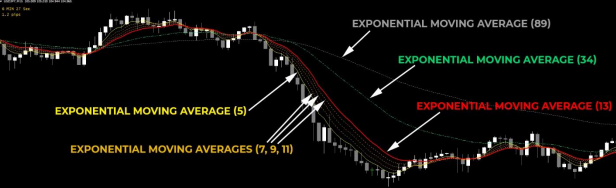

Components of the System

1. Moving Averages Indicator The Viper Trend trading system uses 4 main Moving Averages plus 3 additional ones. Each Moving Average indicator draws a line on our price chart and Buy and Sell signals are generated when the lines criss cross over each other.

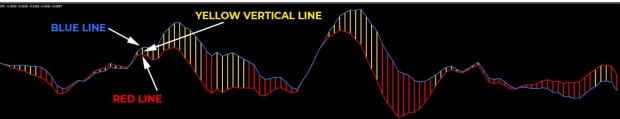

2. DPI Indicator DPI Indicator (Dynamic Positioning Indicator) is an indicator that will help us determine the trend and our entry positions. It consists of Blue and Red Line, filled with either Red or Yellow vertical lines.

The DPI Indicator is an additional tool to help us identify Entry points. It consists of Blue and Red Line, filled with either Red or Yellow vertical lines. Buy Scenario: Blue Line is above the Red Line Vertical Line is Yellow

Trading Rules

Buy Trade Rules

Setup

1. Wait for the Moving Averages to align in the following order:

Gray EMA 89 at the bottom

Green EMA 34 above the Gray EMA 89

Red EMA 13 above the Green EMA 34

Yellow EMA 5 above the Red EMA 13

2. DPI Blue Line must be above the Red Line and vertical fill line must be Yellow.

3. Open a Buy trade at the open of the next candle.

4. Place your Stop Loss a few pips below the most recent Swing Low.

5. Place your Take Profit twice the distance away from your entry as your Stop Loss, i.e. 1:2 Risk/Reward Ratio (a 1:1 Risk/Reward Ratio is also acceptable).

6. Move your Stop Loss to Breakeven when price reaches half the distance to the target.

7. You may also consider exiting the trade manually when Yellow EMA crosses above the Red EMA

Sell Trade Rules

Setup

1. Wait for the Moving Averages to align in the following order:

Gray EMA 89 at the top

Green EMA 34 below the Gray EMA 89

Red EMA 13 below the Green EMA 34

Yellow EMA 5 below the Red EMA 13

2. DPI Blue Line must be below the Red Line and vertical fill line must be Red.

3. Open a Sell trade at the open of the next candle.

4. Place your Stop Loss a few pips above the most recent Swing High.

5. Place your Take Profit twice the distance away from your entry as your Stop Loss, i.e. 1:2 Risk/Reward Ratio (a 1:1 Risk/Reward Ratio is also acceptable).

6. Move your Stop Loss to Breakeven when price reaches half the distance to the target.

7. You may also consider exiting the trade manually when Yellow EMA crosses below the Red EMA

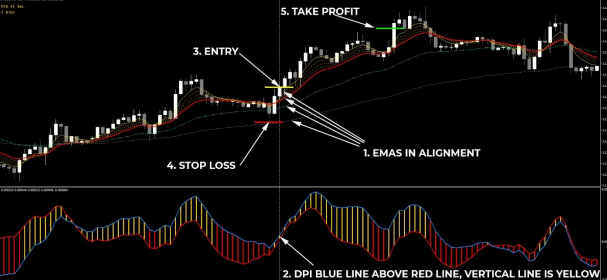

Buy Trade Example

This Buy example was taken on the EURUD currency pair, H1 time frame. First of all, I checked whether the EMAs are aligned in the correct order: Gray at the bottom, Green on top of Gray, Red on top of Green and Yellow on top of Red (1). Next was the DPI. DPI’s Blue Line was above the Red Line and the Vertical fill line was Yellow (2). That meant we’ve met all the conditions and we’re ready to enter the trade. As soon as the candle closed, I enter the Sell trade (3). My Stop Loss was set below the most recent Swing Low (4) and the Take Profit was set at 1:2 Risk to Reward ratio, which means twice the distance away from my entry as my Stop Loss. The price continued to rise and my Target was hit 10 candles after the Entry, making it a really clean and profitable trade.

Sell Trade Example

Here’s another example trade, but this time around, I’ll be trading in the Short or Sell direction. This Sell example was taken on the USDJPY currency pair, H1 time frame. First of all, I checked whether the EMAs are aligned in the correct order: Gray at the top, Green below the Gray, Red below the Green and Yellow below the Red (1). Next was the DPI. DPI’s Blue Line was below the Red Line and the Vertical fill line was Red as well (2). That meant we’ve met all the conditions and we’re ready to enter the trade. As soon as the candle closed, I entered the Sell trade (3). My Stop Loss was set above the most recent Swing High (4) and the Take Profit was set at 1:2 Risk to Reward ratio, which means twice the distance away from my entry as my Stop Loss. The price continued to fall and my Target was hit, making it a really clean and profitable trade.