179# Best Ichimoku Trend Strategy

Ichimoku with moving averages

Ichimoku as filter.

Submit by Janus Trader

Best Ichimoku Trend Strategy is a trading system based on Ichimoku cloud as filter of slow moving averages that generated signals buy and sell with crossover.

In the strategy there are also other indicators as weekly, montly pivot levels and an slow moving average 150 period.

Trading system for day trading and swing trading.

Time Frame 5 min or higher.

Currency pairs:any.

Metatrader Indicators:

Ichimoku (9,26, 52).

Zig Zag arrow (160,0 160).

Zig Zag arrow ( 10,0, 50).

MA cross alert (14 period smooted, 20 period snoothed).

LWMA moving average 150 period, closo.

Pivot points levels weekly.

Pivot points levels montly.

CCI trend 100 period, close.

CCI Trend 21 period, close.

Trading rules Best Ichimoku Trend Strategy

Trades only in the direction of the trend

Buy

Ichimoku ma crosses upward (red line > aqua line).

Ma alerts buy arrow.

CCI 100 >0

Sell

Ichimoku ma crosses downward (red line < aqua line).

Ma alerts sell arrow.

CCI 100 <0

Exit position at opposite arrow or at the levels of pivot point if time frame is above 5 min.

Initial stop loss at the previous swing high/low, you can use the ichimoku cloud as a trailing stop to follow the position.

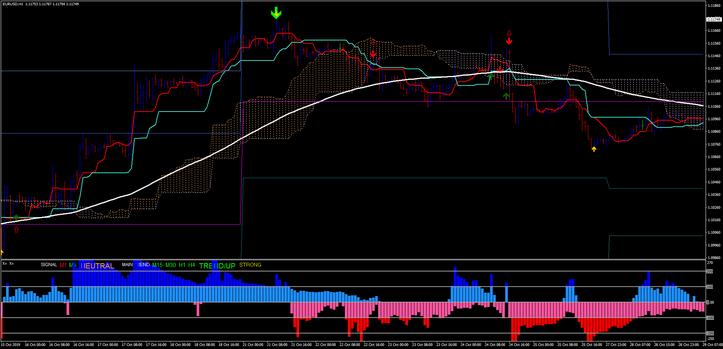

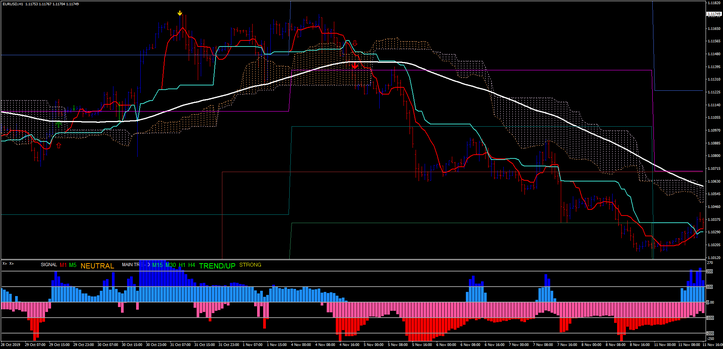

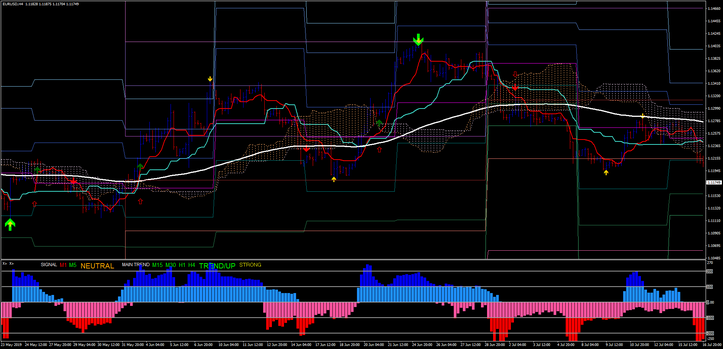

In the pictures Best Ichimoku Trend Strategy in action.

This tempate can also be interpreted trend reversal.

When a large green arrow is formed, only follow the trades in the direction of the large green arrow (a very slow zig zag)

Time frame 30 min, H1, 240 min, daily.

Trading rules

Buy

Zig zag big buy arrow ,.

Zig zag fast arrow (optional).

Ichimoku miving averae crosses upward

Moving average alerts buy arrow (timing for entry).

Sell

Zig zag big sell arrow ,.

Zig zag fast sell arrow (optional).

Ichimoku miving averae crosses downward

Moving average alerts sell arrow (timing for entry).

Initial stop loss on the previous swing high / low.

Profit Target ratio stop loss 1: 1.25 or at the leves of pivot points levels.

Note: In this case, as others have done, I do not use, future projections or neural networks, because I believe that Ichimoku is quite solid in predicting a price movement.

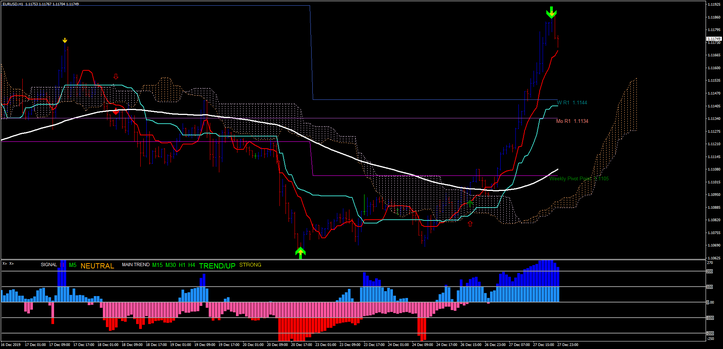

In the pictures Trend reversal of Best Ichimoku in action.

Telegram Channel https://t.me/freeforexresources

Share your opinion.

Rolando (Monday, 06 January 2020 08:58)

Is the indicator repaints?