171# 3MA Trend Power

3 moving average alert trading

Trading on retracement and Trend Power filter

Submit by Alex

3MA Trend Power is a trend following strategy based on an advanced moving averages indicator that indicates the intersection of the three moving averages, the crossing of two moving averages and the retracement on the slow moving average in a trend. So you can have three signals generated: strategies the crossing of three moving averages, the retracement on the slower moving average, and the crossing of two moving averages. These signals are indicated with alerts, arrows, dot and square. The visual impact of this indicator is interesting and educational because it summarizes three trend-following entries. This indicator is wonderful for the visual impact and was made by Mladen (MQL Rock Star).

This post does not define a strategy but a method of using the moving average.

The first step is to choose the time frame on which we want to operate.

The second step is to choose the currency pair based on the corrency power. A strong currency will be chosen against a weak currency.

the third step is to define the type of trend following entry using this wonderful Mladen indicator. from experience it is not recommended to use all three entrances, but at most two.

Time frame 5 min or higher

Currency pairs that tend to be more in a trend like GBP / AUD, GBP / CAD, AUD / USD, GBP / NZD, GBP / USD, AUD / NZD, AUD / JPY.

Metatrader 4 indicators

MT4 currency power,

3 MA cross with alert,

KM trend Movers,

Pivot daily 2 for day trading,

Symbol changer,

Trend Power as filter.

3MA Trend Power trading rules

The entries long or short on the market that I propose are two that can be used both individually and together:

Crossing of the three moving averages indicated with the arrow symbol and the entry on the retracement indicated with the dot symbol.

Buy

Aqua buy arrow crossing upward of three moving averages.

Aqua dot entry on retracement.

Sell

Yellow sell arrow crossing downward of three moving averages.

Yellow dot entry on retracement.

But which entry should be used to have greater profitability? The experience tells me the entry on the retracement seems to have a greater long-term profitability on the condition that it is possible to choose currencies in trend something that is learned with the practice.

The indicators Trend Power and KM trend movers can be used as a filter.

Exit position

Initial stop loss on the previous swing high/low.

Profit Target at the next intersection or on levels of support or resistance or pivot levels / day trading).

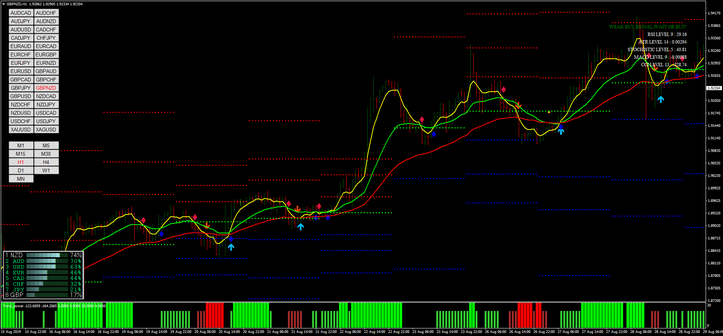

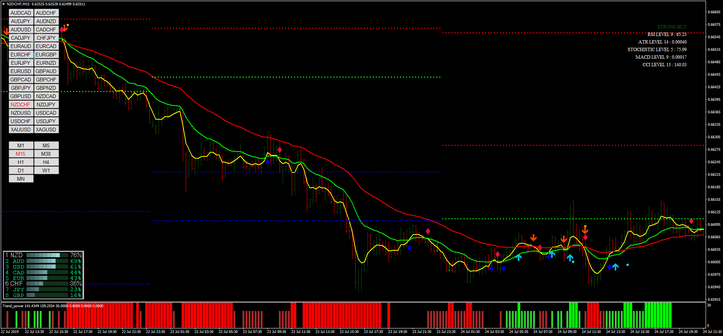

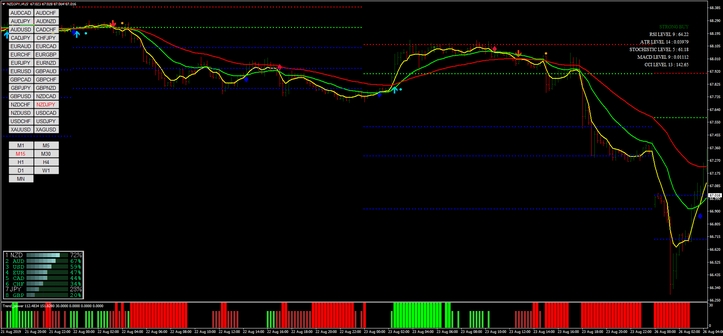

In the pictures 3MA Trend Power trading rules in action.

Share your opinion.