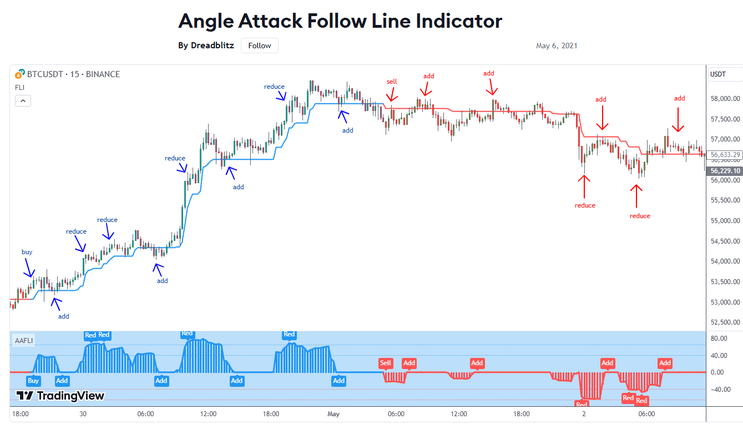

151# Angle Attack Follow Line Indicator

by Lorenz 2024

Angle Attack Follow Line Indicator is a strategy based on two custom tradingView indicators:

Angle Attack (AAFLI) by Dreadbliz and Follow Line Indicator by Kivan Ozbilgic.

The Angle Attack Follow Line Indicator evaluates angles formed by price movements and trendlines to guide trading decisions. It is particularly useful for managing positions by signaling when to add to or reduce them based on market conditions.

How to Use:

-

Setup:

-

Add the script to TradingView by copying it into the Pine Editor and applying it to your chart.

-

Configure the settings based on your trading strategy:

-

Bollinger Band Period and Deviations: Adjust to determine trend boundaries.

-

ATR Period: Use this for trend filtering and angle calculations.

-

Angle Thresholds: Define upper and lower angle limits to trigger actions.

-

-

-

Trading Actions:

-

Buy and Sell Signals:

-

The indicator generates signals when price crosses the Bollinger Bands and the trend shifts.

-

-

Add to Position:

-

Buy or sell additional units when angles meet predefined criteria (e.g., positive angle for buy, negative for sell).

-

-

Reduce Position:

-

Reduce exposure when the angle exceeds critical thresholds.

-

-

Signals appear as colored labels on the chart, with additional histograms for visual confirmation.

-

-

Timeframe Consideration:

-

The script supports current resolution and higher timeframe filtering, helping to align trades with broader trends.

-

-

Visualization:

-

Colored bars and trendlines indicate bullish (blue) or bearish (red) momentum.

-

Background color reflects overall trend direction.

-

-

Alerts:

-

Set alerts for specific signals (e.g., buy, sell, add, reduce) to receive notifications.

-

The Follow Line Indicator is a simpler tool designed to track trends based on the current price action and identify potential entries and exits.

How to Use:

-

Setup:

-

Apply the indicator to your chart.

-

It works with your chart's resolution and offers insights into the trend's strength.

-

-

Trend Tracking:

-

The indicator plots a line that "follows" the price, based on moving averages and Bollinger Bands.

-

When the price crosses above the follow line, it indicates a bullish trend.

-

When the price crosses below, it signals a bearish trend.

-

-

Higher Timeframe:

-

Use the higher timeframe option to confirm signals on broader trends.

-

-

Trading Actions:

-

Use the line as a dynamic support/resistance level:

-

Enter long trades when the price is above the line and showing strength.

-

Consider short trades when the price is below the line.

-

-

-

Alerts and Visualization:

-

Combine this indicator with alerts or other tools for better trade timing.

-

Adjust settings to fine-tune its sensitivity to price movements.

-

Combination of Both Indicators

When used together, these indicators provide a comprehensive system:

-

Use the Follow Line Indicator to determine the overall trend.

-

Use the Angle Attack Follow Line Indicator to refine entries, add/reduce positions, and manage risk.

-

Example Buy 1 US100 contract and liquidate 0.1every time you have reduction alert ( and viceversa).

-

Example Sell 1 US100 contract and liquidate 0.1 whenever you have reduction alert (and viceversa).

Both tools emphasize proper risk management—always test on a demo account before applying in live trading.