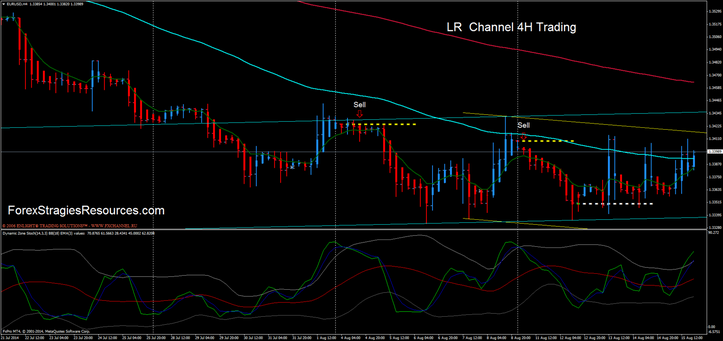

587# LR Channel 4H Trading

LR Channel Trading

Submit by Tommy 16/06/2014

LR Channel 4H Trading is a forex strategy trend-momentum based on the regression channel.

Time Frame 4H

Currency pairs: EUR/USD, GBP/USD, EUR/CHF, UDF/CHF, AUD/USD, USD/CAD, EUR/JPY, AUD/JPY, GBP/JPY, AUD/NZ.

Exponetial moving average (period 4);

Exponetial moving average (period 72);

Exponetial moving average (period 200);

Support and resistance;

Sinergy Bar,

enlight LR Channel (38, 5);

en light LR Channel (0, 2);

Dynamic Zone Stochastic ( 14,3,3, 18).

Rules LR Channel 4H Trading

If we are within an uptrend we look only long entry at the

bottoms of the channel and when we're inside an downtrend we're looking to market the tops.

Conditions for entry in the market:

Buy

EMA 4 > EMA72 > 200;

Up market LR Channel point up;

Price touches or breaks lower band;

Dynamic Zone Stochastic break lower band and re-entry into channel to upward.

The price is above the resistance that is formed.

Heiken Ashi Blue color.

Sell

EMA 4 < EMA72 < 200;

Up market LR Channel point up;

Price touches or breaks upper band;

Dynamic Zone Stochastic break upper band and re-entry into channel to downward;

The price is beloew the support that is formed;

Heiken Ashi blue color.

Exit position

When the colour of the Synergy candle changes .

Profit Target 60, 100 pips depends by currency pairs.

Note: EUR/CHF 20 -25 pips.

Initial stop loss on the previous swing.

Note:

This Forex Trading Strategy makes less trades per month for currency. But it has a high profitability.

You can also use Traders Dynamic Index

Write a comment

asaens (Sunday, 17 August 2014 01:12)

is this file missing?: dynamic-zone-stochastic.ex4

asaens (Sunday, 17 August 2014 01:51)

to author: if you have time, remove all objects by right-clicking on screen, selecting "objects list", and then high light all and delete. that should remove objects created for you by your system. then choose lower/higher time frame and then go back to H4 to just produce basic objects needed for you screen shot and then immediately save a template to try to produce a good trimmed basic template without other unnecessary objects in it for the general public to use. just a suggestion and shouldn't take too much time. thanks for the strategy and it's an interesting one.

asaens (Sunday, 17 August 2014 03:47)

I'm a fan of MTF (multiple time frame) indicators. I added a mtf stochastic at setting 14,2,2 on a D1 (1440) time frame to act as a filter to take trades in the same direction as the daily so as not to be fighting with the daily trend. I also change the default color to white thickness 2 on the faster stochastic and red thickness 2 on the slower to make it more visible.