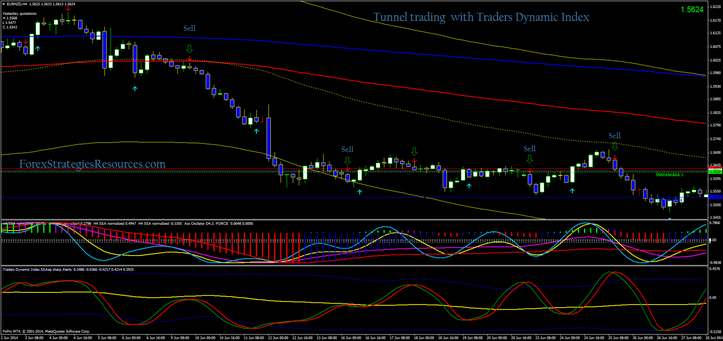

577# Tunnel trading with Traders Dynamic Index

Traders Dynamic Index with alerts

Submit by RogerFx 30/06/2014

Tunnel trading with Traders Dynamic Index is a complex trading system based on the indicators trend-momentum smoothed by SSA normalized and metatrader indicators based on the SSA normalized.

I trade only in direction of the trend but with this trading system (template-s) there are many interpretations.

Time Frame H1 or higher.

Currency pairs: any.

Metatrader Indicators library and templates:

Signal Price,

200 Exponential moving average,

89 exponential moving average (close) with levels (300 and – 300);

Pulse fibonacci Pivot optional for intraday trading;

480 exponential moving average (close);

SSA (0, 20,2, 55);

SSA (0,20, 4, 21);

SSA (0,10,2, 10);

SSA (0, 20, 2 144);

SSA Force oscillator;

Traders Dinamic Index SSA Nomalizrd with alerts.(setting 500

bars)

Library:

Ahp.dll

libSSA.

Templates:

Ass

Ass1

Ass2

Template of this example is AS 1.

Rules for Tunnel trading with Traders Dynamic Index

Trades only in direction of the trend.

Buy

Price > 89 EMA> 200 EMA > 480 EMA;

Traders Dinamic Index Buy alert;

When the trend changes and the direction is up: buy the first arrow;

Re-entry (very important)

when the price touches or retraces into the tunnel (colour yellow);

You can to confirme the long entry with the SSA line deep sky blue is > of the SSA yellow line (this is optional).

Sell

Price < 89 EMA < 200 EMA < 480 EMA;

Traders Dinamic Index Buy alert;

When the trend changes and the direction is up: buy the first arrow;

Re-entry (very important)

when the price touches or retraces into the tunnel (colour yellow);

You can to confirme the short entry with the SSA line deep sky blue is < of the SSA yellow line (this is optional).

Exit position

at the oppiste arrow or at the profit target predetermided.

Initial Stop loss at the previous swing.

This hybrid indicator is developed to assist traders in their

ability to decipher and monitor market conditions related to

trend direction, market strength, and market volatility.

Even though comprehensive, the T.D.I. is easy to read and use.

Green line = RSI Price line

Red line = Trade Signal line

Blue lines = Volatility Band

Yellow line = Market Base Line

Trend Direction - Immediate and Overall

Immediate = Green over Red...price action is moving up.

Red over Green...price action is moving down.

Overall = Yellow line trends up and down generally between the

lines 32 & 68. Watch for Yellow line to bounces off

these lines for market reversal. Trade long when

price is above the Yellow line, and trade short when

price is below.

Market Strength & Volatility - Immediate and Overall

Immediate = Green Line - Strong = Steep slope up or down.

Weak = Moderate to Flat slope.

Overall = Blue Lines - When expanding, market is strong and

trending. When constricting, market is weak and

in a range. When the Blue lines are extremely tight

in a narrow range, expect an economic announcement

or other market condition to spike the market.

Entry conditions

Scalping - Long = Green over Red, Short = Red over Green

Active - Long = Green over Red & Yellow lines

Short = Red over Green & Yellow lines

Moderate - Long = Green over Red, Yellow, & 50 lines

Short= Red over Green, Green below Yellow & 50 line |

Exit conditions*

Long = Green crosses below Red

Short = Green crosses above Red

* If Green crosses either Blue lines, consider exiting when

when the Green line crosses back over the Blue line.

IMPORTANT: The default settings are well tested and proven.

But, you can change the settings to fit your

trading style.

Price & Line Type settings:

RSI Price settings

0 = Close price [DEFAULT]

1 = Open price.

2 = High price.

3 = Low price.

4 = Median price, (high+low)/2.

5 = Typical price, (high+low+close)/3.

6 = Weighted close price, (high+low+close+close)/4.

| RSI Price Line & Signal Line Type settings

0 = Simple moving average [DEFAULT]

1 = Exponential moving average

2 = Smoothed moving average

3 = Linear weighted moving average

Good trading,