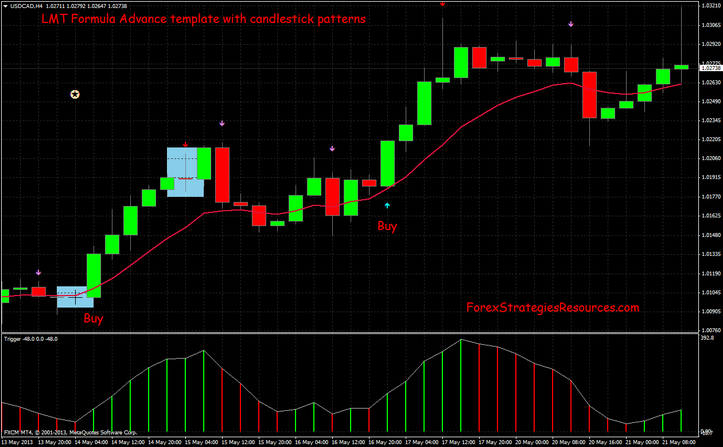

465# LMT Forex Formula Trading System

LMT Forex Formula with Candlestick patterns

Submit by Buddy, Written by Dean Saunders 29/07/2013

Time Frames:

daily or 4 hour charts.

Currency pairs:any

To identify entry signals we are going to use the “Trigger” indicator at the

bottom of your chart which looks like the picture below.

As you can see from the above picture the L.M.T Trigger is constantly oscillating

like a wave and changing colour depending on its direction. The indicator gives

possible signals as it changes from red to green, but there are several things that

must be checked before it can even be considered a trade setup.

1. The entry signal must be in the direction of the current trend as indicated by

the trend direction indicator

There must be at least three red/green bars on the L.M.T Trigger indicator

before the signal is given. For example if the trend is down, there must be three

or more green bars before a red bar forms to signal a sell entry. If the trend is

up, there must be three or more red bars before a green bar forms to signal a

buy entry. If there are only two bars or less before the entry bar, then the signal

is invalid. Below is an example of entries with an up trend.

3. On a chart each candle represents a period of price action, for example on a 4

hour chart each candle represents 4 hours of price action. Every 4 hours one

candle closes and a new candle opens. Before a signal can be generated the

current candle must have completed and closed for the signal to be valid. Often

it may look like a good signal is forming but price can reverse before the candle

is closed so never jump in early.

Make sure the candle which gave the signal is not a huge bullish/ bearish

candle. As a guide, if the candle is more than twice the size of the current

stop value avoid the trade. These large candles will often retrace a long way

before going in the predicted direction and there is a high chance that your

stop loss may be hit before the trade goes into profit. This step is essential, if

you see these huge bars on the entry signal don’t take the trade. (See

example )

LMT Forex Formula Trades Examples

LMT Forex Formula with Candlestick patterns

There are hundreds of

different candle formations but I only take note of the following 3 formations.

Engulfing pattern

An engulfing pattern is a strong change in momentum in the market

often seen off of strong support/resistance levels. For a buy

confirmation the first candle would be red followed by a green candle

that completely engulfs the previous one. For a sell confirmation, the

first candle would be green followed by a red candle that completely engulfs it.

This formation indicates good volume and momentum in the market

Pin bar formation

The pin bar formation is one of my favorites, it shows huge emotion of the

market indicating a sign of a reversal. In this case the bulls pushed the

market high but failed to hold it so price returned to around the open

leaving a pin bar formation. The pin always points away from where price may

be heading, the opposite is true for a bullish pin bar formation. You will often

see these formations after a strong move.

The Doji pattern

The Doji pattern is generally a small candle indicating indecision with not much

movement, the open and close should be at the exact same price but

it is acceptable within few pips.

I like to see 2 or more Doji’s next to each other after a strong move,

which is a great indication that the market could be changing direction.

Initial Stop Loss on the previous swing.

Management position to see the previous examples.

Share your opinion, can help everyone to understand the forex strategy.

LMT Forex Formula with Candlestick Patterns: Indicators and Template

LMT Formula Forex:Indicators and Template

trading system download.

Write a comment

Douglas Bates (Saturday, 18 May 2019 07:17)

what moving average do you use?

Douglas Bates (Thursday, 12 December 2019 18:05)

moving average?