96# Catching the Key Zone Forex Strategy

Zone indicator

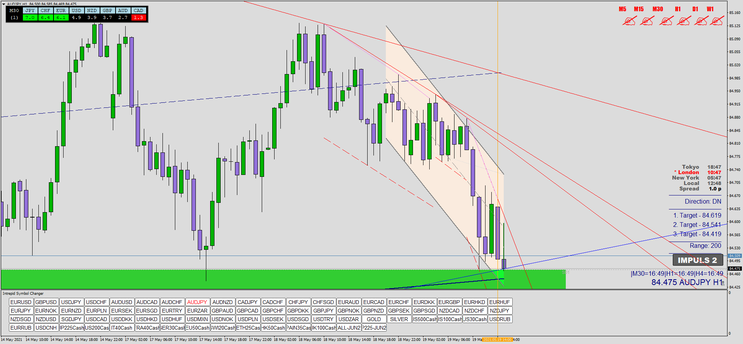

Find the Impulse

Submit by Dimitri author Amdudus

Catching the Key Zone is the King

of price action trading system. The principle of "catching zones" is simple: we look through the W1, D1, H4 instruments one by one using the

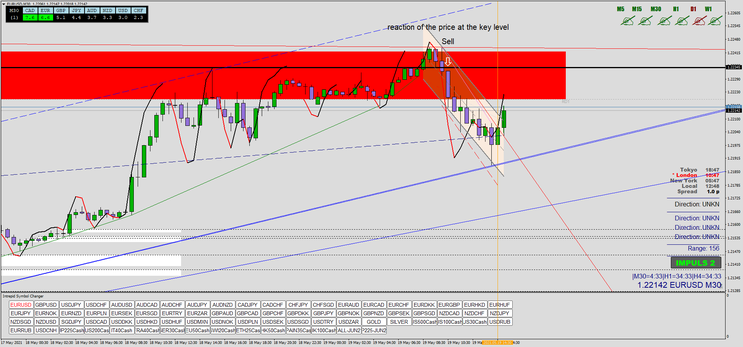

buttons below. Determine the key zones. Look at confirmations - candlestick patterns, impulse, trend arrow or momentum arrow.

If the "support" is confirmed, enter. Entries do not have to be made on Н4. You can also work perfectly on the M30, where we can go after all the

procedures.

Absolutely winning system

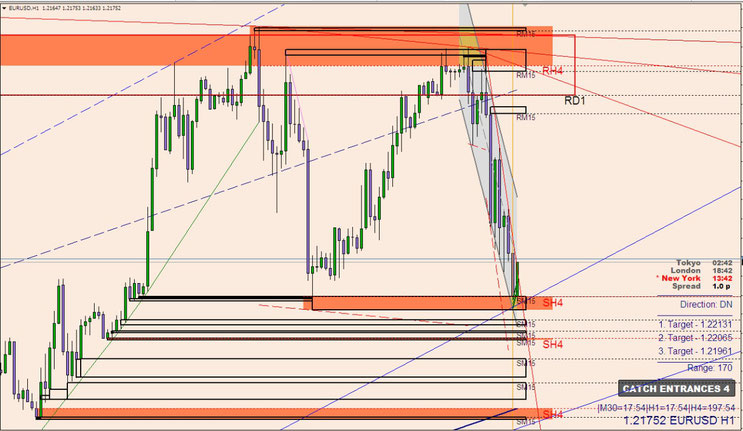

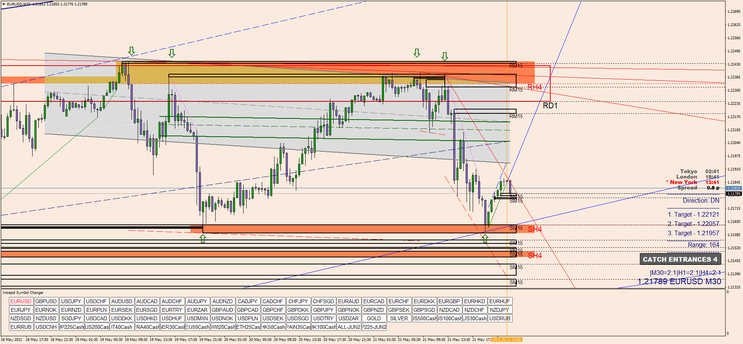

In this post I show you an setup for day trading at 30 and H1 min time frame.

Setup strategy

Price Action strategy

Time frames30 min or higher

currency pairs:any

Metatrader 4 Indicators

Channels indicators 3

Candle Multitime

Pallada assistant (with target Zone and trend direction)

Magnifies price

Chanel trend

Digital 30 Maschek

CS Dash 2021

Bias Zone

Zone indicator (30, 60 TF, setting 240- 240 setting daily, daily setting weekly)

B pattern (optional)

Intrepid Symbol Changer

Trading Rules Catching the Key Zone

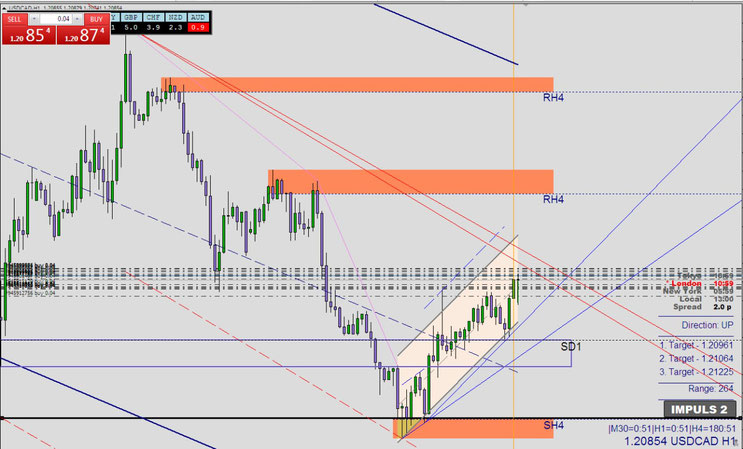

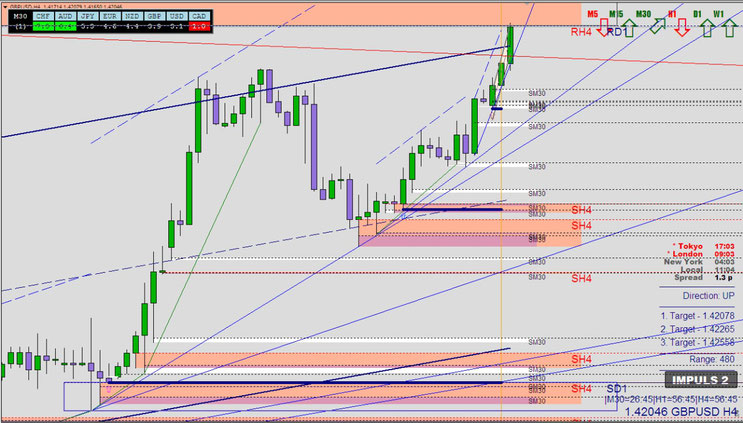

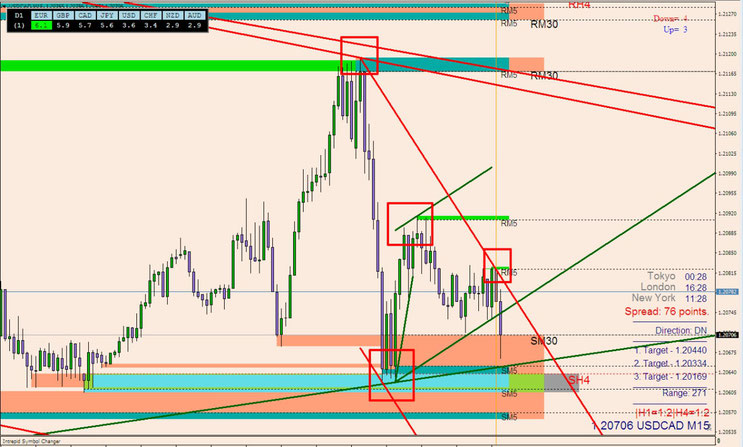

Step 1) Identify the key levels proposed on the daily and 4H chart.

2) go to the 30 min or H1 chart and wait for the price to react at that key level.

Other examples of trades where the price reacts to key levels and becomes a good opportunity to trade with a very high probability of success.

Catch Entrances update

In this update, the focus is on greater clarity and simplification of the model.

A different search indicator of significant levels are noted.

In any case, it is emphasized how these models must be framed in the analysis of the market structure. This templete succeeds fully in its purpose. Generally the market structure models are built

manually this model helps to learn how the model could be built manually.

Catch Entrances TLC update 30/05/2021

This update combines the best of the methods of Anna Zold and Ian Iron. Already featured in Dark Energy.

Update 17(01/2024)

In this new update the principles

remain the same. It is necessary to be clear about the difference between key levels which are on a Daily or higher basis and local levels if you use time frames lower than daily.

Trades are generated when the price bounces from a local or preferably Key level in the direction of the trend.

No need for arrow, it's optional.

My advice is to practice first of all on daily time frames so as to become familiar with the key levels.

This is a winning strategy Happy trading and thanks to Amdudus!!!

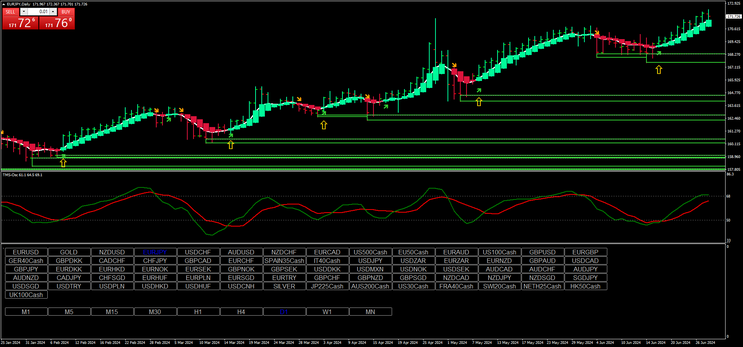

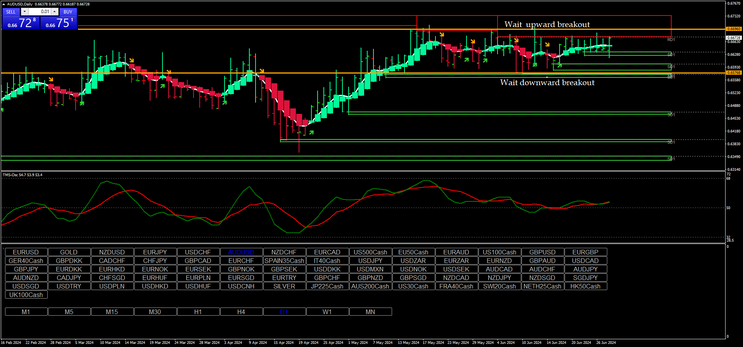

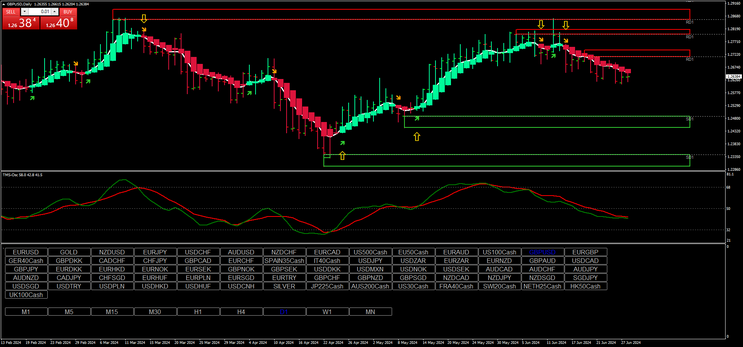

Update 28/06/2024

Key Zone Entries with Heikin Ashi Smoothed and TMS Oscillator

In this update I tried to make the entries as clear as possible even for beginners who do not

know price candle formations and graphic analysis.

The daily time frame system is exceptional, you can easily reach 75% profitability, it has been compared to Hells Angels Daily (a

tough nut to crack). Guys, have faith, don't spend unnecessary money, this is a winning system update inspired by Trading Made Simple on Forex Factory.

This trading strategy leverages key zone levels along with Heikin Ashi Smoothed candles and the TMS (Traders Dynamic Index) oscillator to determine optimal entry points. It is designed for the 4-hour and daily time frames, with key zones identified on the daily chart. The strategy aims to capture price movements by entering trades both on bounces from key levels and breakouts through these levels.

Setup

Time Frame 4H or daily.

Currency pairs: any.

Indicators Used:

Key Zone Levels setting daily time frame.

Heikin Ashi Smoothed Candles

TMS Oscillator: 10, 4, 9, 34; (similar to TDI - Traders Dynamic Index).

Time Frames:Key Zone Levels: Daily

Trading Execution: 4-Hour or Daily.

To operate in the intraday set key zone at 4H but at h1 you can also use the Key Zone at the time frame daily.

Key Components of the Strategy

1. Identifying Key Zones:

Key zones are significant support and resistance levels derived from historical price data on the daily chart. These zones represent areas where price has previously shown strong reactions.

2. Heikin Ashi Smoothed Candles:

Heikin Ashi Smoothed candles are used to filter out market noise and provide a clearer trend direction. Unlike standard Heikin Ashi candles, the smoothed version offers a more gradual and visually intuitive depiction of the trend.

3. TMS Oscillator:

The TMS oscillator, similar to the TDI, combines multiple indicators including RSI, moving averages, and volatility bands to provide a comprehensive view of market conditions. It helps in identifying potential entry points by highlighting changes in market momentum and direction.

Trading Rules

Bounce of the Key Zone

Look for the price to approach and bounce off a key zone level.

Confirm the bounce with a Heikin Ashi Smoothed candle changing color in the direction of the bounce.

Ensure the TMS oscillator shows a corresponding signal (e.g., RSI line crossing above the signal line for a buy, or below for a sell).

Breakout through Key Zone:

Identify a price break through a key zone level.

Confirm the breakout with a Heikin Ashi Smoothed candle closing beyond the key zone.

TMS oscillator should indicate a strong momentum in the direction of the breakout (e.g., RSI line above 50 for a buy, below 50 for a sell).

Exit position

Set a profit target based on the next key zone level or a predefined risk-reward ratio (e.g., 1:2).

Use a trailing stop to lock in profits as the price moves favorably.

Exit the trade if the Heikin Ashi Smoothed candles change color against the trade direction or if the TMS oscillator signals a reversal.

Risk Management:

Use a stop-loss order just below the key zone for long positions and just above the key zone for short positions.

Adjust position size based on account size and risk tolerance, typically risking no more than 1-2% of the trading account per trade.

Example trade scenarios

Bounce Trade

Price approaches a key support zone on the daily chart.

A Heikin Ashi Smoothed candle on the 4-hour or daily chart turns green, indicating a potential bounce.

TMS oscillator shows RSI crossing above the signal line.

Enter a long position with a stop-loss just below the key support zone.

Set a target at the next key resistance zone or use a trailing stop.

Breakout Trade

Price breaks above a key resistance zone on the daily chart.

A Heikin Ashi Smoothed candle closes above the resistance zone on the 4-hour chart.

TMS oscillator shows RSI above 50 and increasing.

Enter a long position with a stop-loss just below the broken resistance zone.

Set a target at the next key resistance level or use a trailing stop.

By combining the precision of key zone levels with the trend-filtering capabilities of Heikin Ashi Smoothed candles and the momentum insights from the TMS oscillator, this strategy aims to capture high-probability trades in the forex, stock, and crypto markets.

Telegram Web: https://t.me/freeforexresources

Vicky (Monday, 22 January 2024 18:54)

Yes after a long time wecome back. We missed you so much

Philip (Wednesday, 07 September 2022 18:29)

hello do you have this system for META5