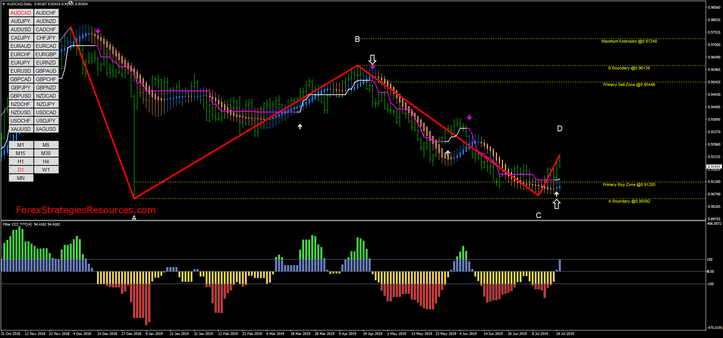

76# Barros Swing Strategy

Projection of support and resistance zones

Trading idea with Barros Swing indicator

Submit by Lorenz

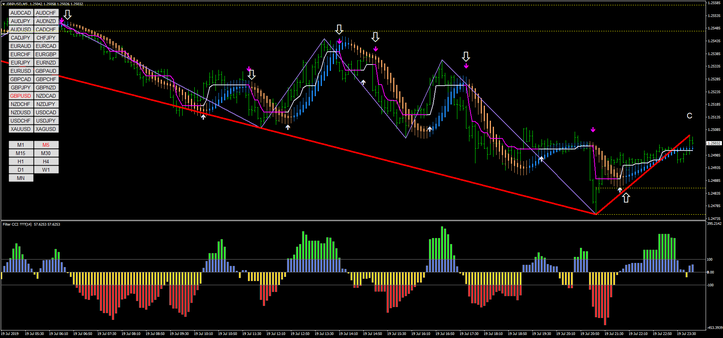

Barros Swing Strategy is a trading idea based on Barros swing indicator that projects support and resistance zones based on previous market movements where we expect the market to have a trend reversal. The trading system is also composed of other indicators (digital CCI filter), Heiken Ashi and half trend V.1. The particularity of the digital CCI filter is the ease with which to identify the divergences that can be interpreted as a confirmation of the support / resistance zones identified by the Barros Swing. In any case, the basic idea of my system is to follow the trend starting from the S / R areas identified by the Barros Swing mq4 indicator.

The Barros Swing strategy is suitable for dayand swving trading.

Time frame 5 min or higher.

Currency pairs:any.

Metatrader Indicators 4

Barros Swing mq4 indicator (default setting).

Half Trend (period 2).

CCI filter (14 period).

Heiken Aschi MA T3 New version (period 21).

Trading rules Barros Swing Strategy

Buy

Price bounces on the Primary-Boundary support area.

CCI> 0, bar with green color is desirable.

Hekein Ashi T £ MA color blue.

Buy arrow of half trend indicator.

Sell

Price bounces on the Primary-Boundary resistance area.

CCI< 0, bar with red color is desirable.

Hekein Ashi T 3 MA color blue.

Sell arrow of half trend indicator.

Continue to take positions in the opposite direction to the S / R area of the price rebound. If an area is broken then there is a false bounce waiting for a new area to be formed. The signal is confirmed or with CCI (red / green or Heiken Ashi t3 MA Blue / orange). Initial stop loss on previous swing high/low. Profit target discretionary.

Concluding the Barros Swing indicator wants to be the compass for sailors, therefore, an instrument that has the ambition to indicate the direction of the market for the trader.

In the pictures Barros Swing Strategy in action.

Share your opinion.