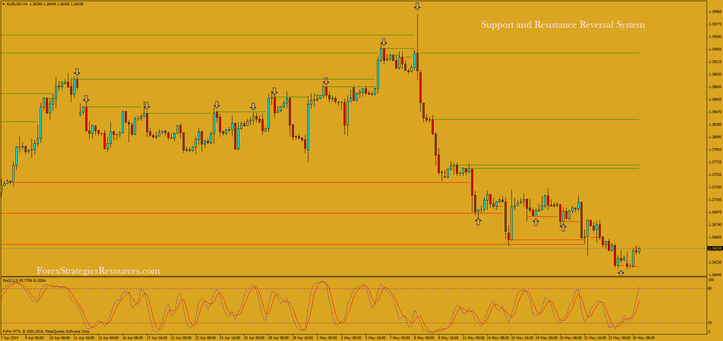

58# Support and Resistance Reversal System

Price action reversal system

Submit by Timmy 26/05/2014

Support and Resistance reversl system is a discretionary strategy pure price action.

Bounce up to the level of price support , buy.

Bounce down to price on the level of resistance , sell.

Time Frame 4H

Time Frame 4H

Markets: Forex, Futures, Indicies.

Support and resistance lines ( green line resistance, red line support).

Stochastic oscillator (5,3,3).

Trading rules Support and resistance reversal trading system:

Candlestick Closings: Entering a trade is triggered at the close of a candle, when it TOUCHES the resistance or support level as long as the close is no more than 20 pips away from that level and no less than 3 pips. If the price goes up and closes 14 pips below a resistance level (or anywhere in between 3 to 20 pips), then entry will be a sell from the open of the next candle. If the price goes down

towards a support level and closes 4 pips above the support level (or anywhere in between 3 to 20 pips), then entry will be a buy from the open of the next candle.

Stochastic Indicator: Once the conditions on the Candlestick closing are met, you MUST look at the stochastic indicator with 5,3,3 settings (especially when you first start using the system, this is all setup automatically when you install the system). The Stochastic needs to be above the 80 line territory or has touched it when selling and below the 20 line territory or has touched it when buying.

Look for either the stochastic red line or blue line to touch either the 80 or 20 line value. Touching the 80 or 20 lines can't be credited for until the current candle actually close. You will find on many occasions that the 80 or 20 lines get touched, but then retreats back once the current candle reverses.

The Stochastic crosses down when the blue line goes below the red line, and crosses up when the red line goes above the blue line.

Crossing down or up is not necessary, but can decrease the trade risk.

Do not enter a buy position if the next resistance level is less than 50 pips

away, and do not sell if the next support level is less than 50 pips away from the resistance level where conditions were met. You MUST disregard the level if you see that the price has not been respecting it recently and closes below/above that level and then closes back above/below it. Disrespected levels are

kept on your chart so that you consider them if you are already in a buy/sell trade, but never actually enter from these levels.

If you see a line-up of entry conditions, but the level has not been respected before, then entry is NOT valid. Just keep in mind that we don't care about how the price has been respecting that level in the past 30 days or so. All we need to look at is the previous one to two days (or whenever the last test was). If you actually see the price not respecting the level in the past tests and it just started respecting

the level in the last test, then that level is good to go, and we can enter as soon as the trade conditions line up.

Again, obviously we don't need to look at how the price has respected the support/resistance level if that level is clean and has not been touched recently.