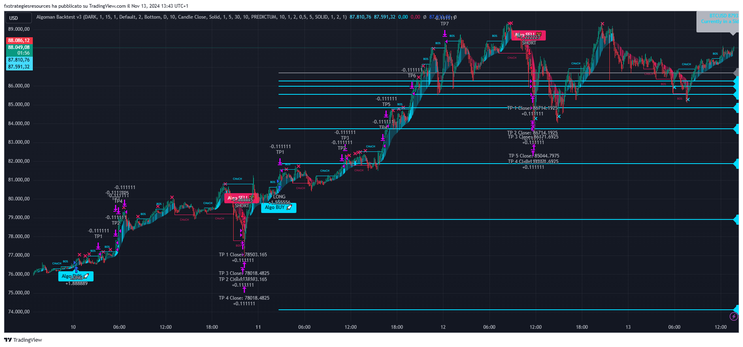

27# Algoman Backtest V1 (PAC) Forex Strategy

Price Action Concepts, Complete Trading System with TradingView

Submit by Karl written by Algomanlifie

The Algoman Backtest V1 (PAC), is a groundbreaking tool designed to empower traders by allowing them to develop and backtest a wide variety of price-action-focused strategies. With an emphasis on flexibility and data-driven decisions, this script enables traders to construct and optimize discretionary trading strategies that are responsive to real-time market conditions.

Leveraging the innovative Step & Match algorithm, traders can define highly customizable entry and exit conditions based on price action dynamics like market structure, order blocks, and imbalances, while also integrating external indicators. The result is a dynamic, personalized trading experience that is both powerful and adaptable.

Key Features of the Algoman Backtest V1 (PAC)

1. Step & Match Algorithm

The Step & Match algorithm is the core innovation driving Algoman Backtest V1 (PAC), providing an advanced framework for setting up complex entry rules by using multiple conditions:

-

Matching Conditions: When multiple conditions share the same step number, they are evaluated simultaneously, allowing traders to test multiple scenarios and improve accuracy by setting highly specific triggers.

-

Sequential Conditions: When conditions have different step numbers, each is assessed in sequence, only moving to the next step after the preceding condition is satisfied. When the final step is true, a market order is triggered, making it ideal for strategies that rely on a series of unfolding events.

This dual functionality enables traders to build intricate strategies that combine multiple conditions in unique ways, enhancing their ability to capture precise market entries and exits.

2. Fully Customizable Price Action Concepts

The PAC version takes price action to new heights by allowing users to define entries based on key market behaviors and structures, including:

-

Market Structure: Commonly used to assess trend direction, market structure focuses on price breaking prior swing points. Traders can use these structures as entry triggers, capitalizing on trend continuations or reversals.

-

Order Blocks: These areas indicate institutional interest and are zones where large liquidity might reside. Traders can leverage order blocks as entry points, expecting that price interactions with these zones may signal significant buying or selling activity.

-

Market Imbalances: Representing supply-demand disparities, imbalances are highly effective for entries. Price interactions with imbalances can provide insights into potential reversals or continuations as the market seeks equilibrium.

-

External Sources Integration: To further enhance strategy flexibility, traders can add external indicators like moving averages, bands, or trailing stops, creating conditions that align with a trader’s unique approach or preferred indicators.

3. Comprehensive Alert System

The Algoman Backtest V1 (PAC) includes a fully functional alert system designed to notify users about every significant action taken by the strategy—from opening to closing positions. The system allows for custom alert messages, providing clear, personalized notifications. If a custom message is not set, default notifications will be sent to keep the trader informed.

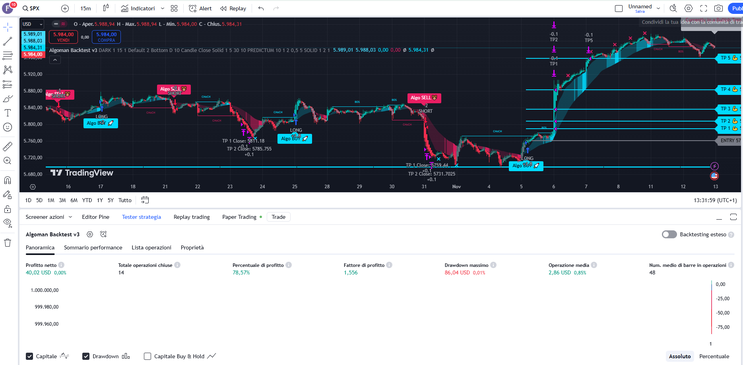

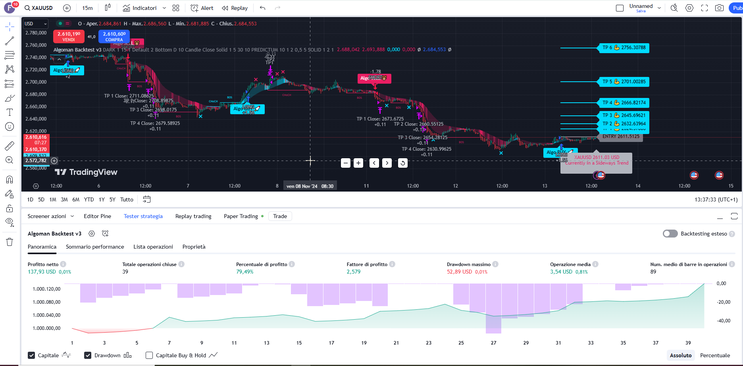

Release Notes – Latest Enhancements

The Algoman team continually enhances the backtesting system, and recent updates include several performance and functionality improvements:

-

Forecast Method for Take Profits: New forecast-based take profit levels, allowing users to set take profit levels based on forecasted price percentiles.

-

Trade-Based Price Forecasting: Adds a new price forecasting feature that improves trade outcome predictions.

-

Stop Loss Management: The stop loss calculation has been updated to include options for manual percentage-based stops or automated stops based on Fibonacci retracements (0.786/0.236 levels).

-

RSI Customization: RSI settings now highlight overbought and oversold zones with visual cues, aiding traders in recognizing potential reversal points.

-

Improved Alerts and Conditions Handling: Numerous fixes ensure that alerts, take profits, and stop loss values operate accurately and reliably across different strategy setups.

How to Use Algoman Backtest V1 (PAC) for Price Action Strategies

To effectively use Algoman Backtest V1 (PAC), a trader can follow these steps to design a robust price-action-based strategy:

-

Define Entry and Exit Conditions Using Price Action Concepts: Leverage market structure, order blocks, and imbalances to create unique entries tailored to current price action.

-

Set Sequential and Matching Conditions: Use the Step & Match algorithm to set complex triggers. For example, you might create a sequence where price breaks a prior swing high (Step 1), enters an order block (Step 2), and closes with a bullish candle (Step 3) to confirm a buy entry.

-

Enable Alerts and Notifications: Customize alerts for significant actions, ensuring you’re instantly notified of trades and any essential updates.

-

Adjust Risk Management Settings: Utilize the forecast-based take profit and stop loss features to safeguard your trades, and set dynamic stops based on Fibonacci levels or percentage targets.

-

Backtest and Optimize: Run backtests to refine conditions and optimize results for different market scenarios.

Conclusion

The Algoman Backtest V1 (PAC) empowers traders with a versatile framework to create data-driven, price-action-focused strategies. Its customizable approach, paired with the innovative Step & Match algorithm and robust alert system, provides all the tools needed to capture high-quality trades, manage risk, and stay informed.

By building a strategy that adapts to market structure and order flow while integrating real-time alerts and forecast-based risk management, Algoman Backtest V1 (PAC) is the ideal choice for traders seeking a sophisticated yet intuitive backtesting solution.

Add script at your chart : https://it.tradingview.com/v/vCqyCiZv/

Options Strategy Trading System

Submit by Janus Trader (written Sam Seiden) 16/01/2012

There are literally hundreds of options strategies, many more if you include the vast

array of complex strategy combinations. Why so many? Simple, it’s because most

options speculators can’t figure out price direction. Instead, they rely on complex

option strategies and a variety of standard pricing models that don’t work and simply

add illusion to a constant simple reality of all markets: supply (resistance) and demand

(support).

When you filter out illusion and replace it with pure supply and demand analysis in options trading, you not only simplify the useless complexity of options, you discover endless low risk-high reward opportunity based on a set of objective rules. This opportunity is one in which the reality-based options speculator simply derives his or her profit from the illusion- or emotion-based options speculator.

See Manual

In the pictures Options Strategy forex system in action.

21# 15 min GBP/USD Range Breakout - Forex Strategies - Forex

28# 4H Strategy: RSX and Murrey Math - Forex Strategies - Forex

7# Hedging Strategy Sure-Fire - Forex Strategies - Forex

17# CCFp Diff v2, Basket Trading - Forex Strategies - Forex ...

15# Ademola Forex - Forex Strategies - Forex Resources - Forex ...

2# Minor Reaction/Trend Resumption - Forex Strategies - Forex ...