531# Sar of MACD Scalping

Parabolic Sar with MACD

Submit by Andreas 23/06/2016

Sar of MACD Scalping is a forex strategy using two parabolic sar and MACD.

This strategy is trend following

Time frame 5 min or 15 min.

Currency pairs: EUR / USD, GBP / USD, AUD / USD, NZD / USD, USD / JPY, USD / CAD , EUR / JPY, GBP/JPY.

Sessions trading: London and New York.

Forex indicator:

Parabolic SAR (0.01, 0.1);

SMA 8 period;

MACD (5,8,9) + Parabolic SAR (0.01, 0.1);

Stochastic Oscillator (14,3,3) optional.

Long Entry

When parabolic SAR dots appears below the price indicates an uptrend signal.

MACD is above 0.

price is above 8SMA.

Stochastic Oversold conditions can be seen that the lines already cross at level 20.

Short Entry

When parabolic SAR dots appears above the price indicates an downtrend signal.

MACD is below 0.

price is below 8 SMA.

Exit position 5 min TF

Profit target 3-7 pips

Place initial a stop loss at previous swing, or max 10-15 pip stop loss.

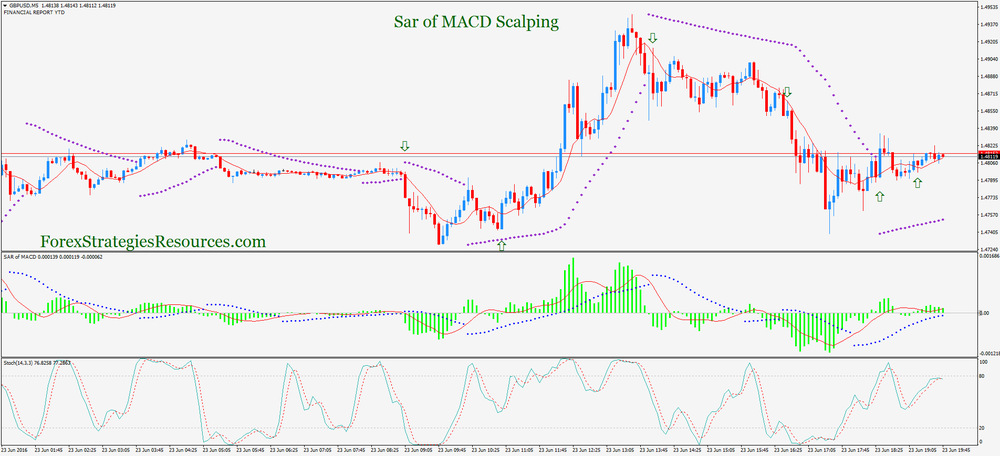

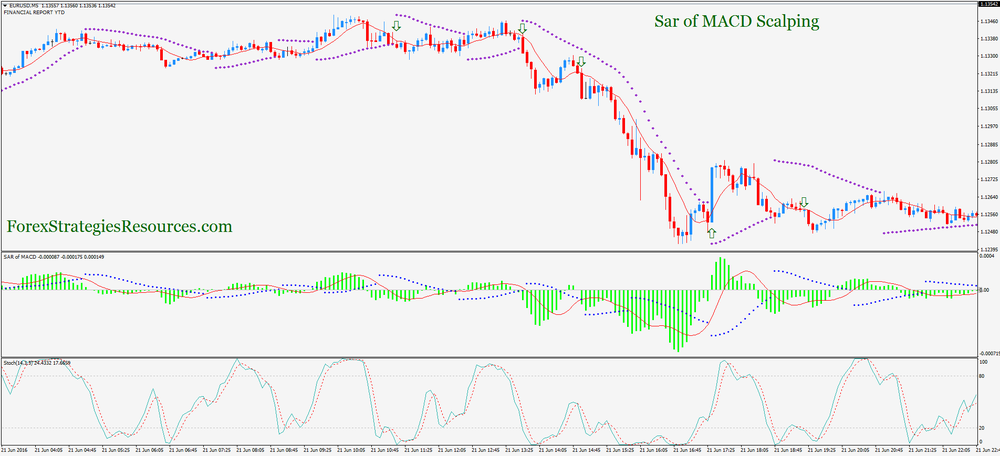

In the pictures Sar of MACD Scalping in action.

Share your opinion, can help everyone to understand the forex strategy

ابو نرجس (Monday, 19 October 2020 22:14)

روعة

Roman (Monday, 07 September 2020 19:43)

On other sites it is called Red Man. Good strategy