486# Super Guppy Trading

Dynamic trading

Submit by Sandy 20/09/2015

Super Guppy trading is as a template tren-momentum similar at a framework with more solutions for trading. This trading system is for intraday trading.

Time Frame 1 min, 5 min, 15 min or 30 min.

Currency pairs with low spread.

Sessions Londn and New York.

Metatrader Indicators:

more 100 ema's

Tenkan,

Kijun (9, 29, 3, 9),

FTI Top and Bottom (period 1, period 2, period 3, Dev step 1 (0), Dev step 2 (0), Dev step (13, 8),

X ZZ ( 33, 5, 3),

RD-pivot lines,

Fibo Pivot daily K,

DX trade daily,

Color stochastic (30, 5, 1),

Double CCI with SMA (89, 21, sma 30),

MTF Waddah Attar Explosionsa.

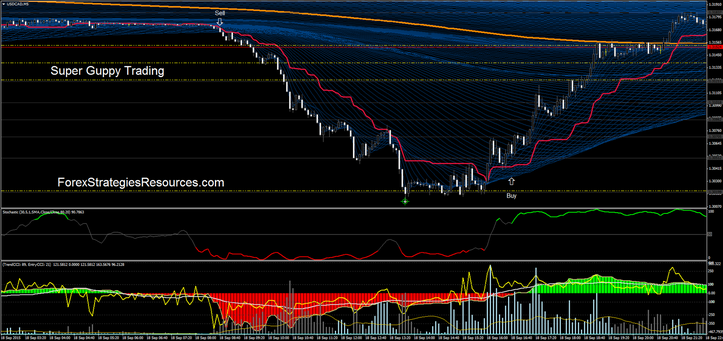

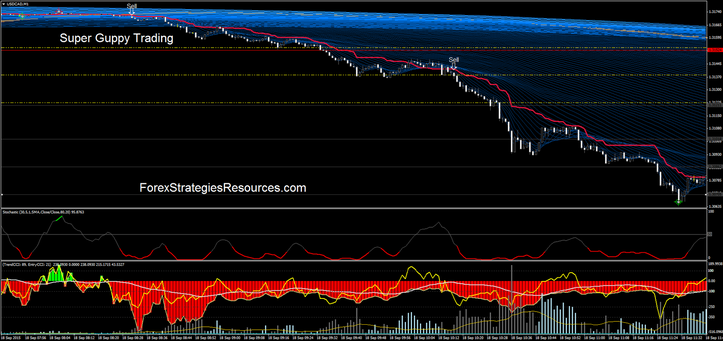

Simple example of trading Rules for Guppy Trading

Buy

Price above kiun Tekan,

Price above MA 55 yellow line,

Price above 50 level of Color Stochastic,

Trend CCI green bar,

Waddah Attar histogram above yellow line.

Sell

Price below kiun Tekan,

Price below MA 55 yellow line,

Price below 50 level of Color Stochastic,

Trend CCI green bar,

Waddah Attar histogram above yellow line.

Exit at the levels of Fibo pivots.

This is a example for trading with this template.

To interpret this system refer to other strategies on the site.

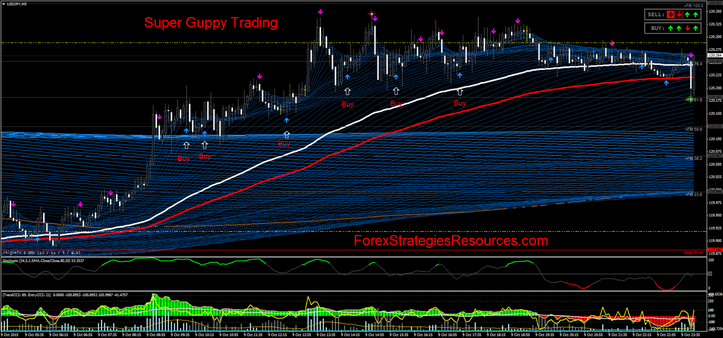

Another example of this strategy.

Indicators add:

100 EMA whilte line

150 EMA Red line.

DNK arrows.

Buy

DNK arrows

100 EMA >150 EMA

Stochastic (34, 5, 1) > 50;

Trend CCI (89) > 0.

Sell

DNK arrows

100 EMA <150 EMA

Stochastic (34, 5, 1) < 50;

Trend CCI (89) <0.

Share your opinion, can help everyone to understand the forex strategy