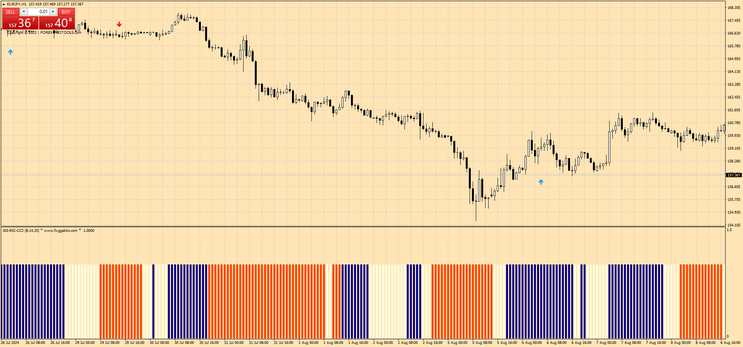

69# Trend Machine for Day Trading

Trend Machine for Day Trading is trendmomentum trading system.

Submit by Maximo Trader

Setup

Indicators:

-

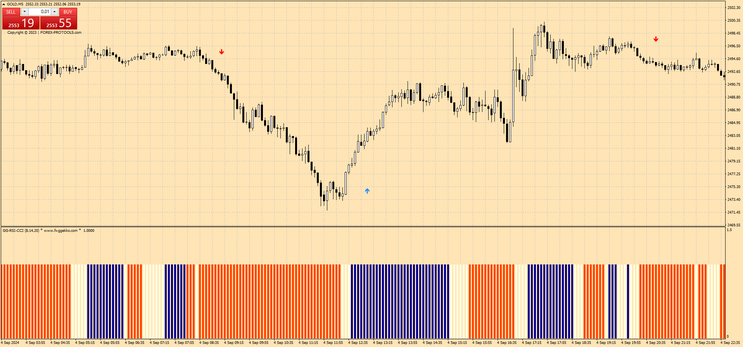

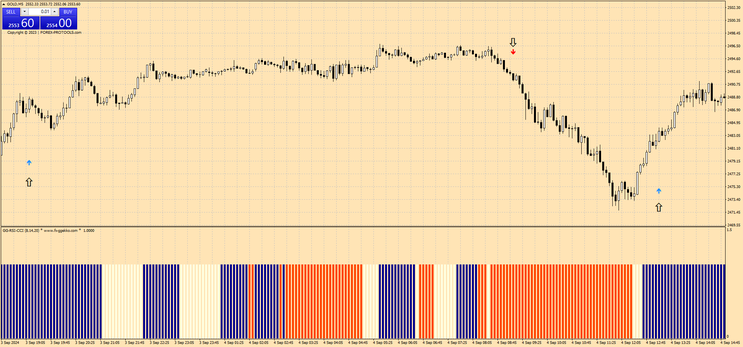

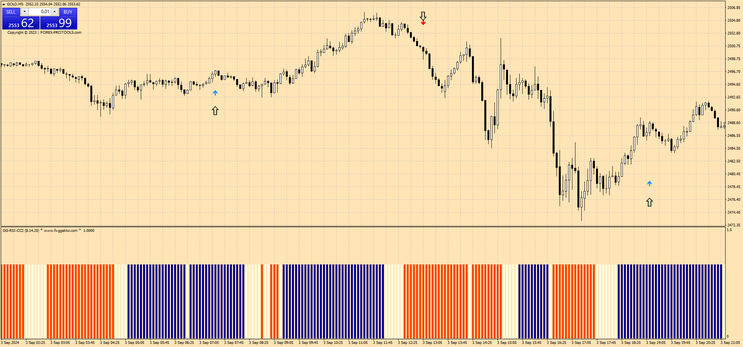

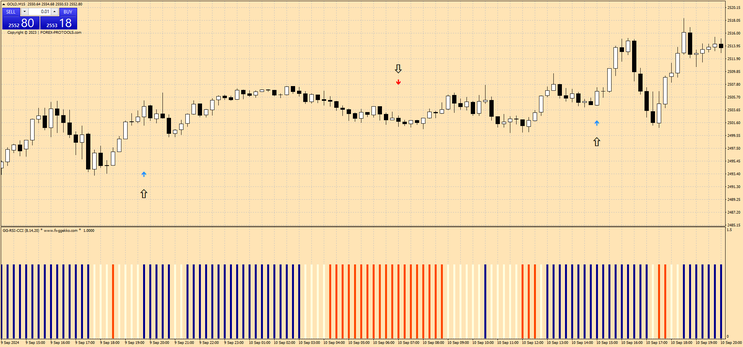

GG RSI CC:

-

Blue bars: Indicates an uptrend.

-

Red bars: Indicates a downtrend.

-

No bars: Indicates a neutral phase (stay out of the market).

-

-

Direction Arrow: A custom directional indicator that gives a visual cue of trend direction (optional but useful for confirmation).

Currency Pairs:

-

Focus on highly volatile pairs, such as GBP/JPY, EUR/JPY, GBP/USD, AUD/JPY, and USD/ZAR.

Timeframe:

-

1-5-minute chart or higher (preferably 15-minute or 1-hour for stronger trend confirmation).

Entry Rules:

For Long (Buy) Setup:

-

GG RSI CC shows blue bars: This indicates an uptrend.

-

Direction Arrow shows an upward signal: Confirms the direction of the trend.

-

Wait for the price to close above the previous candle’s high, which confirms bullish momentum.

Entry Trigger: Place a buy order on the next candle’s open after all conditions are met.

For Short (Sell) Setup:

-

GG RSI CC shows red bars: This indicates a downtrend.

-

Direction Arrow shows a downward signal: Confirms the downward trend direction.

-

Wait for the price to close below the previous candle’s low, confirming bearish momentum.

Entry Trigger: Place a sell order on the next candle’s open after all conditions are met.

Exit Rules:

Stop Loss:

-

For a buy trade, set the Stop Loss below the most recent swing low.

-

For a sell trade, set the Stop Loss above the most recent swing high.

Take Profit:

-

Set the Take Profit at 1.2 times the Stop Loss. For example, if the Stop Loss is 20 pips, set the Take Profit at 24 pips.

Exit on Trend Change:

-

If the GG RSI CC bars change color (from blue to red for long trades, or from red to blue for short trades), close the trade manually, as it signals a potential trend reversal.

Trade Management:

-

Trailing Stop: Once the trade moves in your favor by 50% of the target profit, move the Stop Loss to break even to lock in the gains.

-

Manual Exit: If the market becomes range-bound or the price moves sideways for a prolonged period (e.g., 10-15 candles on a 5-minute chart), consider closing the trade to avoid unnecessary risk.

Additional Filters:

-

Trend Confirmation with a Moving Average (optional): Apply a 50-period Exponential Moving Average (EMA) to confirm the overall trend direction.

-

For long trades, price should be above the 50 EMA.

-

For short trades, price should be below the 50 EMA.

-

Example:

Long Trade (Buy):

-

On the 5-minute chart of GBP/JPY:

-

GG RSI CC shows blue bars.

-

Direction Arrow points upward.

-

Price closes above the previous candle.

-

Enter a buy trade at the next candle’s open.

-

Set the Stop Loss just below the recent swing low (e.g., 18 pips).

-

Set the Take Profit at 1.2 times the Stop Loss (e.g., 21.6 pips).

-

Trail the Stop Loss as the price moves in your favor or exit if the blue bars turn red.

-

Short Trade (Sell):

-

On the 15-minute chart of EUR/USD:

-

GG RSI CC shows red bars.

-

Direction Arrow points downward.

-

Price closes below the previous candle.

-

Enter a sell trade at the next candle’s open.

-

Set the Stop Loss just above the recent swing high (e.g., 25 pips).

-

Set the Take Profit at 1.2 times the Stop Loss (e.g., 30 pips).

-

Trail the Stop Loss as the price moves in your favor or exit if the red bars turn blue.

-

Notes:

-

Avoid trades during neutral phases: If no bars appear under the price (indicating a lack of trend), it’s best to stay out of the market to avoid false signals.

-

News and Volatility: Be cautious around major economic events or news that may cause unpredictable price movements.

-

Backtest the strategy: It's essential to test this on various volatile pairs and timeframes to understand its performance under different market conditions before committing real capital.

This strategy leverages the GG RSI CC indicator to identify trends and uses the color-coded bars as a key component for confirming trades. The addition of a 1:1.2 risk-to-reward ratio ensures that you’re aiming for slightly more profit than the risk on each trade, improving the probability of long-term success in volatile markets.

THV Cobra with TudorGirl's Sinc Spectrum Cycle Trading System

Timeframe : M5 only.other tf will ruin the indicator.

Pair Currency : any pair.GU is recommended.

Market hour : anytime.3.00pm - 10.00pm is recommended.

Metatrader Main indicator:

TudorGirl's Sinc Spectrum Cycle (TGSSC).ex4;

THV Coral.ex4;

THV MTF TrixHisto.ex4.

Long Entry:

TGSSC crossing zero line. upward(buy), downward(sell);

THV MTF TrixHisto color. lime(buy), red(sell);

PA cross Ichimoku Cloud.

Short Entry:

TGSSC crossing zero line. upward(buy), downward(sell);

THV MTF TrixHisto color. lime(buy), red(sell);

PA cross Ichimoku Cloud.

optional safety rule:

PA above THV Coral -buy only

PA below THV Coral -sell only

dont open position in the middle of trend.wait for retracement.

exit rules:

make ur own rule or opposite the entry rules

Target Profit: 6 pips AUD/USD, 8 pips EUR/USD, 10 pips GBP/USD.

Stop Loss : 3 pips above or below the cora

Avoid trade 15min before & 30min after NEWS.

48# Neptune 3, 1min Scalping - Forex Strategies - Forex

118# Trend Hunter Scalping - Forex Strategies - Forex Resources

114# Awesome and Bollinger Bands Scalping - Forex Strategies ...

Hells Angels - Forex Strategies - Forex Resources - Forex ...

69# THV Cobra with TudorGirl's Sinc Spectrum Cycle - Forex ...

25# EMA's Band Scalp - Forex Strategies - Forex Resources -

98# AFX Trader - Forex Strategies - Forex Resources - Forex ...

77# Stochastic, MA, and MACD Scalping

32# The Secret Method - Forex Strategies - Forex Resources -

71# 5m, The Force - Forex Strategies - Forex Resources - Forex ...

104# Vlad System 15 min Day Trading

102# Scalping Trading System " Predator"

16# Mouteki System - Forex Strategies - Forex Resources - Forex ...

138# 5 min Momo Trader - Forex Strategies - Forex Resources ...

8# The 5 minute standard deviation scalp - Forex Strategies - Forex

105# Ichimoku - Forex Strategies - Forex Resources - Forex

121# Ichimoku Kinko Hyo Forex Strategy - Forex Strategies -

15# SMA, MACD, OSAMA with Ichimoku Cloud - Forex Strategies

4# Kumo with Renko Chart - Forex Strategies - Forex Resources ...

FSR (Monday, 16 September 2024 00:43)

Unzip the zip file well, the indicator files work fine.

heron (Saturday, 14 September 2024 12:12)

the file cant open after downloads