55# ATR with Scalper C , Trading System

Submit by Lorentz

This trading strategy is designed for both scalping and day trading on short timeframes (1, 3, and 5 minutes) and longer timeframes (15, 30, and 60 minutes). It uses two indicators: ATR (Average True Range) to measure volatility, and Scalper C (Arrow Trend Momentum). The strategy has specific rules for different timeframes.

Indicators Used

-

ATR (Average True Range):

-

ATR Period: 10

-

ATR Multiplier:

-

1, 3, and 5 minutes = 10

-

15, 30, and 60 minutes = 5

-

-

-

Scalper C (Arrow Trend Momentum):

-

Scalper C Period:

-

3 and 5 minutes = 13

-

15, 30, and 60 minutes = 9

-

-

Timeframe-Specific Settings

-

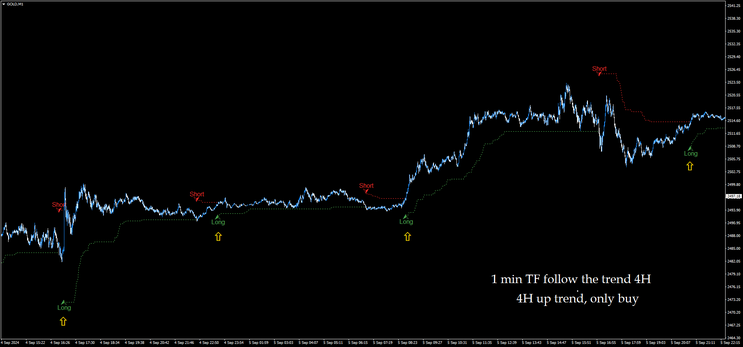

1-Minute Timeframe:

-

ATR Multiplier: 10

-

ATR Period: 10

-

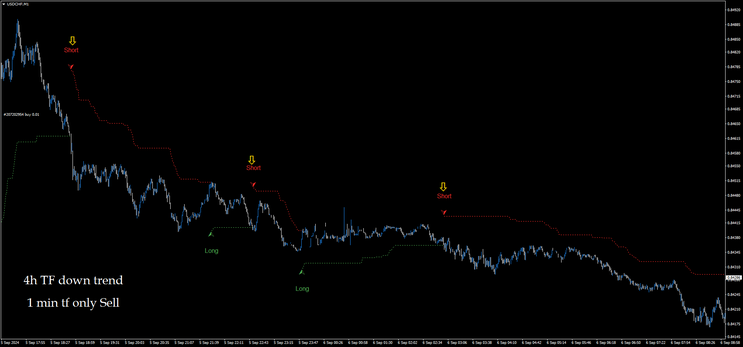

Entry Rule: Follow the 4-hour (4H) trend.

-

If the 4H trend is up, only look for buy trades.

-

If the 4H trend is down, only look for sell trades.

-

(Use Entry 1 only)

-

-

-

3 and 5-Minute Timeframes:

-

ATR Multiplier: 10

-

ATR Period: 10

-

Scalper C Period: 13.

-

-

Entry Rules:

-

Follow the 4-hour (4H) trend:

-

If the 4H trend is up, only buy.

-

If the 4H trend is down, only sell. (Entry 1)

-

-

Use Scalper C when it aligns with the ATR direction for quick profits. (Entry 2)

-

-

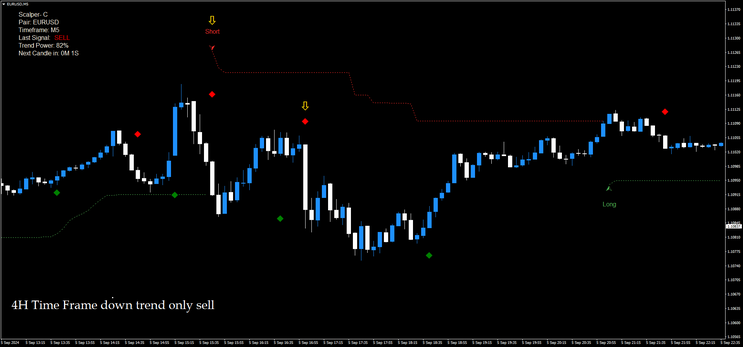

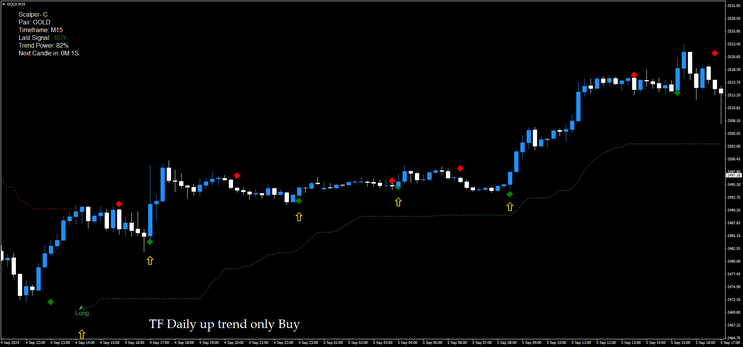

15, 30, and 60-Minute Timeframes:

-

ATR Multiplier: 5

-

ATR Period: 10

-

Scalper C Period: 9

-

Entry Rules:

-

Follow the daily trend:

-

If the daily trend is up, only buy.

-

If the daily trend is down, only sell. (Entry 1)

-

-

Use Scalper C when it aligns with the ATR direction for quick profits. (Entry 2)

-

-

Entry Rules

Entry 1: Follow the Trend with ATR Signals (4H or Daily Trend)

-

Buy Signal:

-

Condition: When price moves above the upper ATR band (calculated using the ATR multiplier), open a Buy position.

-

Stop-Loss: Set below the lower ATR band or at the most recent swing low.

-

Take-Profit: Use either a fixed pip target (based on ATR) or close the trade at the next resistance level.

-

-

Sell Signal:

-

Condition: When price moves below the lower ATR band, open a Sell position.

-

Stop-Loss: Set above the upper ATR band or at the most recent swing high.

-

Take-Profit: Use either a fixed pip target or close the trade at the next support level.

-

Note: For the 1-minute timeframe, only use this ATR-based entry rule.

Entry 2: Scalper C Alignment with ATR (For 3-Minutes and Higher)

-

Buy Signal:

-

Condition: When Scalper C turns bullish (up arrow) and is aligned with the ATR signal (price above the upper ATR band), open a Buy position.

-

Stop-Loss: Place the stop-loss below the lower ATR band or the most recent swing low.

-

Take-Profit: Aim for a few candles or the next key resistance level for quick profit.

-

-

Sell Signal:

-

Condition: When Scalper C turns bearish (down arrow) and aligns with the ATR signal (price below the lower ATR band), open a Sell position.

-

Stop-Loss: Place the stop-loss above the upper ATR band or the most recent swing high.

-

Take-Profit: Aim for a few candles or the next key support level for quick profit.

-

Risk Management

-

Risk per Trade: Limit risk to 1-2% of account capital on each trade.

-

Stop-Loss: Set based on ATR levels or recent highs/lows.

-

Take-Profit: Target a reward-to-risk ratio of 1.5:1 or 2:1, or adjust based on key support/resistance levels.

Additional Guidelines

-

1-Minute Timeframe: Act quickly and only follow the 4H trend using Entry 1. Be mindful of spreads and commissions, which can affect short timeframes.

-

3 and 5-Minute Timeframes: You can use both Entry 1 (4H trend) and Entry 2 (Scalper C alignment). Be quick to exit trades if Scalper C shows signs of reversal.

-

15, 30, and 60-Minute Timeframes: Suitable for both short scalping trades (Entry 2) and longer day trades (Entry 1). The ATR settings are tighter, providing clearer entry and exit points.

By following ATR-based entries and aligning them with Scalper C and higher time frame trends, this strategy offers flexibility across different timeframes, helping you capture both volatility and quick trend reversals efficiently.

Hells Angels - Forex Strategies - Forex Resources - Forex ...

69# THV Cobra with TudorGirl's Sinc Spectrum Cycle - Forex ...

25# EMA's Band Scalp - Forex Strategies - Forex Resources -

98# AFX Trader - Forex Strategies - Forex Resources - Forex ...

77# Stochastic, MA, and MACD Scalping

32# The Secret Method - Forex Strategies - Forex Resources -

71# 5m, The Force - Forex Strategies - Forex Resources - Forex ...

104# Vlad System 15 min Day Trading

102# Scalping Trading System " Predator"

16# Mouteki System - Forex Strategies - Forex Resources - Forex ...

138# 5 min Momo Trader - Forex Strategies - Forex Resources ...

Bullish Reversal Candelstick Pattern - Forex Strategies - Forex ...

19# Action Trade - Forex Strategies - Forex Resources - Forex ...

70# Advanced RSX Scalping Strategy

120# The Secret Method 2.7 - Forex Strategies - Forex Resources

Write a comment

Shail (Monday, 26 January 2015 13:01)

Awesome formula sir, helping a lot. thanks.