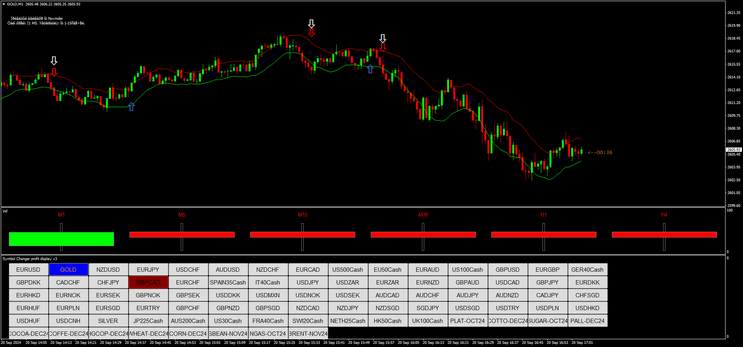

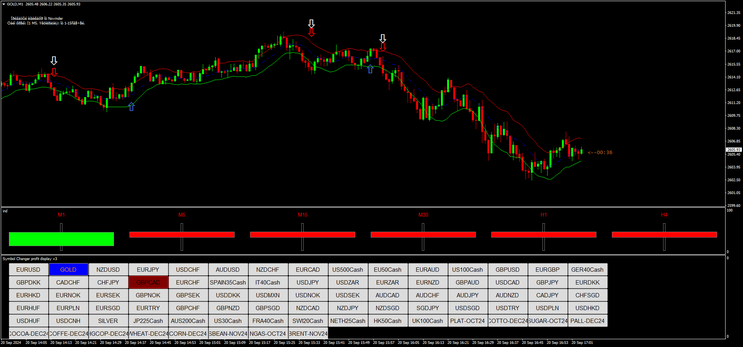

145# Novinder Signal Scalping Strategy

Overview:

This strategy combines three key components to generate entry and exit signals:

-

Novinder Arrow Indicator: This provides buy or sell signals based on price action.

-

10-Period Simple Moving Average (SMA) Channel: Consisting of an upper and lower band created by a 10-period SMA, this channel is used to identify key areas of support and resistance.

-

Trend Indicator Based on Multiple Time Frames (MTF): A trend filter based on the color of candles (red or green) from six time frames (ranging from 1 minute to 4 hours). These candles show the trend in each time frame, with green indicating an uptrend and red indicating a downtrend.

Entry Criteria:

Buy Setup:

-

Novinder Arrow Buy Signal: A buy arrow from the Novinder indicator appears.

-

Price Interaction with SMA Channel:

-

Price should be near or above the lower band of the 10-period SMA channel. This indicates that the price is in a support area or in an uptrend.

-

-

MTF Trend Confirmation:

-

At least 4 out of the 6 candles on the trend indicator must be green. This suggests that the trend is bullish across multiple time frames.

-

Sell Setup:

-

Novinder Arrow Sell Signal: A sell arrow from the Novinder indicator appears.

-

Price Interaction with SMA Channel:

-

Price should be near or below the upper band of the 10-period SMA channel. This indicates resistance or a potential downtrend.

-

-

MTF Trend Confirmation:

-

At least 4 out of the 6 candles on the trend indicator must be red. This suggests that the trend is bearish across multiple time frames.

-

Additional Condition to the Strategy:

If, at the time the Novinder Arrow signal appears (buy or sell), the trend filter (based on multiple timeframes) does not confirm the entry (i.e., fewer than 4 candles are aligned in the same direction), a trade can still be entered later under the following conditions:

-

Trend Filter Alignment: Later, at least 4 out of 6 candles on the trend filter align with the direction of the initial Novinder Arrow signal (either up for a buy or down for a sell).

-

Breakout of the SMA Channel: The price must break through the 10-period SMA channel in the direction of the signal:

-

For a buy trade, the price must break above the upper band of the SMA channel.

-

For a sell trade, the price must break below the lower band of the SMA channel.

-

This allows for entries even if the trend filter was not initially confirming the signal, but aligns later and the price action confirms the breakout in the desired direction.

If the filter does not satisfy because it is too sensitive you can use a 200-period simple moving average as a filter.

Sell

Novinder Arrow Sell Signal: A sell arrow appears from the Novinder indicator.

Price should be below the lower band of the 10-period SMA channel.

200-Period SMA Confirmation:

-

The price must be below the 200-period SMA, indicating an overall downtrend.

Buy

Novinder Arrow Buy Signal: A buy arrow appears from the Novinder indicator.

Price should be above the upper band of the 10-period SMA channel.

200-Period SMA Confirmation:

-

The price must be above the 200-period SMA, indicating an overall downtrend.

Additional Notes:

-

Avoid trading in sideways markets when the price is frequently crossing both the upper and lower SMA bands and the MTF trend indicator shows mixed colors (e.g., 3 green and 3 red).

-

Higher Time Frame Dominance: While 4 out of 6 candles are required for trend confirmation, be aware of the importance of the higher time frames (e.g., 1 hour and 4-hour candles) as they carry more weight in determining the overall trend.

This strategy ensures that trades are taken in the direction of the broader trend across multiple time frames while leveraging price action signals from the Novinder indicator and the dynamic support and resistance zones from the SMA channel.

FX Prime Trading System

Submit By Jabus Trader (Written by Canadian Dude)01/12/2012

This is a momentum forex system based on the indicators.

Time Frame 1min

Currency Pairs: majors

Long Trade

CCI 170 Over the 0 Line showing uptrend MUST BE THE FIRST TO CROSS

CCI 34 Over 0 line as well

showing uptrend MUST BE SECOND TO CROSS IN SAME DIRECTION

RSI over 55 <------

VERY IMPORTANT dont enter if its in between the 45-55 zone (45-55) IS DANGER DO NOT ENTER ZONE once it crosses in the same direction take the trade.

Short Trade

CCI 170 under 0 line showing down trend MUST CROSS FIRST

CCI 34 under 0 line showing down trend MUST CROSS SECOND

RSI under 45 same as above dont trade when in the 45-55 zone.

Example Trades

TRADE A (Short)

On trade A we see both the cci's are under 0 we also see that the Heiken Ashichanges color and we see that that line now becomes resistance also RSI is under the 45 we take the trade and exit when Heiken Ashi turns blue or CCI 34 is showing weakness and crosses back under the 0 line.

Trade B (Long)

Again another wonderful trade as we see its hitting the resistance line and is ready to go up. You see both CCIs are over 0 and rsi is over 55. We exit when ccigoes back under 0.

*** On the above chart there is one more signal that could of been traded after reading the rules try fo find it!!!*** would of given you another 15-20 pips! **

CCI Forex Strategies

- 107# CCI, MACD, Zig Zag - Forex Strategies - Forex Resources ...

- 49# CCI and Stochastic Retracement - Forex Strategies - Forex ...

- CCI Metatrader Indicator - Forex Strategies - Forex Resources ...

- 10# CCI Stochastic and MACD - Forex Strategies - Forex

- 58# CCI Floor Forex - Forex Strategies - Forex Resources - Forex

- 72# CCI Explosion - Forex Strategies - Forex Resources - Forex ...

- 93# CCI Trend Strategy - Forex Strategies - Forex Resources -

- 45# CCI and EMA - Forex Strategies - Forex Resources - Forex ...

- 34# CCI Floor Forex II - Forex Strategies - Forex Resources - Forex

- 208# Gann, CCI and MACD - Forex Strategies - Forex Resources ...

- 356# Trading 50 cci - Forex Strategies - Forex Resources - Forex ...

- 248# CCI Strategy - Forex Strategies - Forex Resources - Forex ...

- 187# 10 pips a day with CCI and MACD - Forex Strategies - Forex

- 45# CCI and EMA - Forex Strategies - Forex Resources - Forex ...

- 211# Scalping with 200 CCI - Forex Strategies - Forex Resources ...

- 302# CCI 50 Strategy - Forex Strategies - Forex Resources - Forex

- 9# Breakout With CCI - Forex Strategies - Forex Resources - Forex

- 148# Fx Sniper's Ergodic CCI System - Forex Strategies - Forex ...

- 16# CCI System - Forex Strategies - Forex Resources - Forex ...