142# The Wall Street Sniper Trading Strategy

By Maximo Trader 2025

The Wall Street Sniper Trading Strategy is a trend-momentum trading system designed for short time frames but also adaptable to higher time frames, such as M15 and M30. This strategy is based on a triple filter system and an arrow indicator for precise entry timing:

-

Moving averages on the main chart as a trend filter.

-

A trend filter and a trend momentum filter below the main chart.

Indicators MT4 Used

-

Arrow Buy and Sell Indicator (default settings).

-

Simple Moving Averages (SMA):

-

34-period SMA (close).

-

34-period SMA (high).

-

34-period SMA (low).

-

-

Auto Sessions Indicator.

-

Precision Trend Indicator:

-

Precision Trend is not used at 15 and 30 minute time frames.

Setting 1 minute time frame periods 30 and atr 3.0

Setting 5 minute time frame periods 26 atr 2.6.

-

-

Trading Lab Filter:

-

Settings: 5 peiods for 1-minute and 5-minute time frames.

-

Settings: 4 periods for 15-minute and 30-minute time frames.

-

-

Symbol Changer Indicator (for easier pair switching).

To recap we have 3 templates

first for 1 minute time frame.

second for 5 minutes time frame,

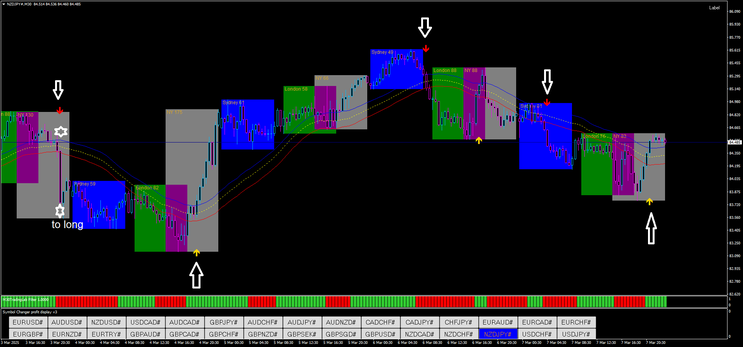

third for 15 and 30 minutes time frame where precision trend is not used.

Trading Rules

The following rules are for 1 minute and 5 minutes time frame for 15 and 30 minutes time frame the rules are the same but precision trend is not used.

Buy Entry Criteria

-

Price is above the moving averages.

-

A buy arrow appears.

-

The Precision Trend indicator shows a green bar.

-

The Lab Filter indicator shows a green bar.

Sell Entry Criteria

-

Price is below the moving averages.

-

A sell arrow appears.

-

The Precision Trend indicator shows a red bar.

-

The Lab Filter indicator shows a red bar.

Exit Strategy

-

Profit Target: Maintain a risk-reward ratio of 1:1 to 1:1.3.

-

Stop Loss: Place stop loss above or below the previous swing high/low.

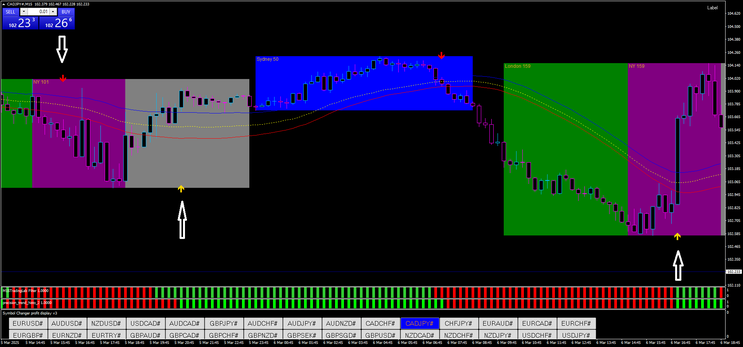

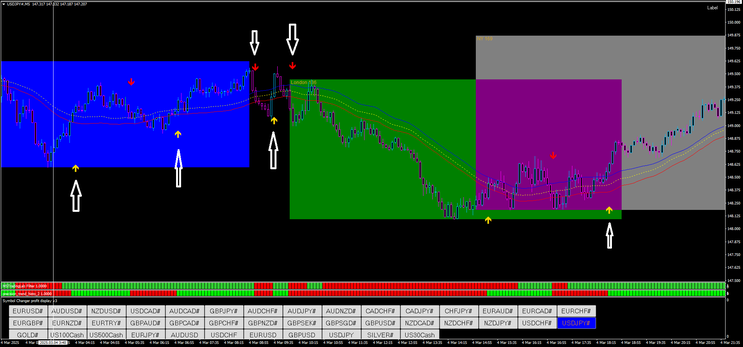

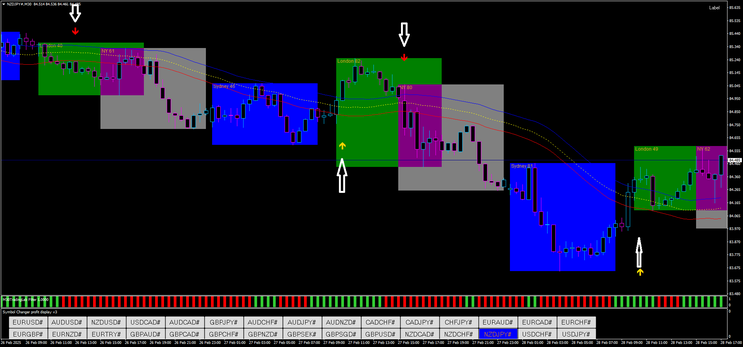

Now I show examples of the three templates

first 1 minute time frame,

second 5 minutes time frame,

third 15, 30 minutes time frame.

142# 100 pips Trading System

100 pips forex strategy

Submit by Janus Trader 27/11/2011

Time Frames and Pairs

- 1 min, 5 min

- All major pairs

(Works fine on EUR/USD 1 minute timeframe)

Long trades occur when the 100 Pips changes color from Red to Blue and 200EMA>365EMA.

Short trades occur when the 100 changes color from Blue to red and 200EMA<365EMA.

Stop Loss

Option 1

Place your stop loss according to the popup alert number.

It is a previous bar high or low + extra number of pips.

Adjust the SL extra number of pips in the indicator INPUTS.

IMPORTANT: Set stop loss for all your trades and do not deviate from it.

Once the trade has touched your stop loss be disciplined and close the trade.

This will protect you from major capital losses.

Exiting Trades

Exit trades when the 100 Pips Daily Scalper issues the opposite trading signal.

This ensures that you trade with maximum profits and right before the market

reverses.

Another exit mechanism which is highly effective is to exit near strong support

or resistance levels. It is a method that generates exits earlier, so you take

profits early.

Never use the indicator on a weak/slow market – outside

recommended trading hours ( London or US sessions ).

Scalping signals never work well on a weak market, this has been

proven many times…

example:

AGAIN: Never use the indicator on a weak/slow market – outside

recommended trading hours ( London or US sessions ).

Scalping never works on a weak market, this has been proven many times…

The London session is the largest market and opens at 8.00GMT or 3AM EST

and closes at 17.00 GMT or 12 PM EST. Trading is best between

7.00GMT and 10AM GMT.

The New York session opens at 13.00 GMT or 8 AM EST and closes at

22.00GMT or 5 PM EST. The best trades occur in the first 2-3 hours.

IMPORTANT: It is extremely important to trade only following a current

trend! It will cut ALL bad trades! Never place a trade against a trend.

Example: If the current trend is up and the indicator

shows “BUY” signal – place a trade.

If the current trend is up and the indicator

shows “SELL” signal – NO TRADE! Wait for the next “BUY” signal…

Stay away from using the signals and open trades on unclear trends or

sideways trends.

1 min Scalping

- 23# 1 min Scalper - Forex Strategies - Forex Resources - Forex ...

- 49# MACD Scalping 1 min - Forex Strategies - Forex Resources ...

- 85# 1 min Scalping IV "Powerful" - Forex Strategies - Forex ...

- 75# 1 min Scalping GBP/USD - Forex Strategies - Forex

- 76# 1 min Scalping II - Forex Strategies - Forex Resources - Forex

- 84# 1 min Scalping III "Profit System" - Forex Strategies - Forex ...

- 82# 1min Eur/USD Scalping - Forex Strategies - Forex Resources

- 136# 1 min Scalping with Pivot Points (IX) - Forex Strategies -

- 133# 1 min Contrarian Scalping (VIII) - Forex Strategies - Forex ...

- 115# 1 min Scalping VII - Forex Strategies - Forex Resources ...

- 106# 1 min Scalping VI - Forex Strategies - Forex Resources -

- 86# 1 min Scalping V - Forex Strategies - Forex Resources - Forex

- 147# Absolute Strength Scalping (1 min XIII) - Forex Strategies ...

- 137# 1 min Scalping X - Forex Strategies - Forex Resources -

- 179# Simple 1 min Scalping XIV - Forex Strategies - Forex ...

- 176# Cycle 1 min Scalping XII - Forex Strategies - Forex Resources

- 141# Scalper 4free 1 min XI - Forex Strategies - Forex Resources

- 142# 100 pips 1min XII - Forex Strategies - Forex Resources -

5 min forex strategies

- 5 min Trending

- 5 min Scalping

- 5 min Scalping System

- 54# 5min Forex Trade - Forex Strategies - Forex Resources - Forex

- 164# 5 min Scalping System - Forex Strategies - Forex Resources

- 8# The 5 minute standard deviation scalp - Forex Strategies - Forex

- 184# 5 min Scalping - Forex Strategies - Forex Resources - Forex

- 27# 5 Min Intraday - Forex Strategies - Forex Resources - Forex ...

- 51# 5min Breakout - Forex Strategies - Forex Resources - Forex ...

- 138# 5 min Momo Trader - Forex Strategies - Forex Resources ...

- 101# 5 min Trading System - Forex Strategies - Forex Resources ...

- 95# 5 min Method - Forex Strategies - Forex Resources - Forex ...

- 131# 5 min Keltner System - Forex Strategies - Forex Resources ...

- 126# 5 min Trend Follower - Forex Strategies - Forex Resources ...

- 39# 5 min Channel - Forex Strategies - Forex Resources - Forex ...

- 192# 5 min Trading Guide - Forex Strategies - Forex Resources ...

- 125# 5 min Momo trade - Forex Strategies - Forex Resources ...

- 2# 5 Min Blue Trend Rider - Forex Strategies - Forex Resources ...

Kumar (Tuesday, 11 March 2025 11:02)

really loving your contribution