128# Fx Viper Dashboard

Submit by Alexander 2024

The FX Viper Dashboard is a comprehensive trading system designed to accommodate different trading styles and experience levels. It offers two distinct modes, multiple indicators, and clear signal-based entry and exit strategies, making it suitable for traders of all levels.

Trading Rules

BUY Entry

-

Open the Viper Scanner and select a currency pair marked in blue.

-

Wait for the blue arrow to appear on the chart.

-

The blue arrow represents a valid BUY signal.

-

-

Enter a BUY trade immediately when the blue arrow appears.

ELL Entry

-

Open the Viper Scanner and select a currency pair marked in black.

-

Wait for the black arrow to appear on the chart.

-

The black arrow represents a valid SELL signal.

-

-

Enter a SELL trade immediately when the black arrow appears.

Avoid White Symbols

-

Do not trade pairs marked in white on the scanner, as they indicate slowing market conditions or potential direction changes. Wait for the symbol to change to blue or black before trading.

Exit Rules

-

Close on Opposite Signal: Exit the trade when the opposite arrow (signal) appears.

-

Custom Exit Techniques: Alternatively, you can use your own exit strategy based on:

-

Support and resistance levels.

-

Round numbers.

-

Custom indicators for exit points.

-

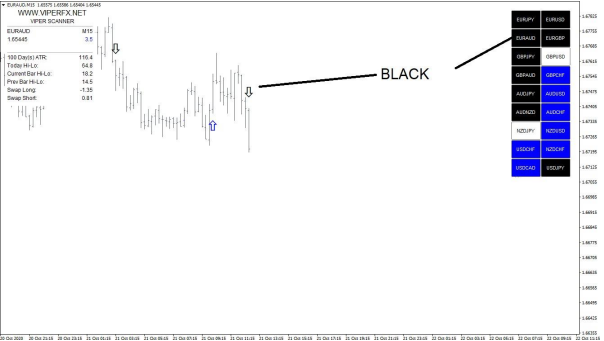

Sell Signal Example

To understand how sell signals work, switch to a pair such as EURAUD that is marked as black on the scanner.

Wait for a downward black arrow to appear on the chart.

When the black arrow shows up, it represents a valid sell

signal.

Close the trade when an opposite signal

appears.

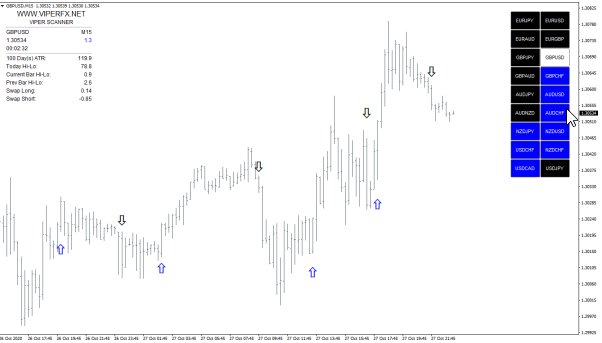

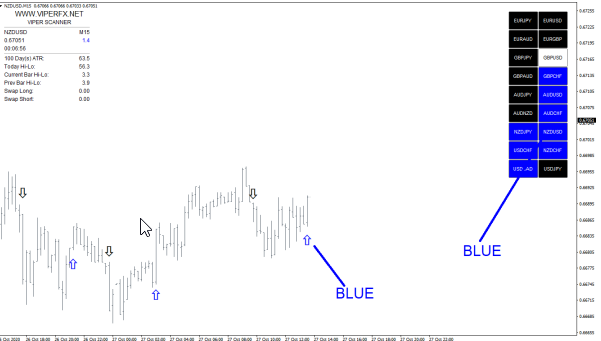

Entry Examples

To select a currency pair, use the market scanner. Simply click on the desired pair, and the chart will automatically update to display that pair.

In this example, we choose NZDUSD, highlighted in blue on the scanner.

Next, wait for a signal that matches the color—an upward

signal, indicated by a blue arrow.

When the blue arrow appears, it confirms a valid BUY

signal.

Keep the trade open until an opposite signal is generated.

Alternatively, you can apply your own exit strategy, such as using support/resistance levels,

round numbers, or custom indicators to determine the optimal exit point.

- 107# CCI, MACD, Zig Zag - Forex Strategies - Forex Resources ...

- 49# CCI and Stochastic Retracement - Forex Strategies - Forex ...

- CCI Metatrader Indicator - Forex Strategies - Forex Resources ...

- 10# CCI Stochastic and MACD - Forex Strategies - Forex

- 58# CCI Floor Forex - Forex Strategies - Forex Resources - Forex

- 72# CCI Explosion - Forex Strategies - Forex Resources - Forex ...

- 93# CCI Trend Strategy - Forex Strategies - Forex Resources -

- 45# CCI and EMA - Forex Strategies - Forex Resources - Forex ...

- 34# CCI Floor Forex II - Forex Strategies - Forex Resources - Forex

- 208# Gann, CCI and MACD - Forex Strategies - Forex Resources ...

- 356# Trading 50 cci - Forex Strategies - Forex Resources - Forex ...

- 248# CCI Strategy - Forex Strategies - Forex Resources - Forex ...

- 187# 10 pips a day with CCI and MACD - Forex Strategies - Forex

- 45# CCI and EMA - Forex Strategies - Forex Resources - Forex ...

- 211# Scalping with 200 CCI - Forex Strategies - Forex Resources ...

- 302# CCI 50 Strategy - Forex Strategies - Forex Resources - Forex

- 9# Breakout With CCI - Forex Strategies - Forex Resources - Forex

- 148# Fx Sniper's Ergodic CCI System - Forex Strategies - Forex ...

- 16# CCI System - Forex Strategies - Forex Resources - Forex ...

Write a comment

Bob (Saturday, 30 November 2024 07:14)

Folder is empty

FSR (Sunday, 01 December 2024 01:21)

Check now