12# Scalping With Machine Learning and MA Shift

By Maximo Trader 2025

Scalping with Machine Learning and MA Shift is designed to capture and ride trends in the market using a combination of machine learning and moving average shifts. This strategy focuses on identifying sustained price movements and trend continuations, making it suitable for swing traders and trend followers.

Setup

-

Time Frame: 5-minute charts or higher.

-

Currency Pairs: Any.

-

Platform: TradingView.

Indicators Used

-

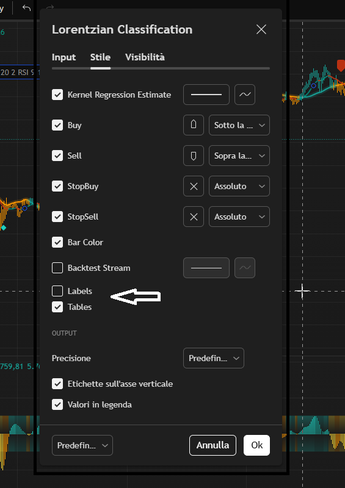

Lorentzian Classification (Machine Learning-based Indicator)

-

Helps identify potential reversal points using a combination of RSI, ADX, CCI, and other momentum-based indicators.

-

Default settings.

-

-

MA Shift (Moving Average Shift Indicator)

-

Provides dynamic support and resistance levels based on smoothed moving averages.

-

Default settings: (SMA, 40, hl2, 15, 0.5).

-

Trading Rules

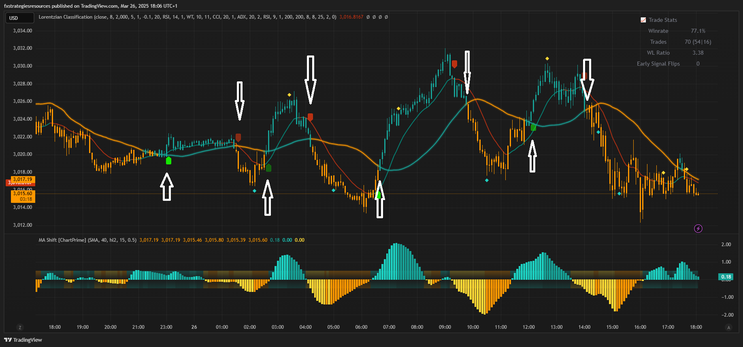

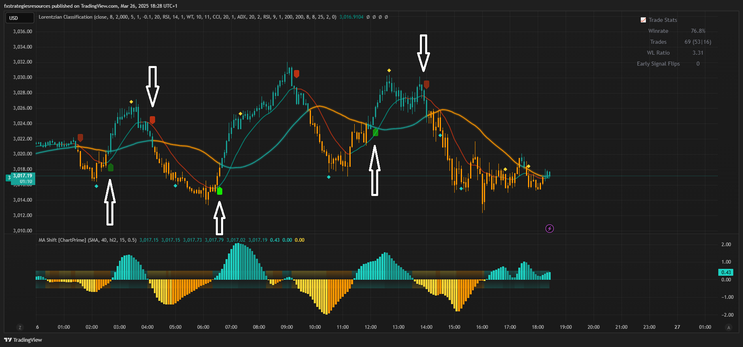

Buy Setup

-

MA Shift turns blue, indicating an uptrend.

-

A buy arrow appears from the Lorentzian Classification indicator, confirming the bullish trend.

-

The histogram is above 0, indicating positive momentum.

-

Enter a buy trade when these conditions align.

Sell Setup

-

MA Shift turns red, indicating a downtrend.

-

A sell arrow appears from the Lorentzian Classification indicator, confirming the bearish trend.

-

The histogram is below 0, indicating negative momentum.

-

Enter a sell trade when these conditions align.

Exit Rules

-

Take Profit: Use a trailing take profit or exit when price shows clear trend exhaustion, such as a crossover of the opposite MA Shift direction.

-

Stop Loss: Place stop loss just below the last swing low for buy trades and above the last swing high for sell trades.

-

Trailing Stop: Consider using a trailing stop once in profit to maximize gains while minimizing risk.

-

Potential Enhancements:

Filter weak trends: Consider adding an ADX threshold (e.g., ADX > 20) to avoid choppy

markets.

Better stop placement:

Instead of just the last swing high/low, an ATR-based stop loss could dynamically adapt to volatility.

Re-entry options: If price temporarily retraces but the trend is still valid, a pullback entry rule could increase

opportunities.

Conclusion

This trend-following strategy leverages machine learning signals to identify strong trend continuations, combined with the MA Shift to confirm trade entries. The approach ensures a balance between risk and reward by using a combination of price action, momentum shifts, and advanced indicators. Traders should always backtest and refine the strategy to suit their individual risk tolerance and market conditions.

12# Supports and Resistances Dynamics

Supports and Resistances scalp

Submit by ForexStrategiesresources

This is an dynamic breakout forex system. The advantage of this system is good earnings in trending market and less drawdown.

Pairs:Major

Time frame: 15M.

Spread max:0,0001.

“The Supports and Resistances Dynamics ” method scalps pips when price breaks through major support and resistance. There is always an opportunity to grab at least a few pips and on some occasions catch a runner.

Indicators:

support and resistance dynamics (dyn_r_s).

Entry position: Wait for the m15 candle to close. Enter long 1 pip above the red dot of the closed candle and short 1 pip below the blue dot of that candle. You should use pending orders to ensure you enter at the correct price. Pending orders are valid until they are triggered or until another dot appears on an m15 candle.

Profit Exit: 8 pips (EUR/USD), 7 pips (AUD,USD, USD/JPY), 9 pips (GBP/USD).

Loss Exit: stop loss on high/low setup bar and the settings set a break even as we gain 5 pips.

-

#3

what settings do you use on indicator?

Thanks.

Regards,

Ivan -

#2

Please could you teach me how set up the trading system(s) unto my metatrader software?

-

#1

I use the same method but manual, nice to have the indicator :D and by the way its the most profitable and stressless system out there!

Support and resistance dynamics

Support and Resistance Forex Strategies

4# Simple Support and Resistance Strategy - Forex Strategies ...

36# Tutorial Support and Resistance - Forex Strategies - Forex ...

5# Support and Resistance important or psycho level - Forex ...

23# Fibnacci Support and Resistence - Forex Strategies - Forex ...

12# SRDC Method Level III - Forex Strategies - Forex Resources ...

9# SRDC Method Level I - Forex Strategies - Forex Resources ...

11# SRDC Method Level II with Fibo - Forex Strategies - Forex ...

8# Fibonacci Fan - Forex Strategies - Forex Resources - Forex ...

37# Trade Zone Tutorial - Forex Strategies - Forex Resources ...