Fisher Trading Killing Pips

Exploring Fischer with very slow setting

Two templates with Fisher slow

Submit by Lorenz

In this post I present an experimental study on the use of the Fisher transform with a very slow configuration. The idea is that the very slow setting manages to decrease the recalculation of the indicator.

So, I present two experimental strategies one for trading in 1-5-15 minutes and the other for trading in 5 minutes and above.

The two strategies differ in the Fischer setting and in the use of another indicator in one that recalculates as entry timing.

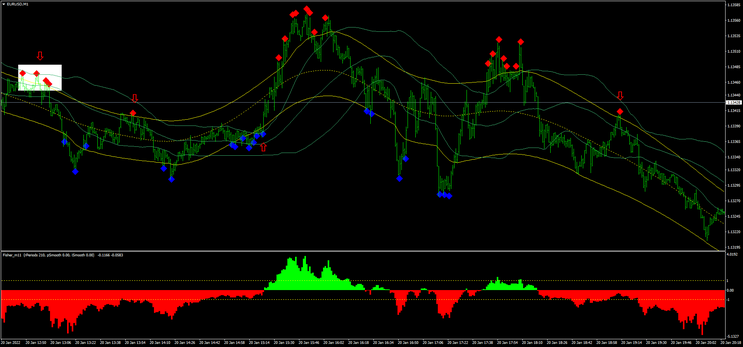

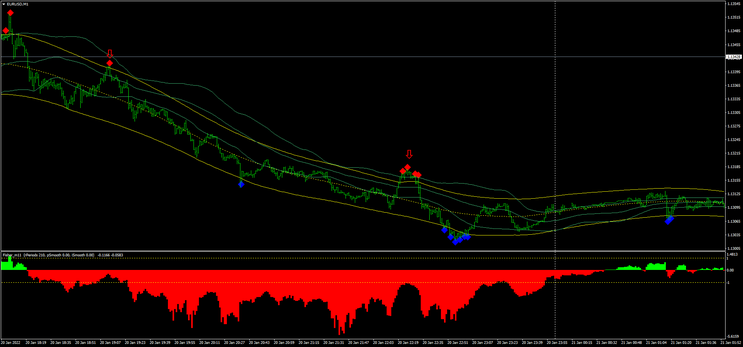

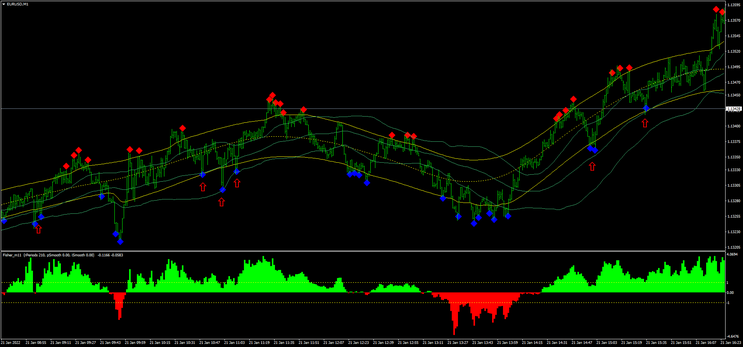

Fisher with TMA

The main feature of this strategy is the very slow setting of Fiscer 210 periods and the use of TMA bands as entry timings.

Setup

Time frame 1-5-15-minutes, but it can also be used for higher time frames.

Currency pairs:any.

Indicators

Fischer 210 periods. (levels 0.8, -0.8).

TMA bands (70, 2.0).

Bollinger bands (70, 1.0).

Trading Rules.

Buy

Fischer green bar (optional filter bar above 0.8).

Blu square as timing of entry.

Sell

Fischer red bar (optional filter bar below -0.8).

Red square as timing of entry.

Exit position

Stop loss 7-8 pips below/above the square.

Profit target at middle or opposite band of Bollinger Bands.

Examples of trades

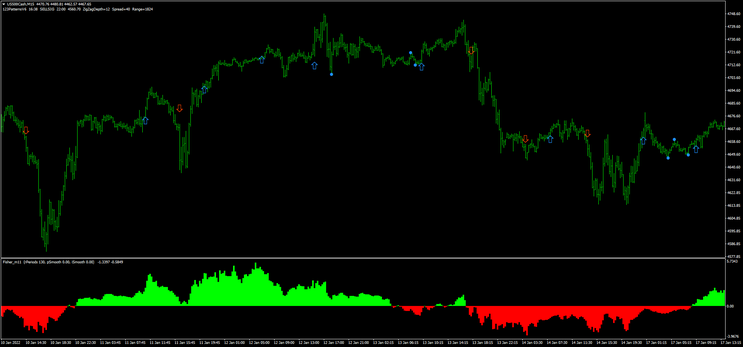

Fisher with 1-2-3 pattern

Setup

Time frame 5 or higher.

Currency pairs:any.

Indicators

Fischer 210 periods. (levels 0.8, -0.8).

1-2-3-pattern

Trading rules

Fischer green bar (optional filter bar above 0.8).

1-2-3 buy arrow

Sell

Fischer red bar (optional filter bar below -0.8).

1-2-3 sell arrow

Exit position

Place initial stop loss above below the previous swing high/low.

Fast profit target.

Examples of Trades