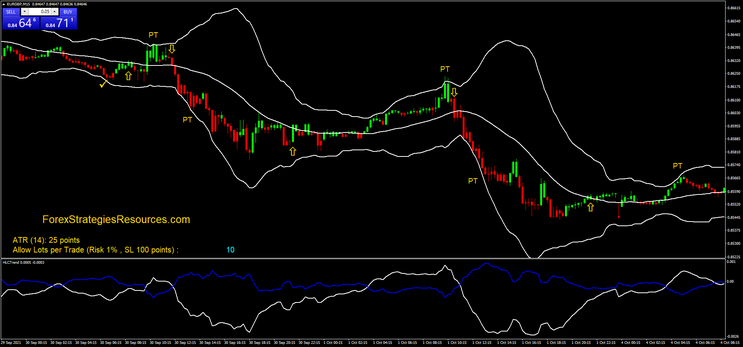

704# Extreme overbought - oversold with Bollinger Bands

Extreme Reversal Trading

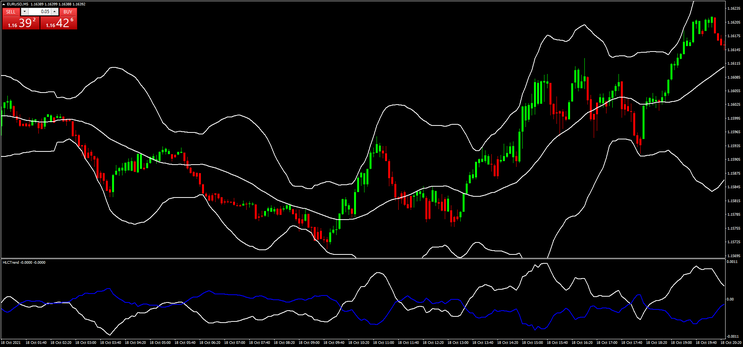

Bollinger Bands with HLC Trend

Submit by Maximo Trader

Extreme overbought - oversold with Bollinger Bands is a reversal technique based on price excursions on the Bollinger Bands but with a slower setting. Then the entry signal is given by the HLC Trend. This technique is also great for scalping on synthetic pairs, but is suitable for all time frames.

Setup Strategy

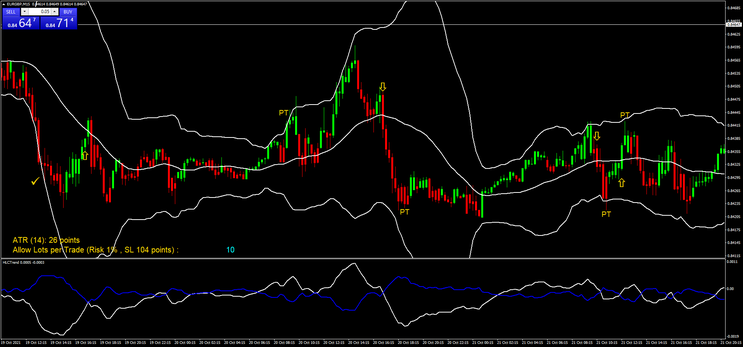

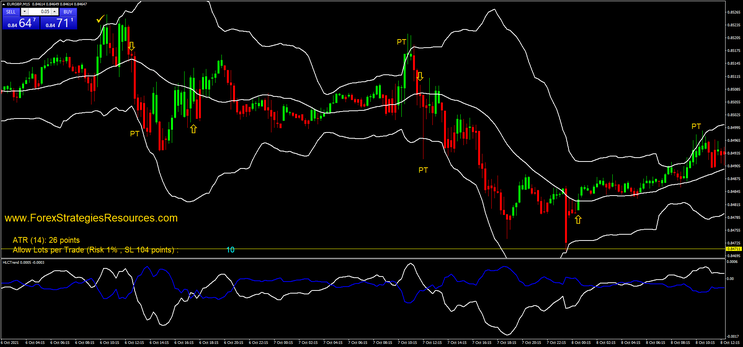

Time Frame 5 minutes or higher

Currency pairs EUR-USD and synthetic pairs such as AUDNZD, EURGBP and others.

Platform metatrader 4

High profitability.

Metatrader 4 Indicators

Money management indicator.

OHLC HA indicator.

Bollinger Bands (30 periods -3.0 deviation)

Below the main chart

HLC Trend.

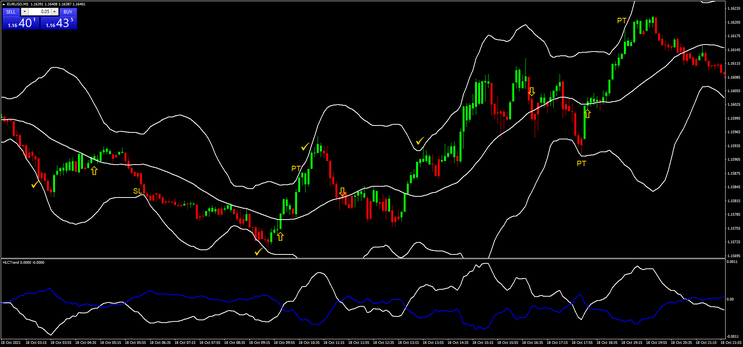

Trading rules Extreme overbought - oversold with Bollinger Bands

Buy

The price touches or breaks the lower band.

From now on only buy trade until the price touches or breaks the opposite band.

Open trade when the white line of the HLCTrend crosses the blue line upward or when the price crosses upward the middle line of Bollinger Bands.

Sell

The price touches or breaks the upper band.

From now on only sell trade until the price touches or breaks the opposite band.

Open trade when the blue line of the HLCTrend crosses the white line upward or when the price crosses downward the middle line of Bollinger Bands.

Exit position

Place initial stop loss below/above the previous swing high/low.

Profit target minimum ratio stop loss 1:1.15.

Examples of trades