693# 5 Minutes Dynamic

MA of HMA Trading

Random Cycle

Submit by Lorenz

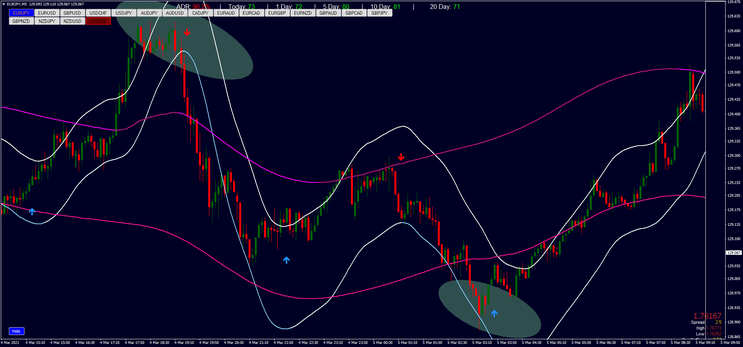

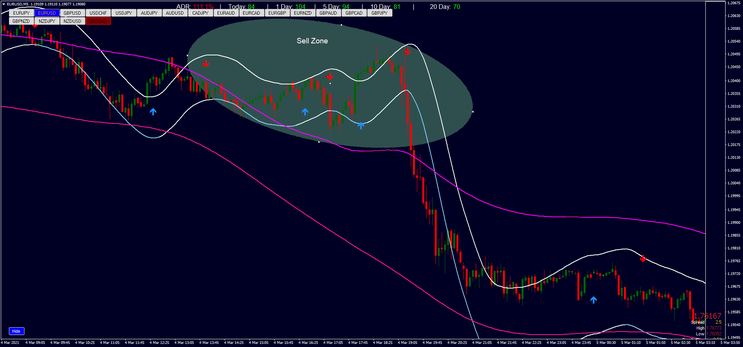

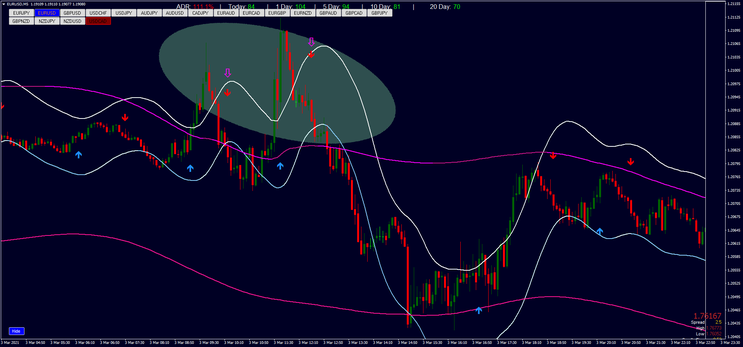

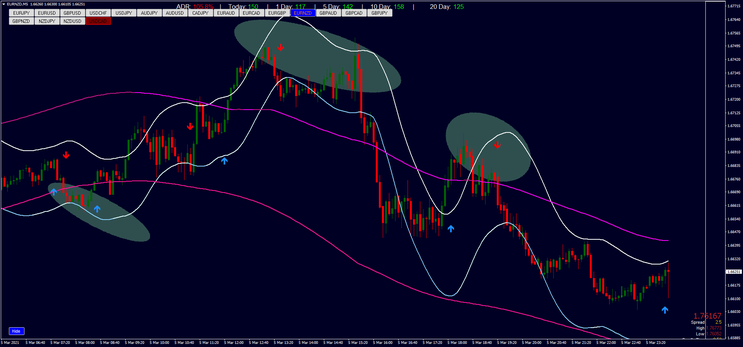

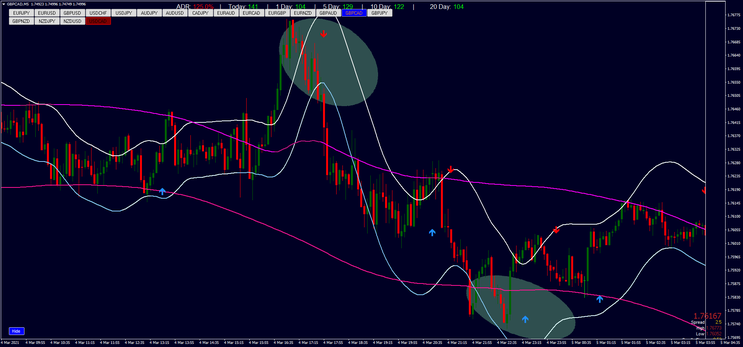

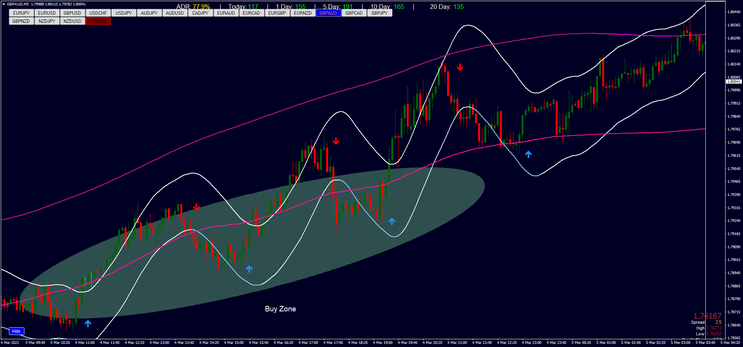

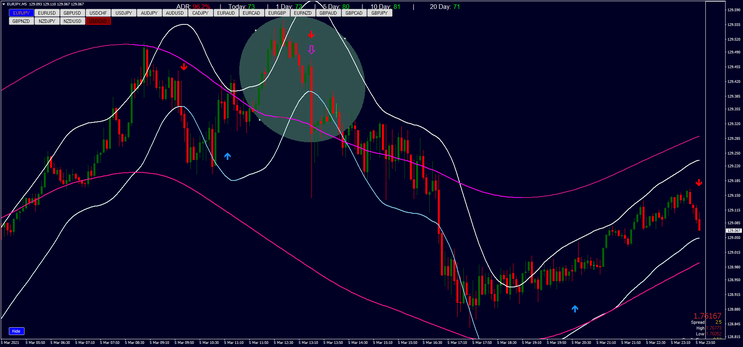

5 minutes Dynamic Overbought and Oversold is inspired by other systems of Joy22 that are on this web site. This is a trading system configured for day trading based on the HMA TMA bands not as entry timings but as random crossings on the plan that delineate random areas of overbought and oversold. The moment of interest is when the short TMA crosses the slow TMA up or down. This means that the price has reached a saturation of the movement and can reverse. The entry timing, on the other hand, is generated by the Half Trend.

Setup Strategy

Time Frame 5 min

Currency pairs: Volatile pairs.

Trading Sessions: any.

Metatrader 4 Indicators

HMA CG 52 period

HMA CG 100 period

ADR

Half Trend amplitude 3.

Symbol changer V.5

Trading rules 5 minutes Dynamic Overbought and Oversold

Buy

Slow HMA (52) lower band breaks lower bands of HMA CG (100).

Price is below lower band of HMA CG (100).

Half Trend buy arrow.

Sell

Slow HMA (52) upper band breaks upper bands of HMA CG (100).

Price is above upper band of HMA CG (100).

Half Trend sell arrow.

Exit position

Place initial stop loss below/above the previous swing high/low.

Profit Target ratio stop loss 1.1.5 or at opposite arrow.

Note: The TMA is an indicator that adapts itself to the historical series and in this case it is good because it must dynamically identify random areas of overbought and oversold of the price.

Practically how to trade with this

system?

Identify all currency pairs where the price is above or below the slow TMA bands and wait for the other conditions to occur. What can I expect from this strategy?

A profitability of 70-75%.

In the pictures examples of trades.

Telegram Web:https://t.me/freeforexresources