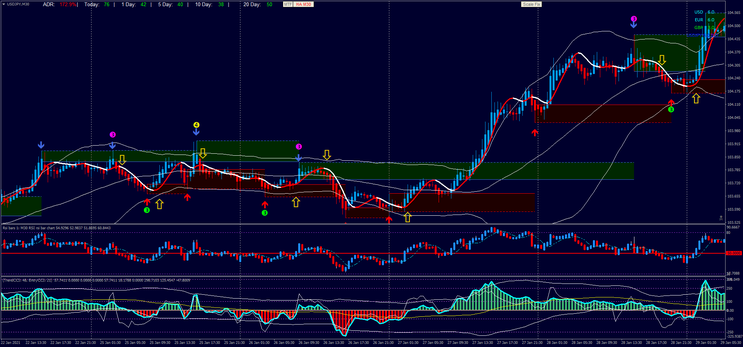

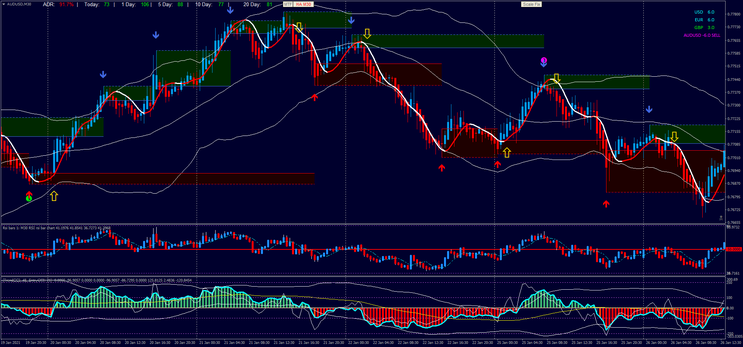

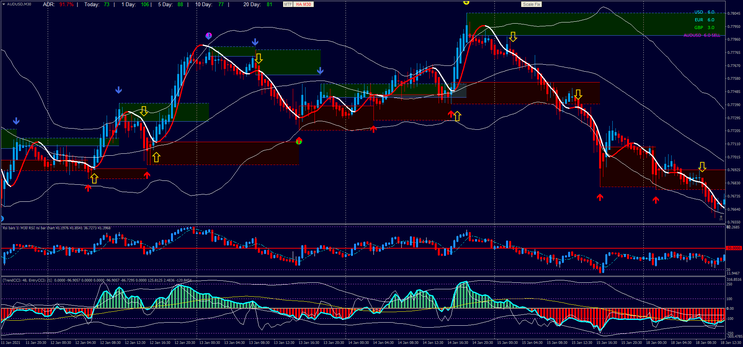

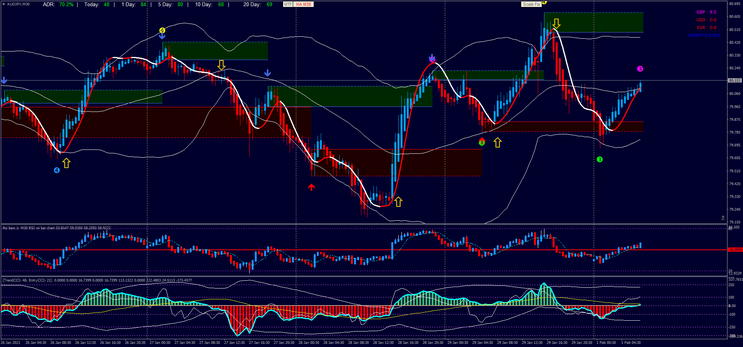

689# Contrarian Day Trading Strategy

Order Block Contrarian Strategy

CCI, RSI and Bollinger Bands Contrarian Strategy

Submit by Lorenz

Contrarian Day Trading Strategy with Double CCI is a strategy contrarian with the construction of a super powerful filter consisting of one side on an algorithmic basis and the other on a graphic basis. The result is high profitability and good Risk / Reward. The purpose of this strategy is to look for intraday inversions which generate good gains, so as mentioned, blocks are drawn on the main chart which are areas of price levels, in which price action is expected to reverse the direction, often occur with the increase in price volatility.

The inversion is confirmed by the algorithms (moving average, RSI, CCI).

The blocks can redraw but the thing is not relevant because what matters is that the price action must be confirmed by the indicators that filter it.

Time Frame 30 min

Currency pairs: Majors, Minors, Indices and Commodities.

Metatrader 4 indicators

Main chart

Heiken Ashi APB

Averages MTF period 20, close.

Bollinger Bands (period 48, deviation 2.0)

Currency Strength (28 pairs (optional)

ADR

4X Semaphore ZZ indi

Order Block Level

First Subwindow

RSI Bars regular but the indicator contains more options than RSI, I also recommend RSX..

Setup: RSI 13 period close or RSX 12 period close.

Second subwindow

Double CCI with Bollinger Bands

Double CCI (48, 21).

Bollinger Bands (48 periods, 2.0 deviation).

Trading rules Contrarian Day Trading Strategy with Double CCI

Buy

The price must exit or bounce off the block in the opposite direction to the previous one, in this case upwards from the red block.

The price is lower than the lower bollinger bands or bounces on it (optional).

RSI or RSX bars greater than level 50

Heike Ashi blue color.

Averages red color.

Double CCI: aggressive entry CCI crosses upward the middle bands of Bollinger Bands. normal CCI 21 and CCI 48 cross upward the middle bands of Bollinger Bands.

Sell

The price must exit or bounce off the block in the opposite direction to the previous one, in this case downwards from the green block.

The price is higher than the upper Bollinger Bands or bounces on it (optional).

RSI or RSX bars minor than level 50

Heike Ashi white color.

Averages white color.

Double CCI: aggressive entry CCI crosses downward the middle bands of Bollinger Bands. Normal CCI 21 and CCI 48 cross downward the middle bands of Bollinger Bands.

Exit position

Place the stop loss at the opposite end of the block.

Profit Target minimum ratio stop loss 1: 1.3

Examples of trades

Telegram Web: https://t.me/freeforexresources