605# Day Mometum Strategy

Day trading with Momentum

MACD and Stochastic Trading

Submit by Lopez

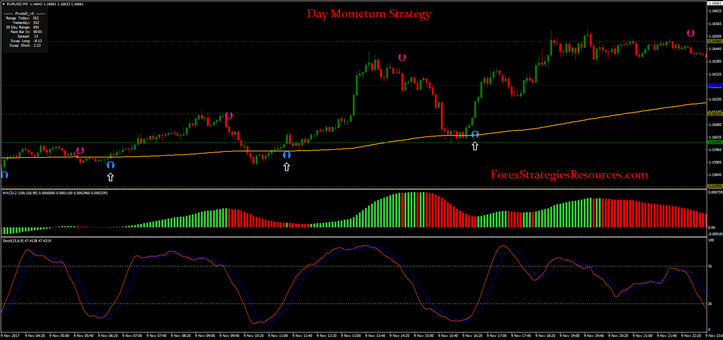

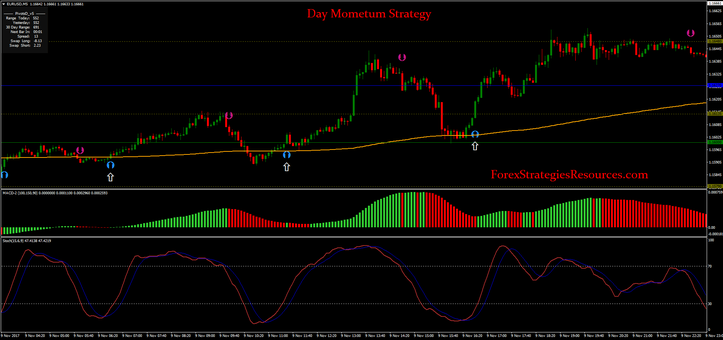

Day Momentum Strategy is trend momentum strategy based on MACD, Stochastic oscillator and Heikem Ashi smoothed as filter of trend arrow indicator. This strategy is for scalping or day trading.

This trading system is suitable also for trading with binary options high/low.

Expiry time 5 candles.

Time frame 1 mi or 5 min.

Currency pairs: Major with low spreads.

Trading Sessions: London and New York.

Metatrader Indicators:

AFS arrow 11 period,

MACD color (100, 150, 90),

Stochastic oscillator (15, 6, 9),

Pivot points levels.

MA 144

Trading Rules Day Mometum Strategy

Buy

Price above 144 MA.

AFS buy arrow.

MACD green color.

Stochastic oscillator crosses upward.

Initiatl stop loss on the previous swing low.

Profit Target options: at the pivot points levels, at the opposite arrow or with predetermined pt (5 – 8 pips).

Sell

Price below 144 MA.

AFS sell arrow.

MACD red color.

Stochastic oscillator crosses downward.

Initiatl stop loss on the previous swing high.

Profit Target options: at the pivot points levels, at the opposite arrow or with predetermine pt (5 – 8 pips).

In the pictures Day Mometum Strategy in action.

Share your opinion, can help everyone to understand the forex strategy.

bsfx (Wednesday, 15 November 2017 13:52)

tnks try

good trade