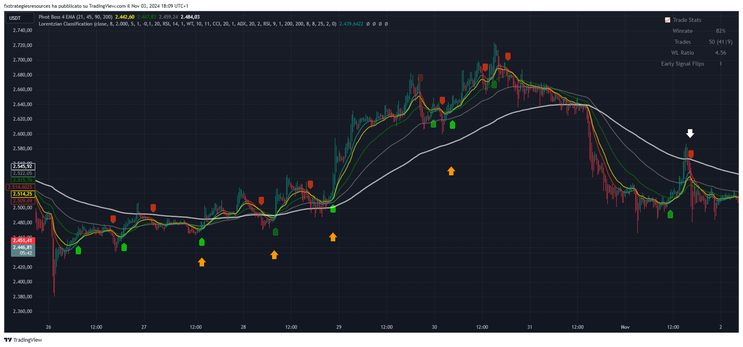

240# Machine Learning Lorentzian Classification with 4 EMA

Submit by Maximo Trader 2024

Machine Learning Lorentzian Classification with 4 EMA is a trading strategy that to capture trends and filter signals for better entry points in volatile markets.

1. Overview of Indicators and Custom Settings

-

Pivot Boss 4 EMA: This setup includes four exponential moving averages (EMAs) with the following customized parameters:

-

Trigger Line (21-period EMA)

-

EMA1 (45-period): Short-term trend indicator.

-

EMA2 (90-period): Medium-term trend indicator.

-

EMA3 (200-period): Long-term trend indicator that defines the primary trend direction.

This configuration allows the 21 EMA to act as a dynamic trigger line to signal entries when price action is moving in the direction of the predominant trend.

-

-

Lorentzian Classification: This machine learning-based indicator classifies trend strength, helping filter false signals in volatile or choppy markets. Using its default setting, it only confirms strong trends, providing a signal for optimal market entry. It’s employed here to validate signals generated by the EMAs, ensuring entries align with meaningful market moves.

2. Trading Rules

This trend-following strategy trades only in the direction of the main trend, as indicated by the 200 EMA:

-

Uptrend: Price above the 200 EMA.

-

Downtrend: Price below the 200 EMA.

Buy Setup

-

Trend Confirmation: Price must be above the 200 EMA (indicating an uptrend).

-

Entry Trigger: The trigger line (21 EMA) should cross above both the 45 and 90 EMAs, with the 45 EMA, 90 EMA, and 200 EMA below the trigger line (ideal setup).

-

Machine Learning Confirmation: Look for a buy arrow from the Lorentzian Classification indicator, indicating a robust uptrend.

Once these conditions are met, initiate a long position.

Sell Setup

-

Trend Confirmation: Price must be below the 200 EMA (indicating a downtrend).

-

Entry Trigger: The trigger line (21 EMA) should cross below the 45 and 90 EMAs, with all EMAs (45, 90, 200) above the trigger line (ideal setup).

-

Machine Learning Confirmation: Look for a sell arrow from Lorentzian Classification, signaling a strong downtrend.

With these conditions satisfied, open a short position.

Stop Loss and Profit Target

-

Stop Loss: Place the stop loss at the previous swing high for short trades and swing low for long trades.

-

Profit Target: Aim for a target profit of 1.2 to 1.7 times the stop-loss distance. This risk/reward ratio increases profitability by capturing substantial moves while limiting losses.

3. Additional Strategy Notes

-

Timeframe: This strategy is adaptable to intraday (e.g., 15-minute) and swing trading (e.g., daily) timeframes, although the 15-minute or higher timeframes work well for limiting noise in the price action.

-

Backtesting and Optimization: Test the setup on various assets, as the 45, 90, and 200 EMAs offer robust trend detection on liquid assets (e.g., major forex pairs, indices, large-cap stocks).

Combining the Pivot Boss 4 EMA trend-following indicators with Lorentzian Classification allows for selective entries in strong trends, filtering out choppy periods that often lead to false signals. This integration of technical and machine learning indicators provides an edge by ensuring trades align with both EMA trends and machine learning-based trend strength

Download link

Machine Learning link: https://it.tradingview.com/script/WhBzgfDu-Machine-Learning-Lorentzian-Classification/

Pivot Boss 4EMA link: https://it.tradingview.com/script/XjW8rxOZ-Pivot-Boss-4-EMA/