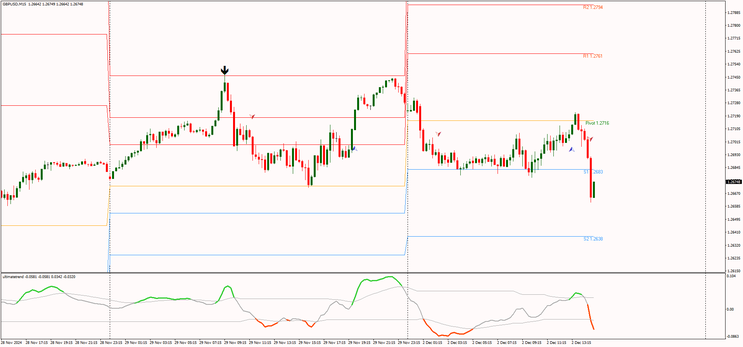

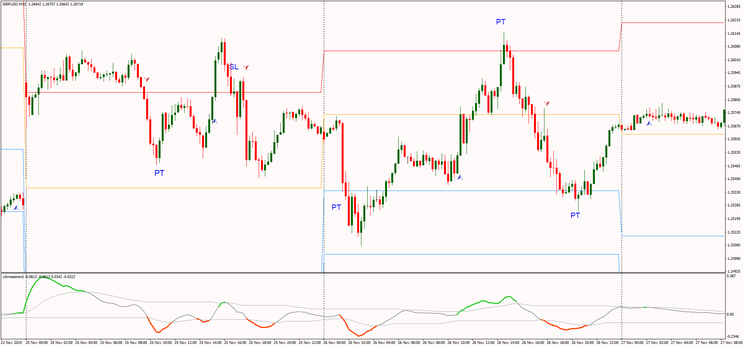

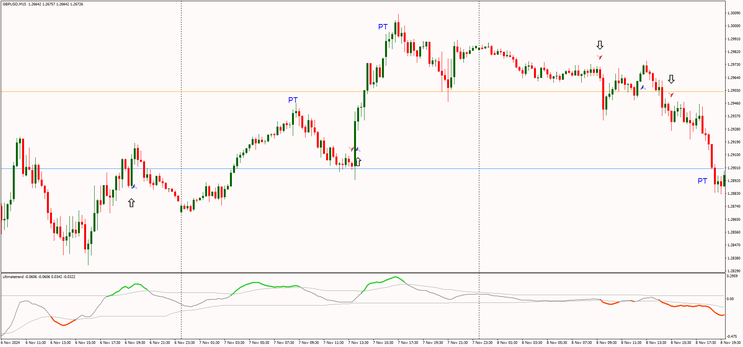

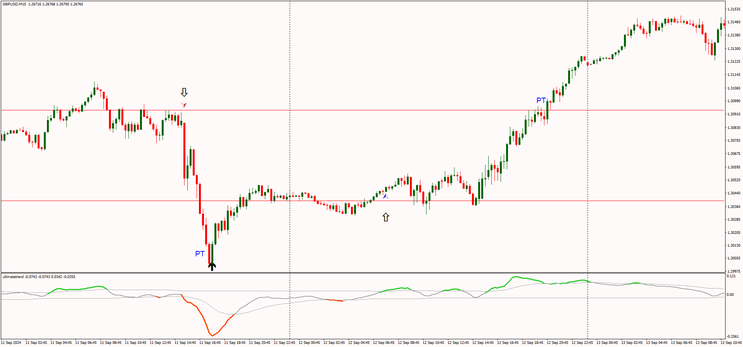

201# One Day, Big Play: Intraday Market Tactics

Submit by Maximo Trader 2024

Trading Strategy Overview:

This is a structured intraday trading strategy designed to capitalize on directional movements within the market. It employs a combination of technical indicators to filter signals and determine

entry and exit points. The strategy is executed on shorter timeframes (5, 15, and 30 minutes) using the MetaTrader platform.

Indicators Used:

-

Directional Arrow

-

Indicates potential buy/sell opportunities based on directional trends.

-

-

Momentum Filter (34 Period)

-

Red line below the chart confirms momentum in the trade direction.

-

-

Zig Zag Arrow

-

Highlights significant market swings and assists in identifying stop-loss levels.

-

-

Pivot Points (Daily)

-

Used to set profit targets, focusing on key support and resistance levels.

-

BUY Setup

-

Conditions for Entry:

-

A buy arrow appears on the main chart.

-

The momentum filter confirms an upward trend (red line below the chart).

-

-

Stop Loss:

-

Place the stop-loss level at the previous swing low (determined by the Zig Zag indicator).

-

-

Profit Target:

-

Set the target 2 pips before the nearest pivot point level or ratio stop loss 1:1.2.

SELL Setup

-

Conditions for Entry:

-

A sell arrow appears on the main chart.

-

The momentum filter confirms a downward trend (red line below the chart).

-

-

Stop Loss:

-

Place the stop-loss level at the previous swing high (determined by the Zig Zag indicator).

-

-

Profit Target:

-

Set the target 2 pips before the nearest pivot point level or ratio stop loss 1:1.2.

-

Example Workflow:

-

Load the indicators in MetaTrader:

-

Directional Arrow

-

Momentum Filter (34-period)

-

Zig Zag Arrow

-

Daily Pivot Points

-

-

Monitor the selected timeframes (5 min, 15 min, 30 min) for potential trade setups.

-

Validate the trade based on the rules:

-

Directional arrow signal.

-

Momentum filter alignment.

-

-

Enter the trade and set stop-loss and take-profit levels.

-

Manage trades actively, exiting if conditions reverse before hitting stop-loss or take-profit.

Risk Management:

-

Recommended risk per trade: 1-2% of account balance.

-

Adjust lot size according to the distance between entry and stop-loss.

This strategy balances simplicity with precision, leveraging the directional and momentum indicators for high-probability trades.

T3 Clean and Bollinger Bands Scalping

Trading with T3 Clean

t3 clean, Bollinger Bands, MACD and RSX Scalping System

Submit by Janus Trader 30/03/2012

Time Frame 5min

Currency pairs:majors

Trading Session: London and NewYork

Indicators:

T3 clean (6) , Bollinger Bands (14, 0.5), MACD (12, 26,9), RSX(14)

Long Entry:1. Price is clearly above T3 & Bollinger bands; T3>Upper bands;

2. MACD histogram is above zero line.

3. Rsx above 50 and Blue.

Short Entry:

1. Price is clearly below HMA & Bollinger bands; T3<Lower Bands

2. MACD histogram is below zero line.

3. RSX below 50 and Magenta

Stop Loss Middle band of the BB or 9-15 pips.

Profit Target 6-9 pips (AUD/USD 5, GBP/USD 9, EUR/USD 7)

After 3 stop loss to close plattaform. Tommorw is another day.

In the pictures T3 Clean, Bollinger Bands, MACD and RSX Scalping System

Share your opinion, can help everyone to understand the forex strategy.

Bollinger Bands and Stochastic

T3 Metatrader Indicator - Forex Strategies - Forex Resources - Forex ...

201# T3 Clean and Bollinger Bands - Forex Strategies - Forex ...

212# HA T3-1 - Forex Strategies - Forex Resources - Forex Trading

296 T3 Snake - Forex Strategies - Forex Resources - Forex Trading

72# Rads Reverse MTF HAS - Forex Strategies - Forex Resources

Rads Metatrader Indicator - Forex Strategies - Forex Resources ...

19# Action Trade - Forex Strategies - Forex Resources - Forex ...

209# Trend Magic System - Forex Strategies - Forex Resources ...