176# Imbo Algo Crypto Strategy For Succesfull Trading

Submit by Lorenz

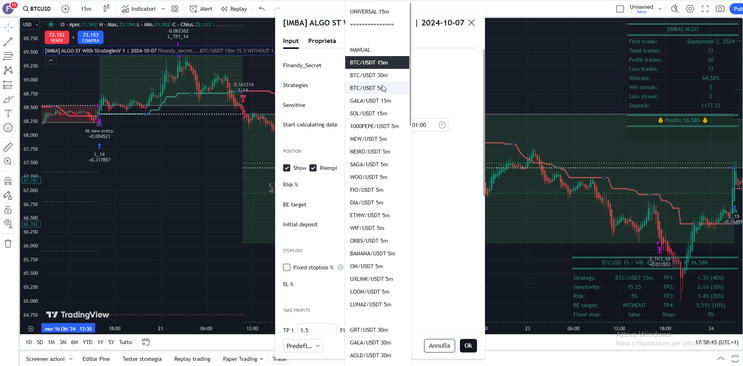

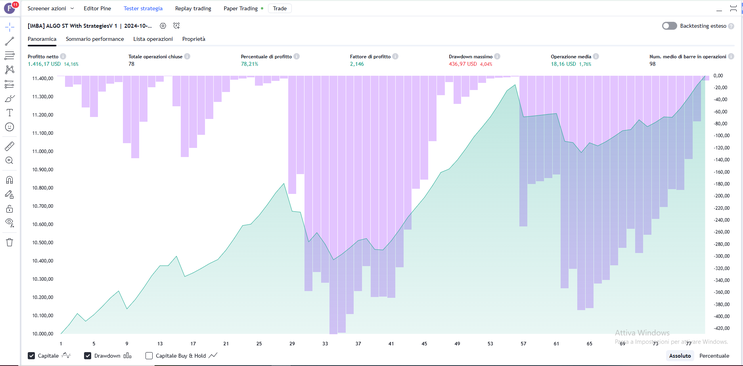

The indicator in this script is the "[IMBA] ALGO ST with Strategies," a Pine Script-based strategy for trading various cryptocurrency pairs on TradingView. The strategy is designed to generate buy and sell signals based on trend sensitivities and other configurable parameters. Key features of this indicator include:

-

Sensitivity Setting: Adjusts the indicator’s responsiveness to price movements. Higher sensitivity detects smaller price changes, suitable for short-term trading, while lower sensitivity is used for longer trends.

-

Take Profit (TP) Levels: Divided into four levels (TP1 to TP4), each representing a different percentage of the target profit. Traders can exit positions at each level to secure profits gradually.

-

Stop-Loss (SL): While there’s no automatic stop loss or trailing stop, a fixed SL is customizable per strategy. It helps in managing losses if the trade goes against the prediction.

-

Break-even: Some strategies have a break-even mechanism, where the entry price becomes the stop after a certain profit is achieved, minimizing risk.

-

Risk Percentage: Sets a percentage of the total capital at risk per trade, typically set to 5%.

Trading Strategy Based on the "[IMBA] ALGO ST with Strategies" Indicator

Strategy: Trend-Following with Multi-Level Take Profits (for 15-minute BTC/USDT Pair)

-

Setup: Choose the 15-minute timeframe and apply the "[IMBA] ALGO ST with Strategies" with the "BTC/USDT 15m" preset.

-

Parameters:

-

Sensitivity: Set to 15.25 for detecting optimal entry points.

-

Risk Percentage: Set at 5%, allocating a manageable portion of the account to each trade.

-

Take Profit (TP) Levels: TP1 at 1.3%, TP2 at 2.1%, TP3 at 3.4%, and TP4 at 5.51%.

-

Stop-Loss (SL): Default SL is set to a fixed 5%, offering protection if the trade turns adverse.

-

-

Entry:

-

Long Entry: When the indicator triggers a buy signal (based on trend sensitivity settings), place a long order.

-

Short Entry: For a sell signal, place a short order.

-

-

Exit:

-

Partial Exits: Take partial profits at each TP level (TP1, TP2, TP3, and TP4). Reduce position size progressively as each TP is hit to lock in gains.

-

Break-Even Adjustment: Once TP1 or TP2 is hit, adjust the SL to the entry point (if "break-even" is enabled) to protect profits.

-

-

Risk Management:

-

Maintain position sizing according to the 5% risk cap to ensure consistent, controlled exposure.

-

This approach suits trend-following traders who seek to capture both short- and medium-term price swings while managing risk through structured take-profit and stop-loss placements

Cycle 1 min Scalping Forex Trading System

Submit By Janus Trader (Written by afolabiay ) 18/01/2012

Time Frame is M1

For ECN Broker Account.

Forex Indicators- lma, sma, macd. daily pivot,currency power, High or normal Fundamental News and overlay chart

Indicators settings- LMA 200, SMA 200, MACD 120,200,88,

Rules-1. LMA 200 cross SMA 200 MACD Cross 0 line after the new has been release check the reaction of the price after the crosses of the indicators, if price move towards pivot S1 or R1 open a position in the direction of the Pivot supp or res area place stop loss at the pivot area and place take profit at the pivot support or resistance area

Rules-2.if the overlay chart cross the main chart after the news the open position in the direction, if the price cross the S1 or R1 before its cross the overlay chart the open your position and place your stop loss to S1 or R1 the put your Take profit to S2 or R2....

I will use USDCHF as an example with AUDUSD Overlay chart

Rule-3. Make the corresponding currency is strong in the currency power indicator

Cycle 1 min Scalping GBPUSD with USDCHF overlay chart

-

#3

And where are the indakators shown on the screen (table) and which currency pairs to trade and how to impose them?

-

#2

me gusta se vende gracias

-

#1

To do trading with 1 min time frame is essential to have an ECN Broker.

23# 1 min Scalper - Forex Strategies - Forex Resources - Forex ...

49# MACD Scalping 1 min - Forex Strategies - Forex Resources ...

85# 1 min Scalping IV "Powerful" - Forex Strategies - Forex ...

75# 1 min Scalping GBP/USD - Forex Strategies - Forex

76# 1 min Scalping II - Forex Strategies - Forex Resources - Forex

84# 1 min Scalping III "Profit System" - Forex Strategies - Forex ...

82# 1min Eur/USD Scalping - Forex Strategies - Forex Resources

136# 1 min Scalping with Pivot Points (IX) - Forex Strategies -

133# 1 min Contrarian Scalping (VIII) - Forex Strategies - Forex ...

115# 1 min Scalping VII - Forex Strategies - Forex Resources ...

106# 1 min Scalping VI - Forex Strategies - Forex Resources -

86# 1 min Scalping V - Forex Strategies - Forex Resources - Forex

147# Absolute Strength Scalping (1 min XIII) - Forex Strategies ...

137# 1 min Scalping X - Forex Strategies - Forex Resources -

179# Simple 1 min Scalping XIV - Forex Strategies - Forex ...

176# Cycle 1 min Scalping XII - Forex Strategies - Forex Resources

141# Scalper 4free 1 min XI - Forex Strategies - Forex Resources

142# 100 pips 1min XII - Forex Strategies - Forex Resources -