172# Supertrend Slow Trading Strategy.

Submit by Janus Trader 2024

This trend following Strategy is based only on the Super trend V indicator of RafaelZioni.

Key Components:

ATR (Average True Range): The ATR (with a period of 15 in this case) measures market volatility. It plays a key role in defining the distance between the price and the SuperTrend line.

Multiplier: The ATR is multiplied by a factor (set to 5 in this strategy) to adjust the sensitivity of the SuperTrend. A higher multiplier makes the trend line smoother and reduces the frequency of signals, making the strategy slower.

Trend Line: The SuperTrend line is plotted either above or below the price. When the price crosses above the trend line, it signals an uptrend, while a crossover below signals a downtrend.

Buy and Sell Signals:

Buy: A buy signal is generated when the price crosses above the SuperTrend line, indicating a shift to an uptrend.

Sell: A sell signal is generated when the price crosses below the SuperTrend line, signaling a shift to a downtrend.

This SuperTrend configuration with a multiplier of 5 and a period of 15 results in a slower-moving indicator, which helps capture longer, more sustained trends, reducing noise and false signals in volatile markets.

Setup:

Currency pairs: volatile.

Time Frame 5 minute or higher.

Indicator Super Trend V setup

-

Timeframe (TF): 72

-

SuperTrend Multiplier: 5

-

SuperTrend Period: 10

-

Take Profit (TP): 3

-

Length: 150

-

Signals: Use the buy and sell signals generated by the SuperTrend indicator.

Entry Rules:

-

Buy: Enter a long position when a buy signal is generated. This occurs when:

-

The price crosses above the SuperTrend line, and

-

The price is above the EMA of the opening prices (

oline).

-

-

Sell: Enter a short position when a sell signal is generated. This occurs when:

-

The price crosses below the SuperTrend line, and

-

The price is below the EMA of the opening prices (

oline).

-

Exit Rules:

-

Take Profit: Use the TP line generated by the indicator, which is based on a 150-period slope and standard deviation.

-

For long positions, exit when the price crosses below the upper TP line.

-

For short positions, exit when the price crosses above the lower TP line.

-

-

Reverse Signal: Exit the position when an opposite signal (buy or sell) is generated. For example:

-

If you are in a long position and a sell signal appears, close the long and enter a short position.

-

Note: This strategy can also be managed with the d'Alembert progression provided that the trading capital is divided into boxes. Each time you risk one box.

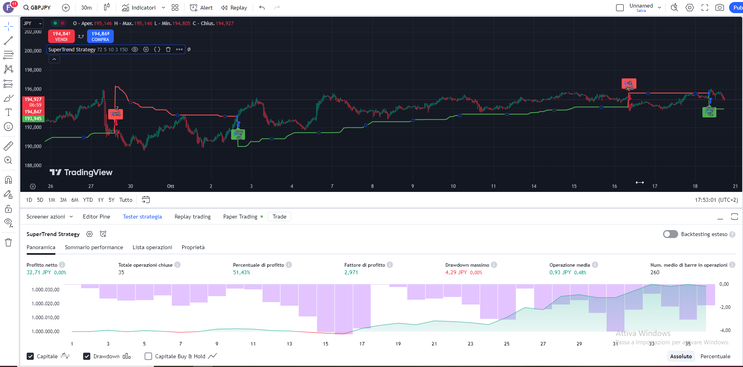

Based on this indicator I wrote a strategy these are the test results.

172# ISAKAS Rebirth - Forex Strategies - Forex Resources - Forex

157# Rubicon Strategy - Forex Strategies - Forex Resources -

193# Gurusomu system - Forex Strategies - Forex Resources ...

290# Sar Supertrend - Forex Strategies - Forex Resources - Forex

199# Market is Dead Scalper MDS - Forex Strategies - Forex ...

252# Din V.3 - Forex Strategies - Forex Resources - Forex Trading

162# Trading System, SEFC Palato

205# Scalping with TDI, Real MACD, StochRainbow

154# 15 min Strategy - Forex Strategies - Forex Resources - Forex

182# JumScalping - Forex Strategies - Forex Resources - Forex ...

216# Forex Miko Parabolic System

186# Hakeem's forex Intraday Method