171# Scalping Strategy for Gold, Indices, and Boom & Crash MT5

Submit by Joy22 2025

The Scalping Strategy for Gold, Indices, and Boom & Crash is a trend reversal strategy specifically

designed for trading on lower time frames. This strategy helps traders identify potential reversals and capitalize on quick price movements.

Setup

Time Frame: 2-3 minutes, 5 minutes, but it also works well at other time frames (15, 30,60 and 240 minutes).

Assets: Gold, US30, Russell, US100, US500, Mib30, DAX, and synthetic indices like Boom and Crash.

Platform: MetaTrader 5

MT5 Indicators

TMA (Triangular Moving Average) – Acts as a dynamic support and resistance indicator and a range filter.

Settings:

Half period: 60

Average true range period: 100;

4 EMA Trend Mover – Helps identify the trend direction.

Settings:

Period: 25, applied to: Close;

Color Bars – Identifies trend strength.

Settings:

Period: 6, applied to: Close;

AMP Signal – Provides trade entry signals.

Settings: Amplitude: 5;

MACD (8,18,6) – Used to confirm take profit levels.

Trading Rules

The key principle of this strategy is to look for extreme price movements where one or more candles close outside the TMA bands.

The lower the time frame, the more mandatory it is to look for extreme situations as described.

At low time frames 2-3 minutes you can use the 60 minute multi time frame filter, that is, you only trade in the direction of the 60 minute chart.

Buy Setup

The price touches or moves outside the lower TMA band.

An AMP signal buy arrow appears.

The 4 EMA green bar is positioned below the candle.

Avoid to enter if the candle price is near or broken the opposite band.

Sell Setup

The price touches or moves outside the upper TMA band.

An AMP signal sell arrow appears.

The 4 EMA green bar is positioned above the candle.

Avoid to enter if the candle price is near or broken the opposite band.

Exit Strategy

Stop Loss: Place the stop loss at the previous swing high/low.

Take Profit: Maintain a profit target ratio of 1:1 to 1:1.2 relative to the stop loss.

Trades examples

Multitime frame filter

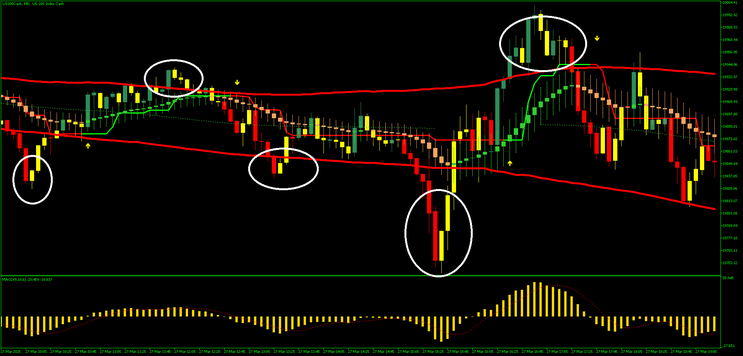

This chart represents a scalping setup for Gold on a lower time frame (M2 or M3)

Key Observations:

-

Buy Entry Points:

-

Several yellow arrows (AMP signal) appear near or just outside the lower TMA band, signaling possible buy opportunities.

-

The EMA trend bars turn green, confirming an upward price movement.

-

These conditions align well with the strategy rules for taking a buy position.

-

-

Avoiding Sell Signals:

-

The chart also shows some sell arrows near the upper TMA band, but since the H1 trend is bullish, these should be ignored.

-

Taking only buy trades in the direction of the higher time frame trend increases the probability of success.

-

In the picture we have 4 winning trades and losing one.

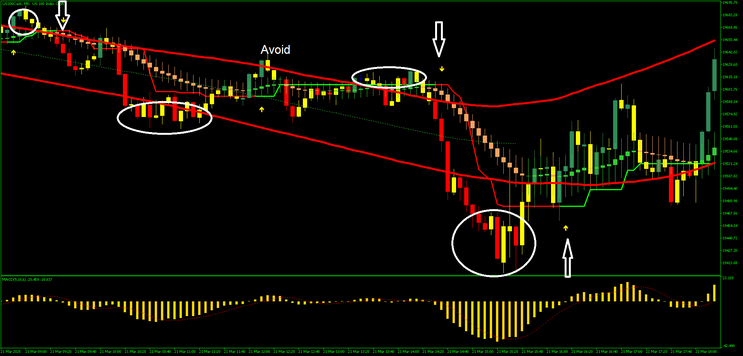

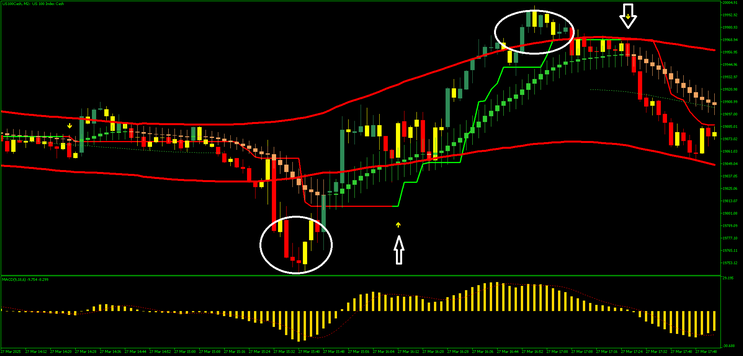

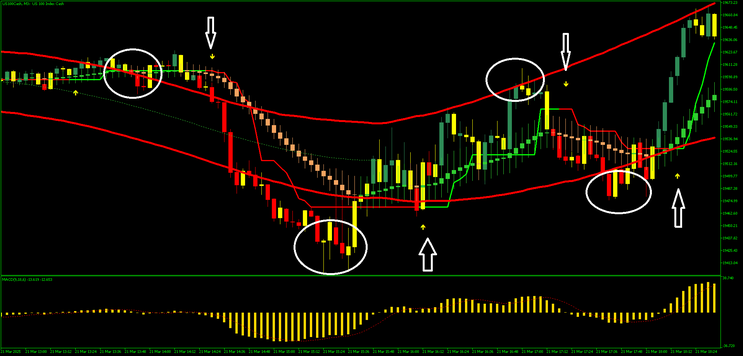

Other examples of trades.

171# ISAKAS II Trading System

BBands Trading System

Submit by KonKer (Written Osentogg, source TDS Forum) 13/01/2012

TimeFrame 30

Currency Pair: all

and the important thing here now

SL need to set lower than TP

refers to the pairs range volatility.

Recommended

for GJ and EJ = SL 40 = TP 50

others = SL 30 =TP 35

or just follow the nonlagdot colors changing..

Entry Buy

- bbands blue, fisher blue, flattrend blue, nonlagdot blue.

Entry Sell

- bbands red, fisher red, flattrend red, nonlagdot red.

In the picture Isakas 2 trading system in action.

-

#1

thanks for sharing

172# ISAKAS Rebirth - Forex Strategies - Forex Resources - Forex

157# Rubicon Strategy - Forex Strategies - Forex Resources -

193# Gurusomu system - Forex Strategies - Forex Resources ...

290# Sar Supertrend - Forex Strategies - Forex Resources - Forex

199# Market is Dead Scalper MDS - Forex Strategies - Forex ...

252# Din V.3 - Forex Strategies - Forex Resources - Forex Trading

162# Trading System, SEFC Palato

205# Scalping with TDI, Real MACD, StochRainbow

154# 15 min Strategy - Forex Strategies - Forex Resources - Forex

182# JumScalping - Forex Strategies - Forex Resources - Forex ...

216# Forex Miko Parabolic System

186# Hakeem's forex Intraday Method