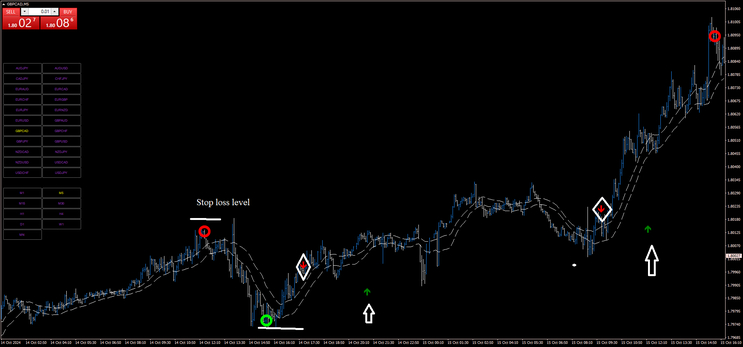

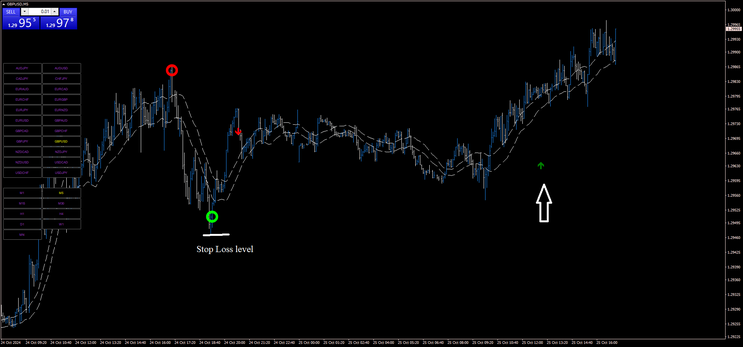

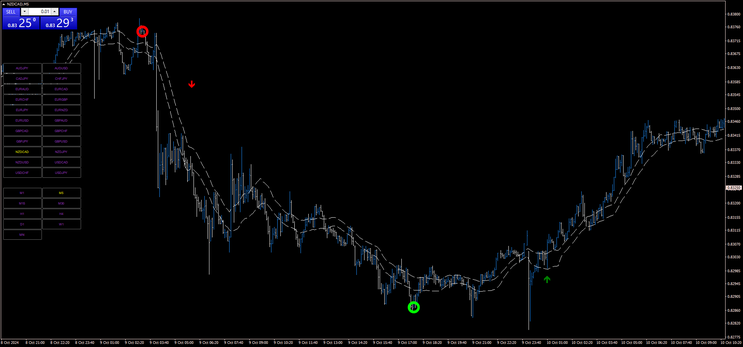

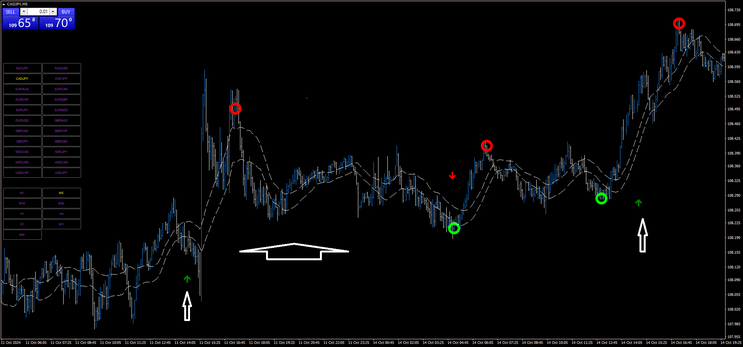

166# Lucky Reversal Scalping Strategy

Submit by Maximo Trader

Lucky Reversal Scalping Strategy is trend revesal trading system with high profittability.

Indicators:

-

SMA (Simple Moving Average) High (20 periods)

-

SMA Low (20 periods)

-

Lucky Reversal Indicator SRZZ (60 periods)

-

Arrow Indicator (for buy and sell signals)

This scalping strategy combines a combination of trend direction with SMA and specific entry signals from the Lucky Reversal Indicator, targeting short-term, high-probability trades.

Buy Setup:

-

Trend Confirmation:

-

Price is above the 20-period SMA High line. This confirms the market is in an uptrend.

-

-

Swing Low Signal:

-

The Lucky Reversal Indicator forms a green circle below a swing low. This indicates a potential reversal or continuation of the upward trend.

-

-

Entry Signal:

-

A buy arrow appears, signaling a potential entry.

-

-

Entry Point:

-

Enter a buy position at the close of the candle where all conditions are met.

-

-

Stop Loss:

-

Place the stop loss below the previous swing low.

-

-

Profit Target:

-

Aim for a profit target ratio of 1:1.3 to 1:1.8 relative to the stop loss.

-

Sell Setup:

-

Trend Confirmation:

-

Price is below the 20-period SMA Low line, confirming the market is in a downtrend.

-

-

Swing High Signal:

-

The Lucky Reversal Indicator forms a red circle above a swing high, indicating a potential downward movement.

-

-

Entry Signal:

-

A sell arrow appears, signaling a potential entry.

-

-

Entry Point:

-

Enter a sell position at the close of the candle where all conditions are met.

-

-

Stop Loss:

-

Place the stop loss above the previous swing high.

-

-

Profit Target:

-

Aim for a profit target ratio of 1:1.3 to 1:1.8 relative to the stop loss.

-

Additional Tips for This Strategy:

-

Trade Management: Move the stop loss to break-even when the price has moved halfway to the target.

-

Session Selection: This strategy works best during high-volatility trading sessions (e.g., London and New York sessions).

-

Risk Management: Avoid over-leveraging; keep risk per trade between 1-2% of the total account balance.

166# FX Carry Range Scalping

FX Range Scalping System

Trading Range

System Rules

Entries

The first step in the strategy is to draw a channel between the highest high and the lowest low of the last 9 bars

The second step is to draw Fibonacci Retracement lines using those two levels

We should enter a long trade when the bar closes above the 61.8% retracement level

We only trade in the direction of the carry.

Exits

Sell Stop: We should close our trades at 3 times the value of the average true range.

Profit Target: Take profits at entry price plus 3 times the average true range

We chose to use the same value both for risk and reward to avoid any statistical bias in any direction. For example, if our stop id much closer than our target, odds are that we are going to have more losing trades than winning trades

Time Frame Traded

4 hour charts

Currency Pairs Traded

EUR/JPY

GBP/JPY

AUD/JPY

NZD/JPY

In the pictures FX Carry Range trading system in action.

198# Luxury Scalping - Forex Strategies - Forex Resources -

166# FX Carry Range Scalping - Forex Strategies - Forex ...

191# LineX Scalping - Forex Strategies - Forex Resources -

228# Range Factor Scalping 15min - Forex Strategies - Forex ...

151# Scalping Breakout - Forex Strategies - Forex Resources ...

Write a comment