158# Algo Scalper Forex Strategy

Submit by Maximo Trader

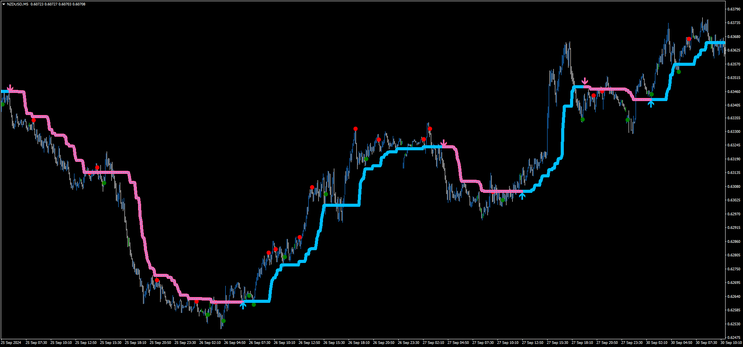

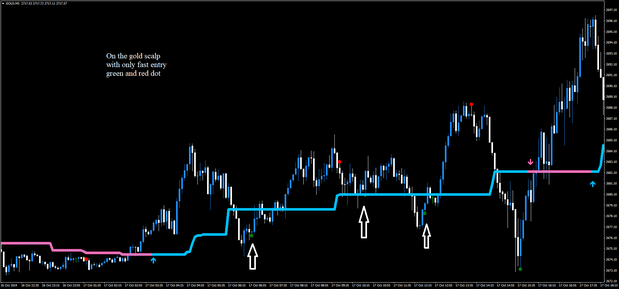

Here’s a trading strategy that combines the Algo Scalper and Smart Forex Indicator for quick re-entries in the same direction. This strategy is designed for experienced traders using a 5-minute timeframe or higher, focusing on volatile currency pairs.

Trading Strategy: Algo Scalper and Smart Forex Indicator

Overview:

-

Timeframe: 5 minutes or higher

-

Currency Pairs: Volatile pairs (e.g., EUR/USD, GBP/JPY)

-

Indicators Used:

-

Algo Scalper: Provides initial buy and sell arrows.

-

Smart Forex Indicator: Indicates re-entry points with green (buy) and red (sell) dots.

-

Strategy Setup:

-

Entry Signals:

-

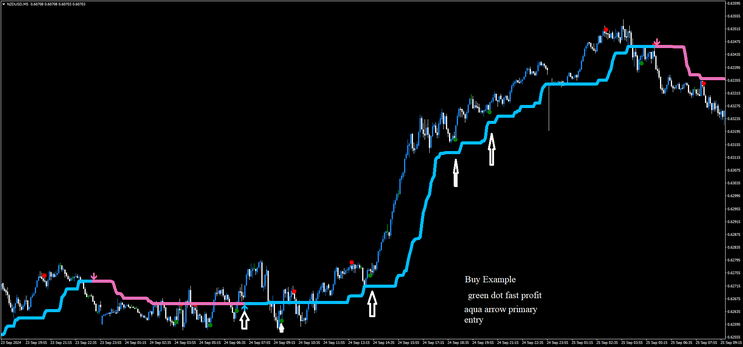

Buy Entry:

-

Look for a Buy Arrow from the Algo Scalper indicator (primary entry).

-

After the Buy Arrow appears, wait for a green dot from the Smart Forex Indicator to confirm the re-entry.

-

-

-

-

Sell Entry:

-

Look for a Sell Arrow from the Algo Scalper indicator (primary entry).

-

After the Sell Arrow appears, wait for a red dot from the Smart Forex Indicator to confirm the re-entry.

-

-

-

Stop Loss:

-

Place the Stop Loss at the previous swing high (for sell trades) or swing low (for buy trades). This helps to protect against significant losses in case the market moves against your position.

-

-

Take Profit:

-

Exit the position at the opposite signal from the Algo Scalper (i.e., a sell arrow for buy trades or a buy arrow for sell trades).

-

-

Alternatively, use a risk-reward ratio of 1:1.3. For example, if the Stop Loss is 20 pips, set the Take Profit at 26 pips.

-

-

Note: You can use both entrances or just one, depending on what you feel most comfortable with.

Trade Management:

-

Monitor trades actively, especially in volatile markets. The fast-paced nature of scalping requires quick decision-making.

-

Adjust your Stop Loss to breakeven once the trade moves favorably by a certain number of pips (e.g., 10 pips) to secure profits.

Example Trade:

-

Buy Scenario:

-

A Buy Arrow appears from the Algo Scalper.

-

A green dot appears shortly after, confirming the buy.

-

Set the Stop Loss below the previous swing low.

-

Exit when an opposite arrow appears or when reaching a 1:1.3 risk-reward ratio.

-

-

Sell Scenario:

-

A Sell Arrow appears from the Algo Scalper.

-

A red dot appears shortly after, confirming the sell.

-

Set the Stop Loss above the previous swing high.

-

Exit when an opposite arrow appears or when reaching a 1:1.3 risk-reward ratio.

-

Conclusion:

This strategy leverages the strengths of both the Algo Scalper and Smart Forex Indicator for effective scalping in volatile markets. By combining initial entry signals with confirmed re-entries, traders can maximize their chances of success while effectively managing risk..

- 5 min Trending

- 5 min Scalping

- 5 min Scalping System

- 54# 5min Forex Trade - Forex Strategies - Forex Resources - Forex

- 164# 5 min Scalping System - Forex Strategies - Forex Resources

- 8# The 5 minute standard deviation scalp - Forex Strategies - Forex

- 184# 5 min Scalping - Forex Strategies - Forex Resources - Forex

- 27# 5 Min Intraday - Forex Strategies - Forex Resources - Forex ...

- 51# 5min Breakout - Forex Strategies - Forex Resources - Forex ...

- 138# 5 min Momo Trader - Forex Strategies - Forex Resources ...

- 101# 5 min Trading System - Forex Strategies - Forex Resources ...

- 95# 5 min Method - Forex Strategies - Forex Resources - Forex ...

- 131# 5 min Keltner System - Forex Strategies - Forex Resources ...

- 126# 5 min Trend Follower - Forex Strategies - Forex Resources ...

- 39# 5 min Channel - Forex Strategies - Forex Resources - Forex ...

- 192# 5 min Trading Guide - Forex Strategies - Forex Resources ...

- 125# 5 min Momo trade - Forex Strategies - Forex Resources ...

- 2# 5 Min Blue Trend Rider - Forex Strategies - Forex Resources ...

Alice (Sunday, 20 October 2024 01:47)

I tried this strategy it is working well. Thanks.