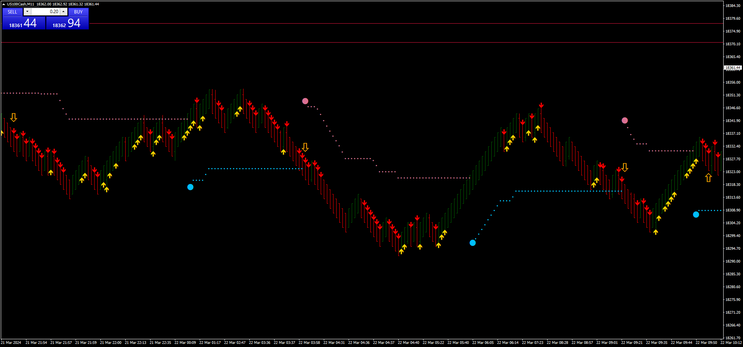

Median Renko with Nasdaq 100

Strategy for volatile instruments

Submit by Maximo Trader

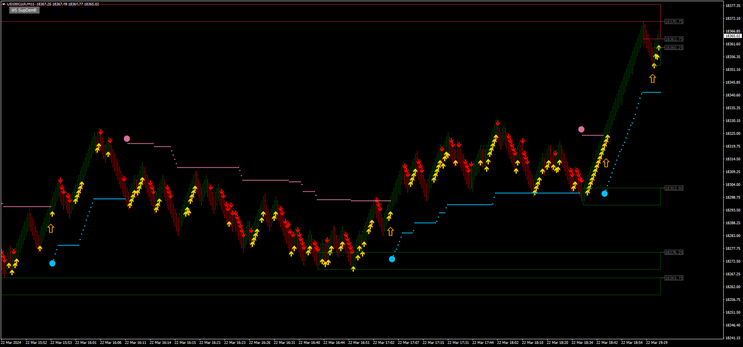

Median Renko with Nasdaq 100 is a trading strategy that uses clean median renko charts to capture the fast price action of volatile instruments like the Nasdaq 100. In this example I show the setting for Nasdaq 100 but others can also be configured such as the Dax, Russell, Oil, Gold, BTCUSD, Ethereum and others.

The strategy is based on three indicators, one of price action, the Superdem which defines the areas of support and resistance, the other the Tango based on the RSI which gives the timing of the entry and finally the Volty Channel Stop which serves as a trailing stop and direction. Finally there is the indicator that allows us to construct the Renko medians on MT4.

Setup Strategy

Box Size 700 pips.

Currency pairs: volatility.

Metatrader 4 indicators:

Superdem,

Tango default setting.

Volty Channel Stop on Jurik

Renko Original Chart.

Trading Rules

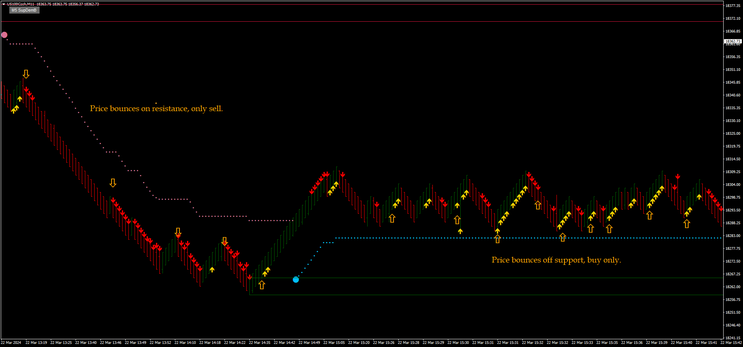

This template can be used in two ways.

Pure trend following so the support and resistance areas are just target and stop levels.

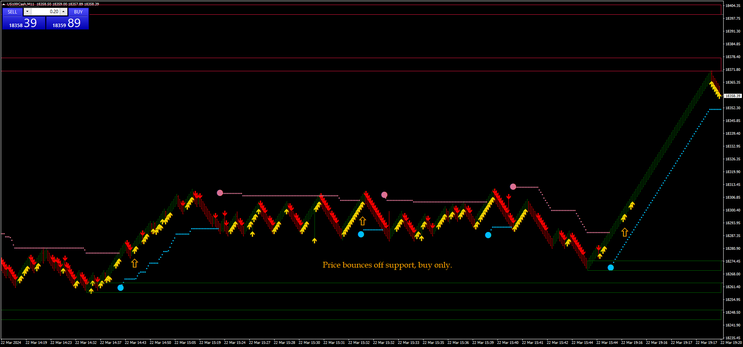

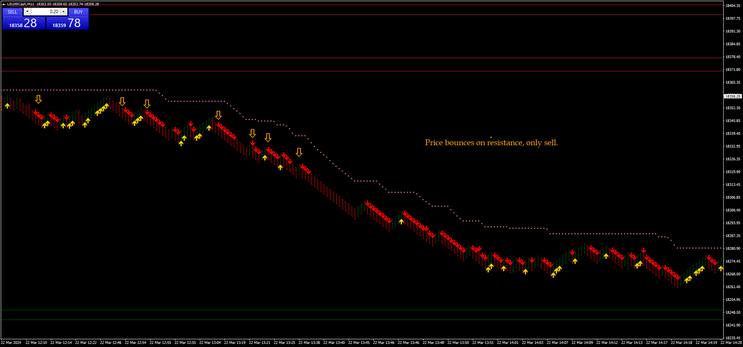

Price Action in which support and resistance levels define key areas for setting up trading.

In this specific case I am referring to price action trading.

Buy

Price bars above support.

Enter Buy trades when, The "Volty Channel Stop is below the bar" shows up-trend, and "Tango" gives buy arrows signals within the up_trend.

Fast scalping can be done by entering the retracement after the red bars with the buy arrow signal.

Sell

Price bars below resistance.

Enter sell trades when, The "Volty Channel Stop is above the bar" shows down-trend, and "Tango" gives sell arrows signals within the down trend.

Fast scalping can be done by entering the retracement after the green bars with the sell arrow signal.

Exit position trend following method when the Volty channel reverses position.

Money management: conservative fix 2%, Aggressive: D’alembert.

Note: This is a very simple winning strategy to use. The advice is to start with a higher box size like 800-1000. Happy Trading.