57# PK Renko Probability Trader

Various trades entries with renko chart

Submit by LeonFx

PK Renko Probability Trader

Concept

We aim to capture 1 – 2 bars of pips by trading regular patterns

We are looking for shorter term trades

This approach is based on using Renko to determine entry and exit points

Using NB recovery should help to make this trading system successful

Note 1.

This is a based on taking consistent small gains from trading regular patterns. The risk return is not the best but the patterns are consistent so should provide a high win rate.

I would not trade every option on every pair but depending on the pairs characteristics some trade types seem to work better than others.

Note 2.

I have studied lots of Renko charts so have a degree of confidence in the basic patterns however the most obvious element only dawned on me the other day and the other bits suddenly made much more sense.

I have not traded this strategy as outlined but have used parts of it at different times. Personally I often found Renko hard to trade manually as the price moved quicker than I could react.

Note 3.

This idea will need refinement. However once the trend concept of Renko is understood it’s quite simple and generally is just trying to capture short term momentum.

The Basic Concepts of the Plan

Underlying EMA trend

Defined by a 750 EMA

If the open for the day is above the 750 trend EMA then the EMA trend is up, if open for the day is below then the EMA trend in down

The Opening Price and a Short Term Moving Average (10 SMA shifted 1 period) are the only other requirements.

The open price is the black line across each period

The Short Term Trend

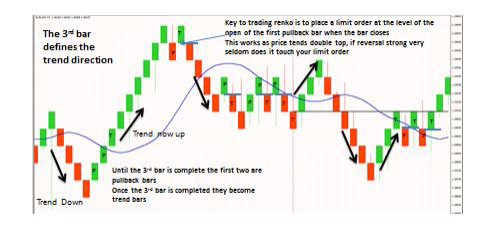

Key Concept to this Strategy is that 3 completed bars defines a trend direction, one or two bars is a trend pullback

Making this simple rule helps to make Renko trading very easy to understand and to design a trading strategy around

Trade Types

We have 3 types of trades

1. Pullback entries

2. MA cross over entries

3. Trend continuation entries ( based on a higher high or a cross of a significant resistance area

1. Pull back Trades

We treat every one and two bar pullback as a trend continuation opportunity. If the 3rd bar forms we change our point of view.

The key to entries for this strategy is to enter at the entry point of the first pullback bar and not wait for the new trend bar to form. This is best done by placing a limit order when the first pullback bar completes.

This is important as often entering once the bar is complete means entering at a resistance point.

We trade only trend trades in the direction of the short term trend defined by the direction of the last 3 completed Renko bars.

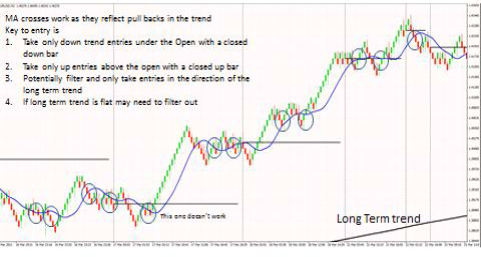

2. MA Cross Over Entries

MA cross over entries work better when there is a stronger trend when filtered with the direction

Rules are

Take down trends entries under the open with a closed down bar

Take only uptrends over the open with a closed up bar

May need to add a filter for longer term ranging periods but the above rules work ok

I use sma10 shift 1 but others may prefer an alternative

3. Trend Continuation Entries

These are created by the cross of significant lines and 4th candles

I have used the open line to show where we can take a single candle, for these I would place an

entry line a few pips on the other side of the line. I think these patterns work because in ranging periods the price seems to stay close to the open.

Fourth candles are traded in the direction of the main underlying trend where there has not been a pull back.

While they seem a little random they work quite well. Generally with the level of momentum a pullback will lead to continuation.

Stop Losses and Recovery

I think the NB recovery will work well with this approach as most of it is trading with the trend giving good recovery options.

Alternatively a standard SL placement can be used.

A martingale strategy also seems sensible given the relatively small take profit targets and higher frequency of trading. The approach used to limit the number of trades seems sensible to me.

Filters

Additional Ranging Filter

To avoid trading in ranging markets an optional filter option to prevent trading within x pips of the trend EMA could be applied. For example if the entry price is within 200 pips of the 750ema do not enter.

With Trend EMA

An option to take each trade type only with the Trend EMA is required

Number of Open Trades per pair / total drawdown

A number of open trades per pair may be useful as a pair could be in recovery while taking a new signal.

https://t.me/freeforexresources Telegram Channel