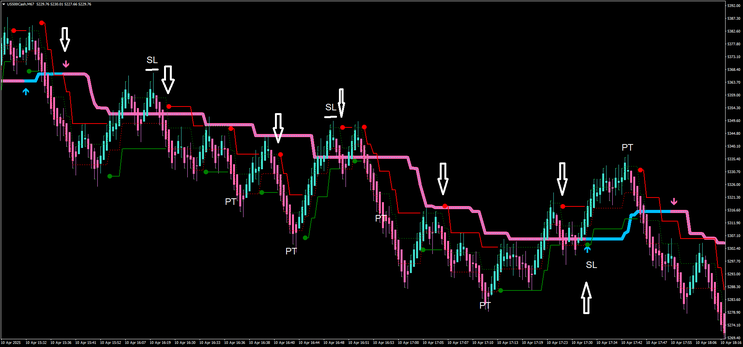

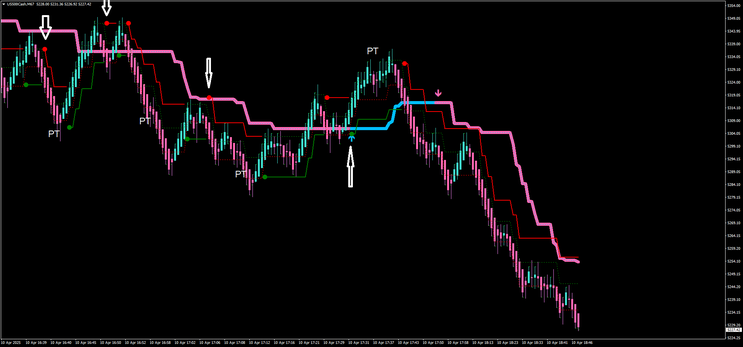

26# Scalping with Renko Adaptive – Trading Strategy

Joy22 2025

The Renko Adaptive Scalping strategy is a trend-following trading system that utilizes Renko charts to identify high-probability entry points in volatile markets. It relies on two indicators: one for determining the market trend, and the other for timing the entries.

Strategy Setup

Instruments

This strategy performs best with volatile instruments. Recommended assets include:

-

Commodities & Indices: Gold, DAX, NASDAQ 100, US500

-

Cryptocurrencies: Bitcoin

-

Forex Pairs: NZDJPY, EURJPY, GBPAUD, GBPNZD, EURAUD

Note: Avoid using very small Renko box sizes, especially on indices and cryptocurrencies. Always test and optimize the box size before live trading.

Indicators: Scalping Signal: amplitude 15.

Adaptive Renko 1.2.

Platform

-

MetaTrader 4 (MT4)

Entry Rules

Buy Setup

-

Trend indicator shows an uptrend (blue line and upward arrow).

-

Renko Adaptive indicator confirms with a blue dot (buy signal).

-

Both indicators must align for a valid long entry.

Sell Setup

-

Trend indicator shows a downtrend (red line and downward arrow).

-

Renko Adaptive indicator confirms with a red dot (sell signal).

-

Both indicators must align for a valid short entry.

Exit Rules

-

Stop Loss: Place just beyond the most recent swing high (for sell) or swing low (for buy), plus half the Renko box size.

-

Take Profit: Use a reward-to-risk ratio between 1:1 and 1:1.3, depending on market volatility and asset behavior.

This strategy is a winning strategy, it is suitable for hedging.

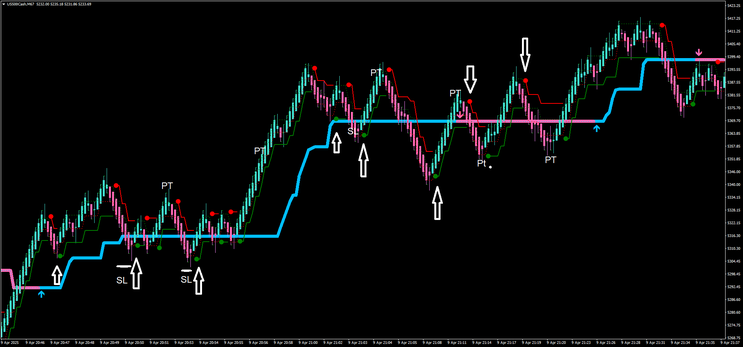

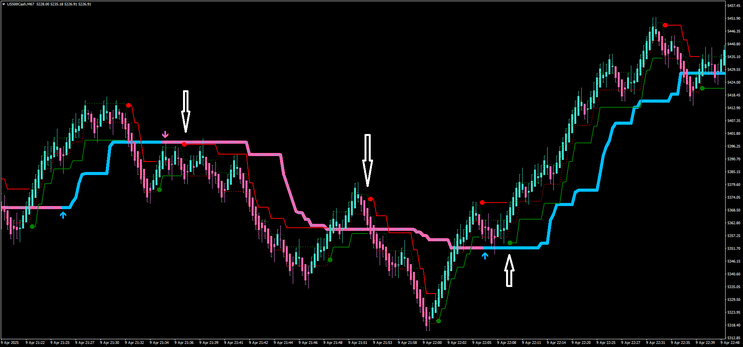

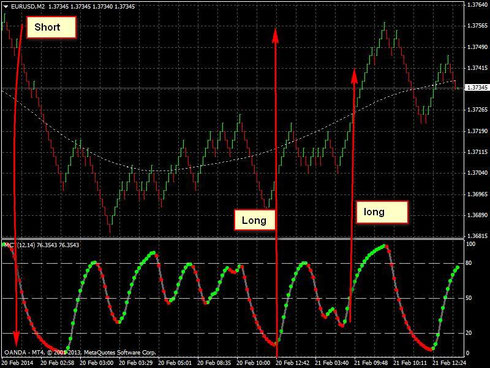

26# Renko Chart Trading System: DSS with Extreme TMA

Renko System Double Stochastic with TMA line

Submit by Mike Trader 22/02/2014

Renko Chart Trading System: Dss with extreme TMA line is a forex strategy trend following.

1) Open M1 chart, disable autoscroll, zoom out max, scroll back with "Home" key as far as it goes.

2) Reenable autoscolling.

3) Add RenkoLiveChart to M1, set whatever box size you fancy.

4) Open offline chart (M2 or whatever you set in the Renko EA) for the same currency.5) 5)Apply template DSS with extremeTMA line to M2 chart.

Box Size setting:

Scalping 4-5 pips;

Intraday 6-10 pips;

Swing trading 11-20 pips

Metatrader Indicators:

DSS Bressert (Double Stochasic Indicator)

Extreme TMA line indicator.

Rules forRenko Chart Trading System: Dss with extreme TMA line

Extreme TMA Line determine the trend

Long Entry

Extreme TMA line most slope up for long trades;

Renko bars or also range bars must close belowe the Extreme TMA line;

DSS Bressert ( double stochastic indicator) green dot below 50 line.

Short Entry

Extreme TMA line most slope down for short trades;

Renko bars or also range bars must close abpve the Extreme TMA line;

DSS Bressert ( double stochastic indicator) red dot above 50 line.

In the pictures Renko Chart Trading System: Dss with extreme TMA line in action