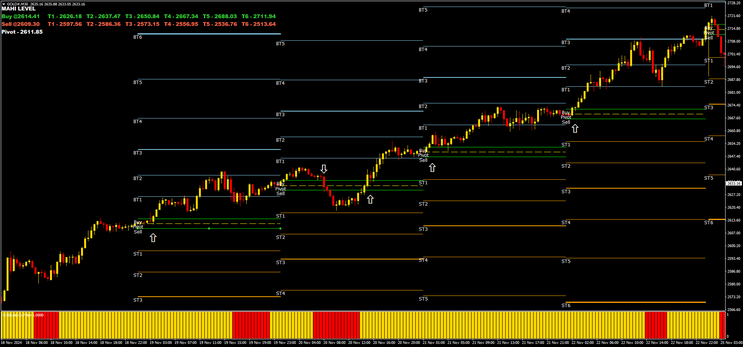

8# Intraday Gold Levels Trading Strategy

Submit by Alexander 2024

This intraday trading strategy is based on pivot levels and is specifically designed for trading gold. It leverages key pivot points and a grid system to define entry and exit points with clear rules for risk management and profit targets.

Overview of the Strategy

-

Pivot Levels:

-

The pivot base level serves as the main reference point.

-

The BT1 level (equivalent to R1) defines the Buy Line.

-

The ST1 level (equivalent to S1) defines the Sell Line.

-

-

Grid System:

-

The grid comprises 6 BT levels (above the pivot) and the Buy Line.

-

Similarly, it includes 6 ST levels (below the pivot) and the Sell Line.

-

Each BT/ST level can act as a potential profit target.

-

Setup Requirements

-

Time Frames:

-

15-minute, 30-minute, or 60-minute charts.

-

-

Sessions:

-

London and New York sessions are preferred for increased volatility.

-

-

Indicators:

-

MetaTrader 4 platform.

-

Gold Levels indicator (default settings).

-

Ratis Filter indicator (default settings).

-

Entry Rules

Buy Setup:

-

The price touches the Buy Line (between the pivot and BT1).

-

The Ratis Filter displays a yellow signal.

Sell Setup:

-

The price touches the Sell Line (between the pivot and ST1).

-

The Ratis Filter displays a red signal.

Exit Rules

-

Profit Targets:

-

All BT and ST levels can be used as potential profit targets.

-

-

Stop Loss:

-

Use a move stop-loss, followed by a trailing stop:

-

Once the price covers half the distance to the first profit target, move the stop-loss just below/above the pivot level.

-

Continue trailing the price as it moves towards subsequent targets.

-

-

Additional Notes

-

Discipline and Risk Management:

-

Always set your stop-loss before entering a trade.

-

Avoid trading during low volatility periods or outside the London and New York sessions.

-

-

Testing and Optimization:

-

Test the strategy on a demo account to adapt to market conditions.

-

This strategy capitalizes on gold's volatile nature and provides clear guidelines for entries and exits, making it suitable for disciplined intraday traders.

Simple Sibuk Trading System

Submit by Ketang (writtenn by Semoga Sukses Trader Indonesia)

Untuk lebih memahami silahkan update link diatas

Pada bagian ini terdiri dari :

1. Indikator

2. Templete

3. Script

4. EA

CatataN :

Untuk menggunakan script dan EA indikator harus harus On di chart

EA dan script akan bekerja berdasarkan setingan pada indikator.

"SEGALA RESIKO DITANGGUNG PENUMPANG"

Untuk Templete :

1. Simpel Breakout Asia. gunakan untuk pair2 yg terkait dengan JPY === UJ, GJ dll (khusus ada news JPY)

2. Simpel new ondst digunakan untuk pair2 : GU , EU dll

3. Untuk: templete "simpel Asyik sekali" silahkan update trade heheheh

Untuk lebih optimal pelajari cara setingan indikator london breakout

Happy Trading

Jangan Lupa setiap WD sisihkan untuk golongan yg membutuhkan

Semoga Sukses Trader Indonesia

Salam