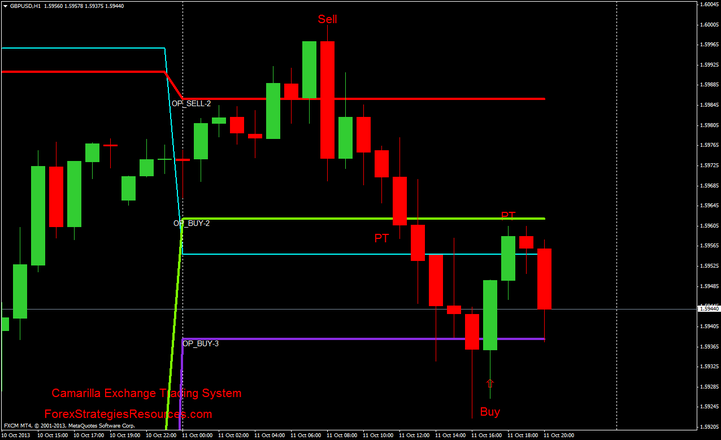

24# Camarilla Exchange Trading System

How To Use Camarilla Exchange indicator

Submit by Joy22 13/10/2013

This is an Intraday trading system based on the Camarilla exchange indicator.

Look at the opening price of currency pair, stocks, indicies, commodities, futures and cfd.

Time Frame 30 min and 60 min.

There three scenario.

Scenario 1

long entry

Open price is between open buy-2 and open buy-3 levels.

Wait for the price to go below open buy-3 and then when it moves back above open buy -3 , buy entry. Stoploss is 15 pips below openn buy-3 level. Target open buy-2 level.

short entry

Open price is between open sell-2 and open sell-3 levels.

Wait for the price to go above open sell-3 and then when it moves back below open sell -3 , sell entry. Stoploss is 15 pips above open sell-3 level. Target open sell-2 level.

Scenario 2

Open price is outside the open buy- 3 and open sell-3.

Wait for the prices to come in range.

Long entry when the price is above open buy-3 level.

Short entry when the price is below open sell-3 level.

The Stop loss and the profit target are, as the previous scenario.

Scenario

3

Open price is between open sell-2 and open buy-2 levels.

Wait for the prices breaks the range .

Buy:

-

Wait for the price to go below open buy-2 and then when it moves back above open buy -2 , buy entry.

-

Wait for the price to go below open buy-3 and then when it moves back above open buy -3 , buy entry.

Sell

-

Wait for the price to go above open sell-2 and then when it moves back above open sell -2 , buy entry.

-

Wait for the price to go above open Sell-3 and then when it moves back above open sell -3 , buy entry.

The Stop loss is 15 pips above or below the level. Profit Target is the next level.

Note: Recommended to use Move Stop loss and Profit Target predetermined 15-20 pips.

Write a comment

nasi bungkus (Wednesday, 18 May 2022 14:42)

NICE INFO