51# Pin Bar with Moving Average

Retracement on moving average

Price action strategy, pipkey indicator

Submit by Alex

Pin Bar with moving average is a price action system. When the market is trending, we can wait for the market to pull back to the moving average and then watch for a pin bar to form. So let’s take a look at a few examples.

First we need to qualify what a proper pin bar is and how to trade it.

1. A pin bar can't close higher than the shadow of the previous candle for a bearish pin bar and can't close lower than the shadow of the previous candle for a bullish pin bar.

2. The “pin” or shadow of the pin bar has to stick out from the candlesticks around it.

3. The really good ones will have a shadow that is as long as or longer than its real body.

Now for the entry rules: 1. A pin bar can't close higher than the shadow of the previous candle for a bearish pin

bar and can't close lower than the shadow of the previous candle for a bullish pin bar.

2. The “pin” or shadow of the pin bar has to stick out from the candlesticks around it.

3. The really good ones will have a shadow that is as long as or longer than its real

body.

Time Frame 15 min or higher. Best Time frame H1, H4 and daily.

Currency pairs: any.

Sessions: any

Day Trading and swing trading.

Platform: Metatrader 4.

Metarader 4 Indicator

PipKey (Pin Bar with 21 moving average on the retracement).

Trading Rules Pin Bar with Moving Average

Buy

1. The pin bar finds support in an uptrend at the 21 EMA (exponential moving average).

2. Place a pending order 5-10 pips above the high of the pin bar.

3. Place a stop loss 5-10 pips below the low of the pin bar.

4. If entry is not signalled within 3-5 candles, delete the pending order and wait for the next signal.

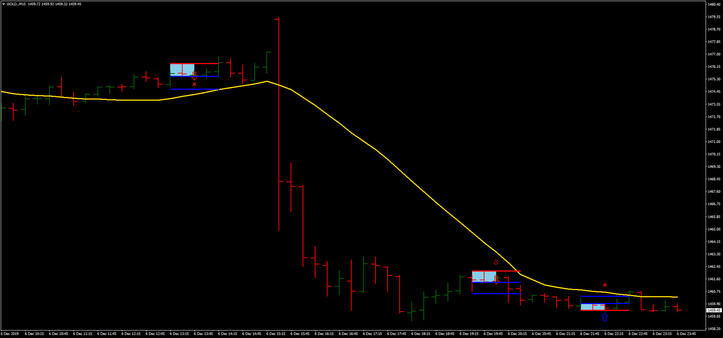

Sell

1. The pin bar finds resistance in a downtrend at the 21 EMA.

2. Place a pending order 5-10 pips below the low of the pin bar.

3. Place a stop loss 5-10 pips above the high of the pin bar.

4. If entry is not triggered within 3-5 candles delete the pending order and wait for the next signal.

Examples of trading

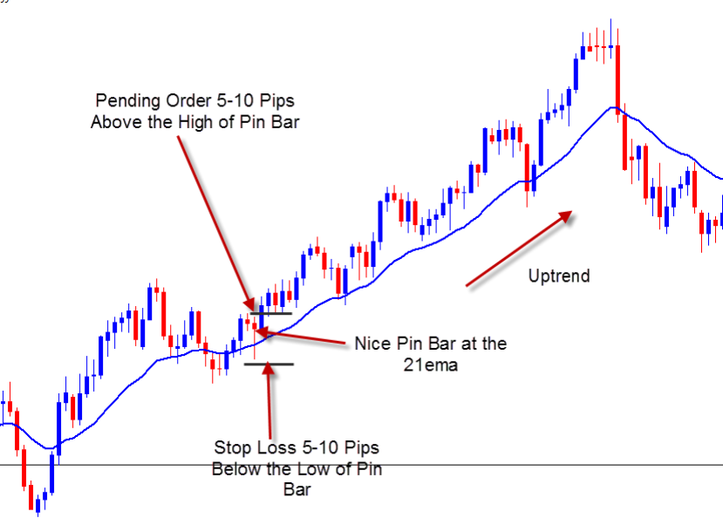

First we'll take a look at an uptrend and look for price to find support at the 21 EMA and then look for a pin bar.

When we're placing our targets we really want to be able to make at least a 1:1 profit.

That means that if we're risking 50 pips we want to make at least 50 pips. This move

definitely hit a 1:1 profit target.

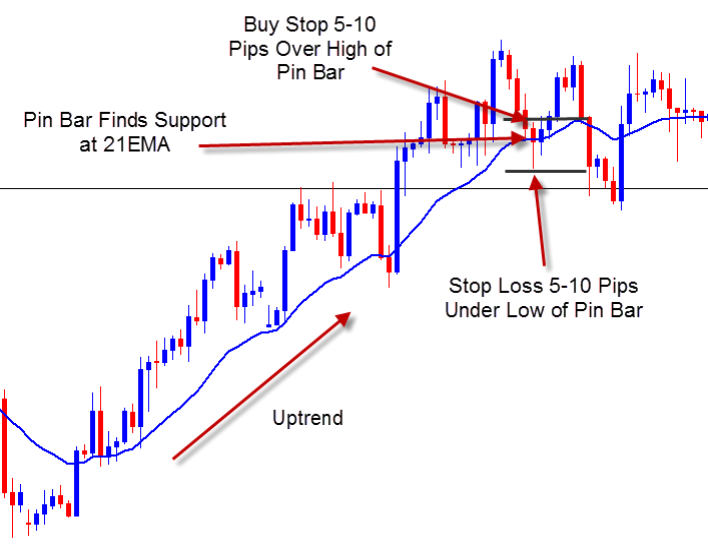

Here's another example of price finding support and creating a pin bar at the 21 EMA. On the very next candle, we got our entry and price went on to hit our 1:1 target very easily.

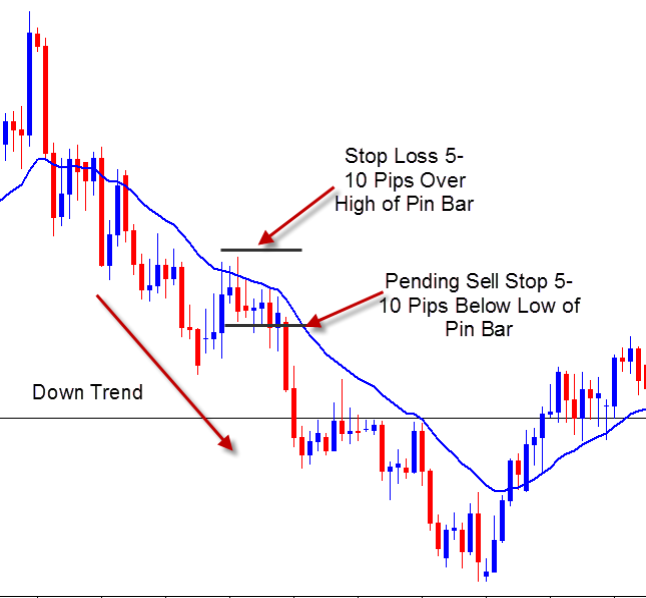

Downtrend example

As you can see, once the market got going, it really took off after finding some really nice resistance at the 21 EMA.

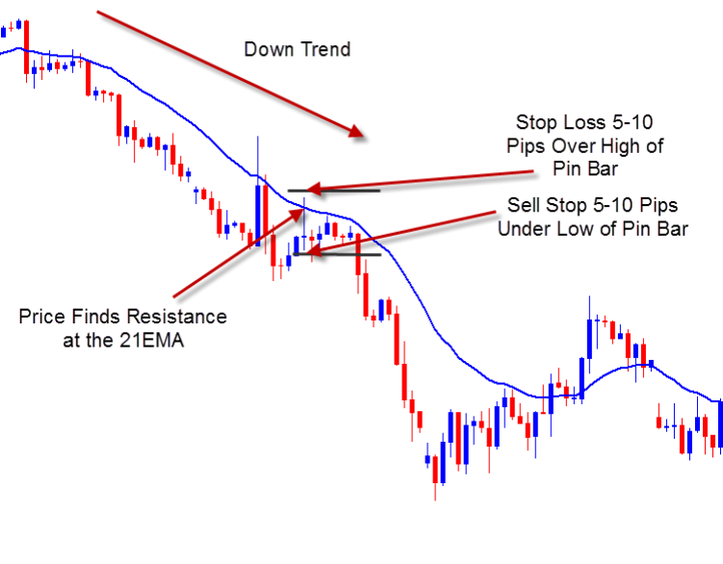

Here's another great example of price finding resistance at the 21 EMA in a downtrend and then creating a nice pin bar that we can trade.

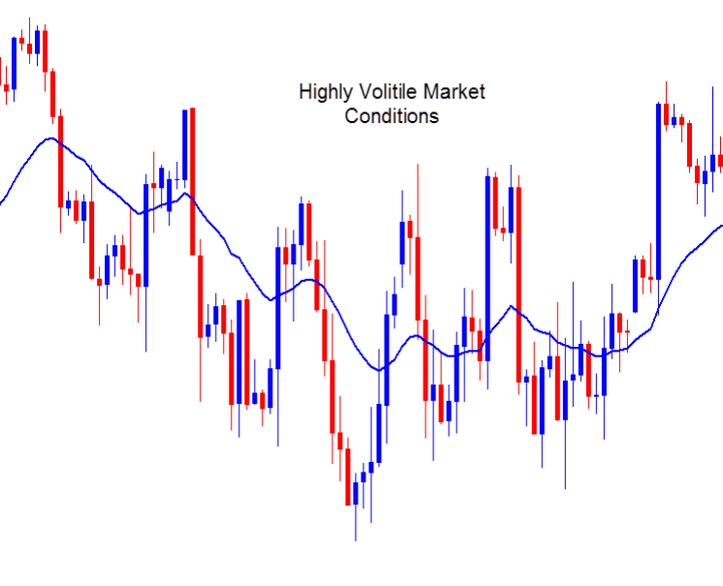

Sideways Markets

One of the things we need to take note of is sideways markets. Things tend to get really choppy and the moving average tends to just look like a flat line. These kinds of situations are good to stay away from because you will find a lot of different candlestick patterns representing indecision rather than conviction. Here are a example of flat markets you would want to stay away from trading.

In the pictures PipKey indicator in action.

Share your opinion.