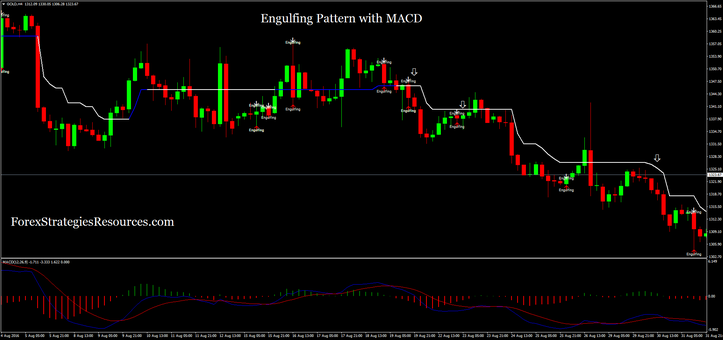

42# Engulfing Pattern with MACD

Pattern trading

Submit by Eloim 02/09/2016

The Engulfing pattern is reversal pattern. It is made up of two candles that

are 2 different colors; red being a downtrend candle, and green being an uptrend

candle. This particular pattern is formed after a clear downtrend in the market. This

candle ideally opens lower that the 1st day’s close, then ideally closes higher than

the 1st day’s open, which will show the green candle completely engulfing the

previous red candle of the day before. The candle for the previous day shows that

the trend was losing momentum, the large body shows that the new direction has

started of with strength.

Here engulfing pattern use in trend trading with trend line and MACD.

Time Frame h1 or higher.

Financial markets:any.

Metatrader Indicators:

Engulfing Pattern indicator;

Trend line indicator (CCI50 , ATR 5);

MACD 2line 12, 26, 9.

Trading Rules Engulfing Pattern with MACD

Buy

Engulfing Pattern arrow

Trend line indicator blue line;

MACD 2 line crosses upward.

Place a pending buy order at the high of the candle with arrow.

Sell

Engulfing Pattern arrow

Trend line indicator white line;

MACD 2 line crosses downward.

Place a pending sell order at the high of the candle with arrow.

Exit position

Profit target depends by time frame, ratio stop loss 1.15.

Stop loss on the previous swing high/low.

You can use this template also with only Trend line and MACD

Buy

Trend line indicator blue line;

MACD 2 line crosses upward.

Sell

Trend line indicator white line;

MACD 2 line crosses downward.

In the pictures Engulfing Pattern with MACD in action.