36# MAB: Moving Average Bands Filtered by SMA slow Strategy

Submit by Joy22

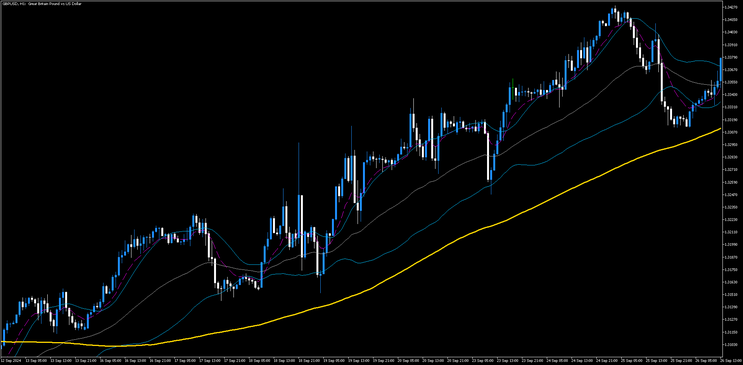

MAB: Moving Average Bands Filtered SMA Strategy is a trend action strategy.

Setup strategy

Time frame 5 min or higher.

Currency pairs: volatile.

indicator Setup:

-

Moving Average Bands (MAB):

-

The "Moving Average Bands" are typically a set of bands formed around a moving average, similar to Bollinger Bands, where the upper and lower bands can act as dynamic support and resistance levels.

-

-

Simple Moving Average (SMA) - 150 Periods:

-

This acts as a trend filter, where trades are only taken in the direction of the overall trend indicated by the SMA.

-

Entry Rules:

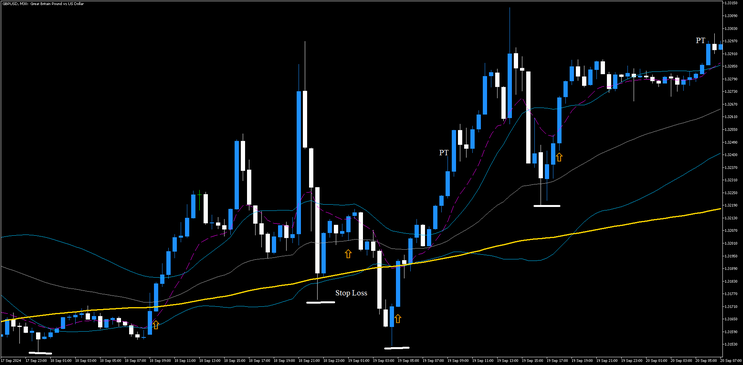

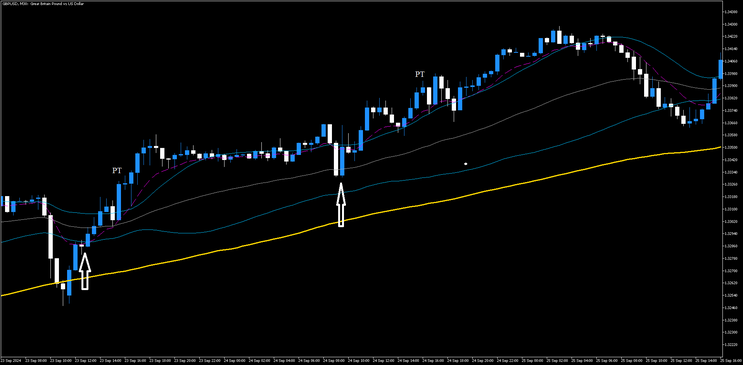

Buy Entry:

-

Trend Filter:

-

The price must be above the 150-period SMA, indicating an overall upward trend.

-

-

Moving Average Bands Signal:

-

The price should touch or break below the lower or the middle band of the Moving Average Bands , signaling a potential oversold condition in the context of the prevailing uptrend.

-

-

Confirmation:

-

Wait for a bullish reversal candlestick pattern (e.g., a bullish engulfing, hammer, or morning star) or wait for the price to close above the purple dotted line.

-

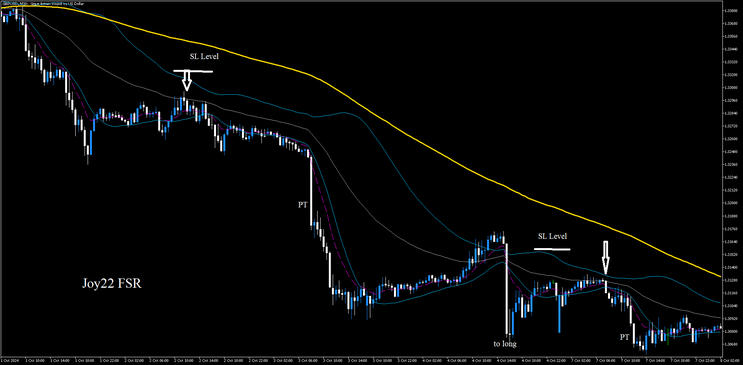

Sell Entry:

-

Trend Filter:

-

The price must be below the 150-period SMA, indicating an overall downward trend.

-

-

Moving Average Bands Signal:

-

The price should touch or break above the middle or upper band of the Moving Average Bands, signaling a potential overbought condition in the context of the prevailing downtrend.

-

-

Confirmation:

-

Wait for a bearish reversal candlestick pattern (e.g., a bearish engulfing, shooting star, or evening star) or wait for the price to close below the purple dotted line.

Exit Rules:

Buy Exit:

-

Take Profit:

-

Set the take profit with a fixed risk-reward ratio of 1:1.3 to 1:1.5..

-

Stop Loss:

-

Place a stop loss just below the lower band of the Moving Average Bands.

-

Sell Exit:

-

Take Profit:

-

Set the take profit with a fixed risk-reward ratio of 1:1.3 to 1:1.5.

-

-

Stop Loss:

-

Place a stop loss just above the upper band of the Moving Average Bands.

-

Risk Management:

-

Position Sizing:

-

Use a position size that risks no more than 1-2% of your account balance on each trade.

-

-

Trade Frequency:

-

Limit trades to when clear signals form, aiming for quality over quantity. Avoid overtrading in choppy market conditions.

-

Additional Considerations:

-

Avoid Trading in a Sideways Market:

-

If the price is constantly crossing above and below the 150-period SMA with no clear direction, avoid taking trades. This suggests a range-bound market where this trend-following strategy may perform poorly.

-

-

News and Events:

-

Avoid trading around major news releases that could cause significant volatility and lead to whipsaws in price.

-

This strategy provides a systematic approach to trading with the Moving Average Bands, filtered by the long-term trend defined by the 150-period SMA. The filter ensures that you are trading in the direction of the trend, while the bands help you time entries based on overbought or oversold conditions.

Albert (Wednesday, 16 October 2024 19:21)

You Try to translate, more value strategies, like this. in MT5. Very Thanks!!