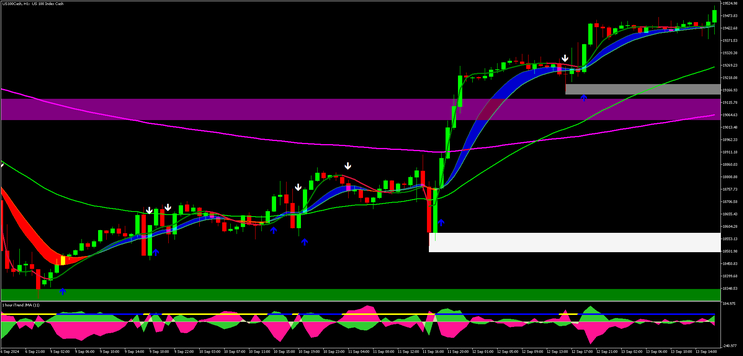

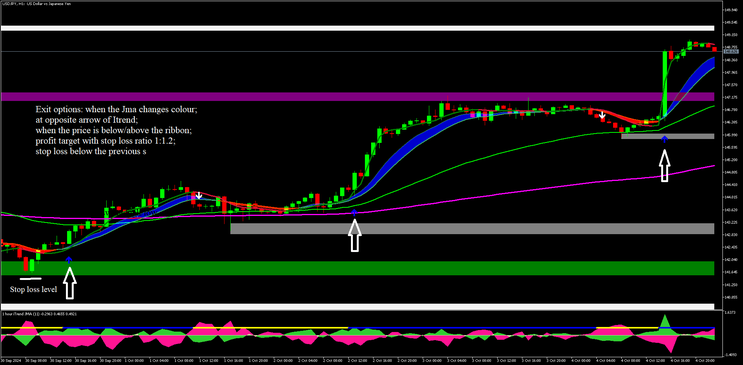

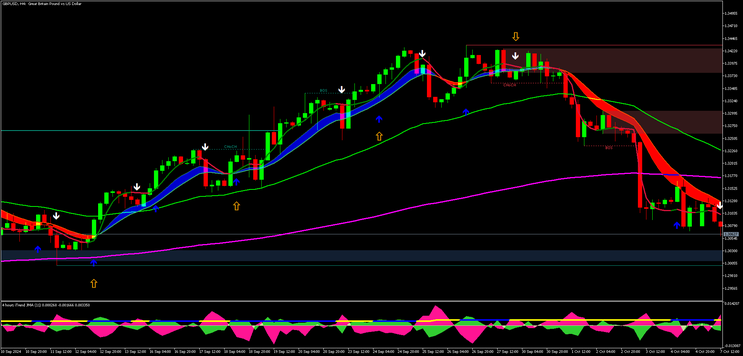

35# Itrend JMA with Key Order Block MT5 Forex Strategy

Submit by Janus Trader 2024

This trend-following trading strategy combines the power of two key technical indicators: iTrend JMA and Key Order Block, alongside moving averages, ATR, and the Ribbon to identify reliable price action and trend signals. It’s a manual strategy, meaning that entries and exits are based on the trader's discretion while following specific rules.

The strategy is provided with two templates, one full and one essential.

In the strategy tests we found that the essential template is more user friendly. I emphasize that to use this template with MT5 you need a lot of ram, please note.

Indicators Used:

-

200 and 50-period Simple Moving Averages (SMA): Used to determine the strength and direction of the trend.

-

Ribbon: Utilizes the EMA variation to create a visual "ribbon," making it easier to identify potential crossovers and trend shifts.

-

Jurik Moving Average (JMA): An adaptive moving average that reacts more quickly to price changes, especially during periods of high volatility.

-

iTrend JMA (Main Indicator): A combination of the iTrend indicator and JMA to provide more accurate trend identification and reduce false signals.

-

Key Order Block (Main Indicator): Helps identify key institutional buy and sell zones on the chart (bullish or bearish order blocks).

-

ATR (Average True Range): Combined with JMA for volatility-based adjustments, making it highly responsive to market changes.

Trading Rules:

This trend-following strategy is designed for manual trading decisions, where the indicators provide signals, but the trader determines the entries, exits, and risk management based on the market structure, support/resistance, and personal risk-reward ratios.

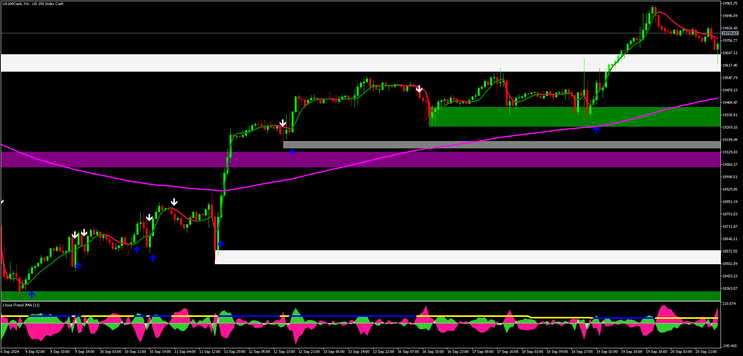

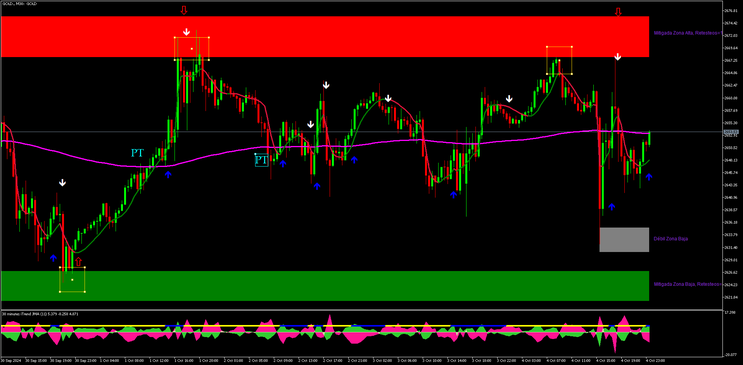

Applicable Markets and Timeframes:

-

The strategy works well across multiple asset classes: forex pairs, stocks, commodities, cryptocurrencies, precious metals, oil, gas, etc.

-

It is suitable for various timeframes, but it performs best on M5, M15, and M30.

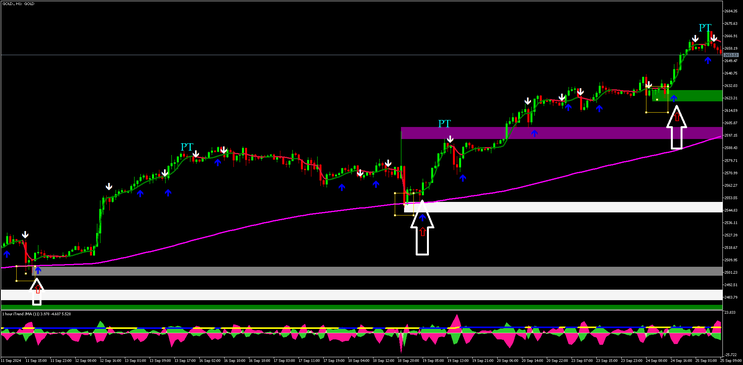

Long Entry Setup:

-

Support Bounce: Ensure the price has bounced from a key support level or a bullish Key Order Block. This indicates that demand is likely exceeding supply at this level.

-

iTrend JMA Signal: Wait for the iTrend JMA to display a buy arrow, signaling a potential bullish reversal or continuation of the trend.

-

Ribbon Confirmation (Optional): The price should be above the Ribbon, indicating that short-term momentum is stronger than the long-term momentum.

-

ATR JMA: The ATR JMA should show a green line, indicating bullish market conditions and low volatility.

-

Price above 200 EMA (optional, but, very important for beginner).

Exit for Long Trade:

-

Look for price reaching a key resistance zone or a bearish Order Block.

-

Consider exiting when the iTrend JMA shows a sell arrow or when the price closes below the Ribbon.

Risk Management:

-

Stop Loss: Place the stop loss below the support level for long trades or below the resistance level for kong trades, typically around recent swing highs or lows.

-

Take Profit: Use nearby support zones, order blocks, or ATR levels to determine take profit targets, ensuring a risk-reward ratio of at least 1:1,2 or better.

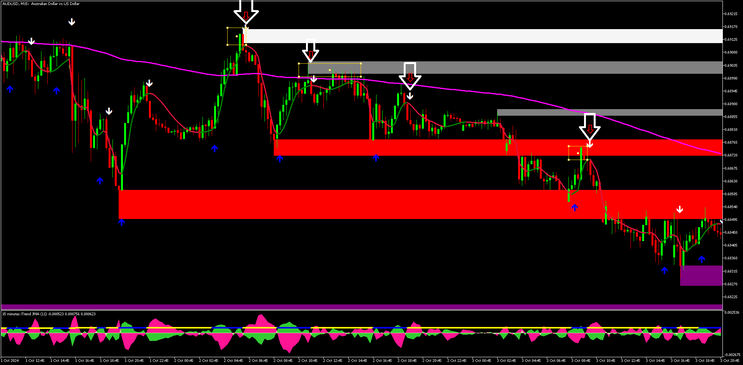

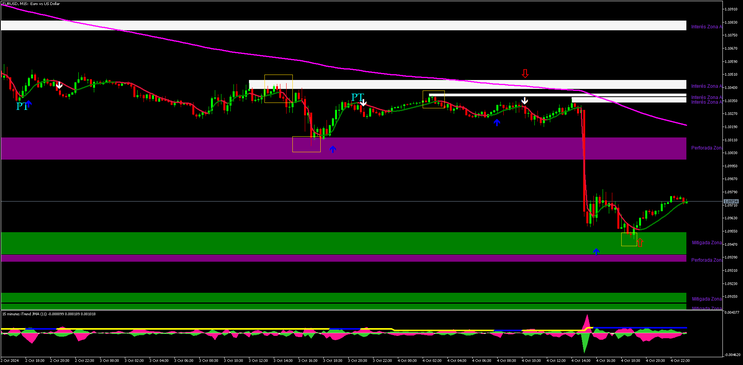

Short Entry Setup:

-

Resistance Bounce: Ensure the price has bounced from a resistance level or a bearish Key Order Block. This suggests that supply is exceeding demand at this level.

-

iTrend JMA Signal: Wait for the iTrend JMA to display a sell arrow, indicating a bearish reversal or continuation of the downtrend.

-

Ribbon Confirmation (Optional): The price should be below the Ribbon, showing that short-term momentum is weaker than the long-term trend.

-

ATR JMA: The ATR JMA should show a red line, signaling bearish market conditions.

-

Price below 200 EMA (optional, but, very important for beginner).

Exit for Short Trade:

-

Target a key support zone or a bullish Order Block.

-

Exit when the iTrend JMA shows a buy arrow or when the price moves above the Ribbon.

Final note: If you use the 3 minute or 5 minute time frame you also need to filter the 200 period moving average.This strategy is also structured for these time frames. This is a winning trading technique.

Risk Management:

-

Stop Loss: Place the stop loss below the support level for long trades or above the resistance level for short trades, typically around recent swing highs or lows.

-

Take Profit: Use nearby resistance zones, order blocks, or ATR levels to determine take profit targets, ensuring a risk-reward ratio of at least 1:1,2 or better.

Key Points for Success:

-

Combining Multiple Indicators: The iTrend JMA and Key Order Block provide solid signals, but using them with the moving averages, ATR, and the Ribbon adds multiple layers of confirmation.

-

Manual Decision Making: While the indicators provide guidance, the trader must evaluate overall market conditions, including support/resistance levels, to make informed decisions.

-

Versatility: This strategy can be adapted across different timeframes and asset classes, making it highly versatile for a variety of trading environments.

By following these rules, this strategy aims to leverage the adaptive nature of the iTrend JMA and the precision of Key Order Blocks to capture trends and reversals in the market, making it an effective and flexible trend price action strategy.

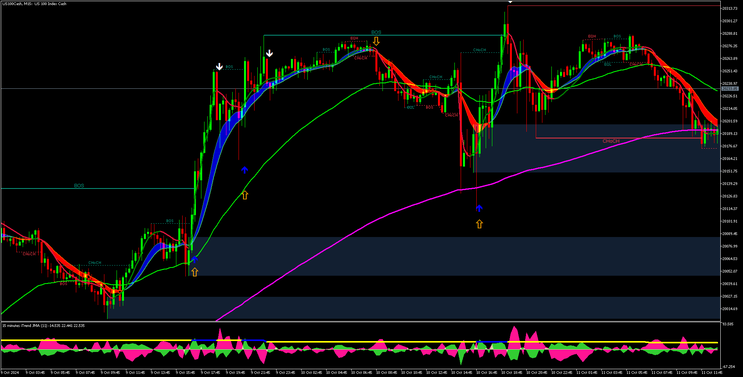

Itrend with Lux Algo SMC

update of the previous strategy 13/10/2024

Submit by Janus Trader

iTrend JMA with Key Order Block is a trend-following trading strategy that uses a combination of technical indicators to identify trends, price action, and institutional buy/sell zones. The core indicators include iTrend JMA, Key Order Block, moving averages, ATR, and the Ribbon to generate signals, but the trader makes manual decisions for entries and exits.

Key modification: Replacing the Key Order Block with the Lux Algo Smart Money Concepts (SMC) indicator.

Strategy Overview (with Lux Algo SMC):

-

Moving Averages: 200 and 50-period SMAs are used to determine overall trend direction.

-

Ribbon: A visual tool using EMAs to highlight trend shifts and crossovers.

-

Jurik Moving Average (JMA): Reacts quickly to price changes, particularly in volatile markets.

-

iTrend JMA: The main indicator that combines iTrend with JMA for precise trend identification and reduced false signals.

-

Lux Algo SMC: Replaces the Key Order Block. Lux Algo SMC identifies key institutional zones like order blocks, liquidity points, and market structures, allowing traders to align with "smart money" movements (banks, large institutions).

-

ATR JMA: ATR combined with JMA for volatility-based signal adjustments.

Differences Between Key Order Block and Lux Algo SMC:

-

Key Order Block: Focuses on detecting key buy/sell zones (order blocks) based on institutional trading behavior.

-

Lux Algo SMC: Offers a more comprehensive view, including order blocks, liquidity pools, and market structure (e.g., break of structure, premium/discount zones). It provides a broader perspective on where "smart money" is active.

Long Entry Setup:

-

Lux Algo SMC Signal: Identify a bullish structure or support zone identified by Lux Algo SMC (e.g., bullish order block, liquidity grab).

-

iTrend JMA Buy Arrow: Confirm the signal with a bullish arrow from iTrend JMA.

-

Ribbon Confirmation: Price should be above the Ribbon for added confirmation.

-

ATR JMA: ATR JMA should show a green line (bullish trend).

-

Price Above 200 EMA: Optional but recommended, especially for beginners.

Short Entry Setup:

-

Lux Algo SMC Signal: Identify a bearish structure or resistance zone (e.g., bearish order block or liquidity grab).

-

iTrend JMA Sell Arrow: Confirm with a bearish arrow from iTrend JMA.

-

Ribbon Confirmation: Price should be below the Ribbon.

-

ATR JMA: ATR JMA should show a red line (bearish trend).

-

Price Below 200 EMA: Optional but important for beginners.

Exits:

-

Exit at Lux Algo SMC-identified zones (support/resistance or order blocks).

-

Look for iTrend JMA counter-signals or price moving below/above the Ribbon.

Key Differences in Application:

-

Lux Algo SMC: Adds deeper insights into smart money movements and market structure, improving precision over the traditional order block approach.

-

Key Order Block: Focuses on basic institutional zones, while Lux Algo SMC encompasses more detailed smart money concepts for better decision-making.

This updated strategy offers enhanced adaptability and precision for identifying institutional behavior, increasing its effectiveness across various markets and timeframes.