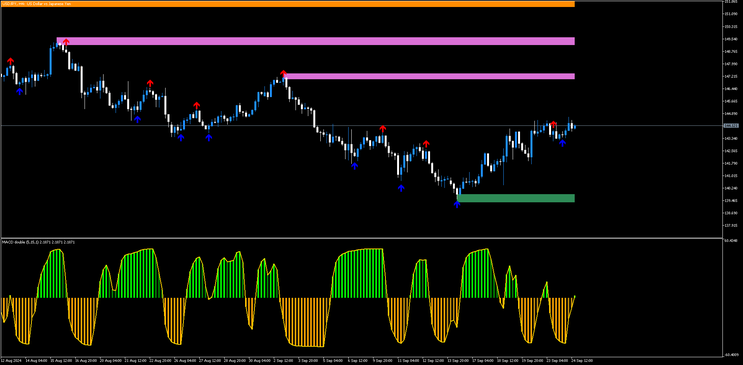

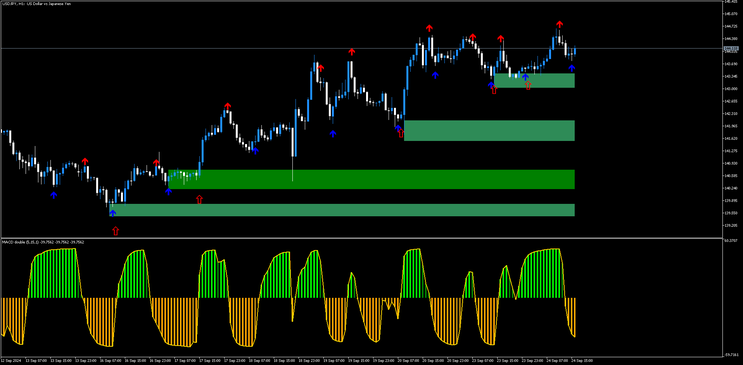

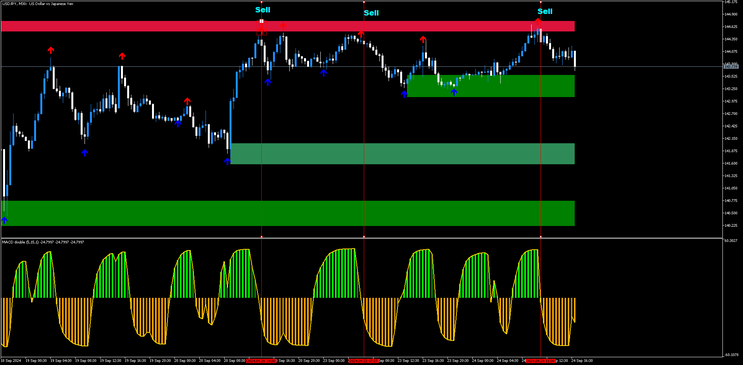

34# RSI Double MACD Strategy MT5

Submit by Alexander

RSI Double MACD Strategy is a trendMomentum price action strategy suitable for forex and binary options. This strategy is based on the following indicators: RSI of Dounle MACD, Supply and Demand and Spike detector.

Setup strategy

time frame from 1 min to 4H.

Currency pairs: any.

MACD with RSI (from the custom indicator):

-

MACD: Based on the settings from your indicator, uses a fast and slow EMA to identify momentum shifts.

-

RSI: The Relative Strength Index is used in conjunction with the MACD to confirm overbought or oversold conditions.

-

RSI 3, MACD 5, 15, 1.

-

Spike Detector: A custom volatility-based indicator to detect sudden price spikes, which signal potential market reversals (default setting).

-

Supply and Demand Zones: Identify areas of supply (resistance) and demand (support) based on price action or use a custom supply and demand indicator (default setting) .

2. Entry Rules

Long Position (Buy Entry):

-

Supply and Demand Confirmation: Price must be at or near a Demand zone (support).

-

Histogram od RSI Double MACD :

-

The histogram should show bullish momentum (above zero or rising from negative).

-

3. Spike Detector confirmation with buy arrow.

3. Short Entry

4.Supply and Demand Confirmation: Price must be at or near a Supply zone (resistance).

5.Histogram od RSI Double MACD :

-

The histogram should show bearish momentum (below zero or rising from negative).

6. Spike Detector confirmation with sell arrow.

3. Exit Rules

For Long Positions (Buy):

-

Histogram: Exit the trade if the Histogram line crosses below the signal line, signaling weakening bullish momentum.

-

Supply Zone Exit: If the price reaches a recognized Supply zone, consider exiting or scaling out of the position.

-

Stop Loss: Place a stop loss just below the last swing low or the bottom of the Demand zone.

-

Take Profit: Set a take profit target near the next Supply zone or based on a risk/reward ratio of at least 1:1.2.

For Short Positions (Sell):

-

Histogram: Exit the trade if the histogram line crosses above the signal line, signaling weakening bearish momentum.

-

Demand Zone Exit: If the price reaches a recognized Demand zone, consider exiting or scaling out of the position.

-

Stop Loss: Place a stop loss just above the last swing high or the top of the Supply zone.

-

Take Profit: Set a take profit target near the next Demand zone or based on a risk/reward ratio of at least 1:1.2.

4. Trade Management

-

Risk Management: Never risk more than 1-2% of your account per trade.

-

Trailing Stop: If the trade moves in your favor, consider using a trailing stop to protect profits. Adjust the stop as the price moves toward the take profit target.

-

Avoid Overtrading: Ensure that all conditions are met before entering a trade. Do not force entries if the signals are unclear.

5. Timeframe & Assets

-

Timeframe: Recommended timeframes are H1 (1-hour) or higher. For short-term trades or scalping, you can test on M15 or M30.

-

Assets: This strategy works well with Forex pairs, commodities, indices, and cryptocurrencies.

By following these rules, you'll be able to use the MACD and RSI combination with the added confirmation of Spike Detector and Supply and Demand zones to find high-probability trade setups.

luis ronald (Tuesday, 24 September 2024 22:14)

obrigado